Commentary

Immunizing Taxpayers from Chronic Overspending

Note: This commentary was published in the Allentown Morning Call, the Bucks County Courier Times, and the Pittsburgh Tribune-Review.

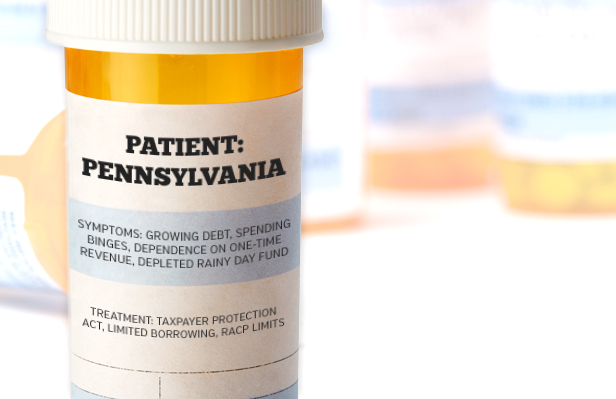

Two major bond rating agencies (Fitch and Standards & Poor’s) recently downgraded Pennsylvania’s debt rating citing poor fiscal health. While this should worry voters—taxpayers will be forced to pay more for state borrowing—it isn’t too late to take our medicine and recover.

This financial virus afflicting the commonwealth came following years of overspending. But controlling spending now and reducing our debt burden can heal our state before we flat-line into bankruptcy.

What should concern voters the most is how pervasive the disease has become—the state’s financial health has declined across both Democratic and Republican administrations. In fact, Pennsylvania has now been spending more than revenue for seven consecutive years.

Despite the notion of a “balanced budget,” policymakers took to temporary federal stimulus dollars, one-time revenue sources—including depleting our “Rainy Day Fund”—and emptying the commonwealth’s checkbook to make ends appear to meet. The problem peaked in 2008-09, when, under Gov. Rendell, the state spent a whopping $4 billion more than it collected in taxes, relying on the federal stimulus bailout to balances the books.

We haven’t yet fully recovered from that spending binge.

But there are things lawmakers can do now to stop the bleeding and prevent this cycle of overspending and borrowing that leaves working families on the hook for higher taxes.

The first antidote is the Taxpayer Protection Act (TPA), which would put guardrails on the growth in state spending. This legislation—Senate Bill 7 sponsored by Sen. Mike Folmer (R-Lebanon County)—has been moving forward in the state Senate.

The TPA would cap the annual increase in the state budget to the rate of inflation plus population growth. This limit could be exceeded with a two-thirds super-majority of lawmakers. No spending cuts are required, but the legislation would effectively confine government growth to the cost of the services government is supposed to provide.

The TPA effectively forces the legislature to control its spending in good years and prepare for downturns in the economy—which is really just commonsense to households across the state.

If the TPA had been in place since 2000, spending would still have been allowed to increase $9 billion—but that increase would have been consistent year to year, with no massive spending jumps followed by frantic tax increases or painful cuts. And over that time, taxpayers would have been able to keep almost $6,000 per family of four.

The second prescription is addressing Pennsylvania’s debt. In the state House, lawmakers are working on bills to limit our borrowing. While the Pennsylvania constitution requires a balanced budget, this only applies to operating expenses. Each year lawmakers also pass an additional “capital budget” for projects financed with borrowing.

Unfortunately, our annual borrowing and payments on debt have been skyrocketing, taking more and more of our state budget and resulting in rating agencies downgrading our bonds. But House Bill 2419, sponsored by Rep. Mike Turzai (R-Allegheny), would put a hard cap on how much the state can borrow each year for capital projects.

Another fiscal pain-reliever, House Bill 2420, sponsored by Rep. Kerry Benninghoff (R-Bellefonte) and passed by the House, would reduce the debt ceiling on the Redevelopment Assistance Capital Program, or RACP.

This program allows the state to borrow money—paid off with interest by taxpayers—to fund private projects. These included dozens of sports stadiums and corporate headquarters. Famously, RACP paid for frivolous monuments to politicians like the Arlen Specter library and the John Murtha Center for Public Policy.

While taxpayers should not be forced to fund corporate welfare via the RACP program at all, limiting its size and lowering the debt ceiling would help prioritize state spending on the things that matter most.

These reforms protecting taxpayers against overspending and excessive debt would make monumental steps towards fixing our state fiscal crisis. To be sure, more is needed, including pension reform and controlling the growth in welfare.

By acting now, lawmakers can immunize Pennsylvania families from the need for massive tax increases down the road.

# # #

Nathan A. Benefield is vice president of policy analysis for the Commonwealth Foundation (CommonwealthFoundation.org), Pennsylvania’s free market think tank.