Media

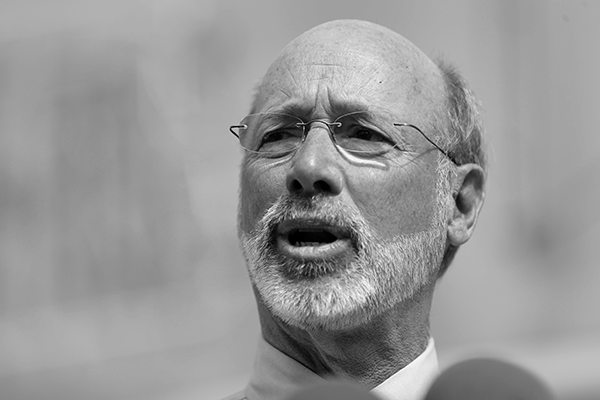

Wolf Tax Reform Hypocrisy

Gov. Wolf has criticized recent federal tax reform proposals—which would lower most tax rates and simplify the tax code by reducing loopholes—because it would eliminate the state and local tax deduction. Wolf claims this provision would hurt middle class families.

But the data shows a different story. Higher income households are more likely to take this deduction. In Pennsylvania, 47 percent of those taking the deduction earned more than $100,000, according to IRS data. Only 17 percent of all taxpayers earned more than $100,000. Similarly, 71 percent of the value of the deduction benefits taxpayers earning $100,000.

Additionally, the state and local tax deduction disproportionately benefits high-tax states. An analysis by the Committee for a Responsible Federal Budget shows that California, New York, and New Jersey residents receive 40 percent of the deduction (while only representing 20 percent of the population).

The problem with the state and local tax deduction is that it incentivizes higher state and local taxes. Gov. Wolf, for example, could push a tax increase—as he’s done multiple times already, all of which would have raised taxes on working families—but argue that (higher-income) individuals won’t pay the full cost since they could take the federal tax deduction. This is a perverse policy.

If Gov. Wolf was consistent in this policy, he would propose a state tax deduction for federal taxes paid.