Memo

Policy Memo: The History of Tom Wolf’s Proposed Tax Hikes

Since assuming office, Gov. Tom Wolf has persistently advocated higher taxes on working families. Thus far, each of Wolf’s broad based tax hike proposals has failed. In July 2016, lawmakers worked with Wolf to pass smaller tax increases on tobacco, e-cigarettes, and digital downloads, along with a budget that was never truly balanced—relying on rosy forecasts of revenue growth from unsustainable taxes. Inevitably, this resulted in a deficit for the 2016-17 fiscal year, and a projected shortfall for 2017-18. Lawmakers should reject further tax hikes and favor structural reforms instead to spur economic growth.

Tax Hike Proposal #1

In his first budget address in 2015, Wolf proposed a $4.6 billion tax hike—a net increase of $1,400 per family of four. This would have been the largest tax hike in Pennsylvania’s history, as well as larger than tax increases proposed by every other governor, combined, in 2015. Every income group would have paid higher taxes under Wolf's first plan.

This proposal was never introduced in the House, where revenue legislation must begin. In the Senate, Sen. Vince Hughes could not find a single cosponsor for the bill. When offered as an amendment to another bill in June 2015, this proposal received zero votes in the House.

Tax Hike Proposal #2

Wolf’s second call for more taxes came in September 2015. This budget plan came with a smaller income tax hike, no increase in the sales tax rate, and fewer new items subject to the sales tax. It promised to generate $3.2 billion in revenue—just over $1,000 per family of four.

Legislative leaders promised Gov. Wolf a vote on this plan and gave him time to lobby for votes; however there was little support for this plan, hence a third tax hike proposal.

Tax Hike Proposal #3

To gain legislative support for tax hikes, Gov. Wolf altered his plan to include a personal income tax increase and a natural gas severance tax (on top of the current impact fee tax). This plan would have generated $2.4 billion—$744 per family of four.

The House held a vote on this proposal in October, which failed by a 73-127 count. Sixty-four percent of the House voted against this tax hike, including all Republicans and nine Democrats.

Tax Hike Proposal #4

Wolf’s fourth tax hike plan would have raised the sales tax rate to 7.25 percent—second highest in the U.S.—with the revenue to be used for property tax reductions. At the same time, the plan redirected gaming revenue from property tax relief to new state spending. In total, this was a $600 million net tax increase.

This scheme received little support and strong opposition from both Democrats and Republicans. It fell apart and was replaced with a new “framework.”

Tax Hike Proposal #5

While never publicly disclosed, Wolf’s fifth tax hike plan was a combination of sales taxes on currently untaxed goods and services, higher tobacco taxes, higher taxes on banks, and a new fee on businesses just for the right to stay open.

Like all previous plans, this did not generate support. Democrats wanted more concessions to support the sales tax increases, such as raising the state minimum wage, which the Independent Fiscal Office estimated would result in 31,000 jobs lost.

The governor was unsuccessful in raising taxes during his first year of office.

Tax Hike Proposal #6

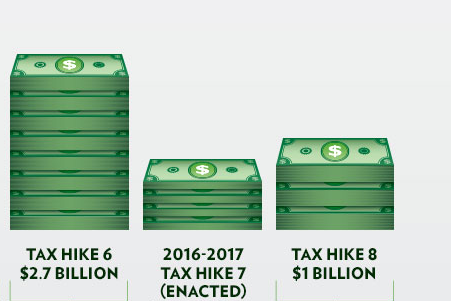

In February 2016, Wolf offered his sixth tax hike proposal in his second budget address. This plan promised $2.7 billion in revenue per year—a burden of $850 per family of four. Roughly half of this increase came from raising the personal income tax rate by 11 percent. Additionally, there was also a severance tax, expansion of sales taxes, and higher tobacco taxes.

This proposal included retroactive tax increases, with taxes on bank shares and insurance premiums. The higher tax rate would have gone into effect on January 1, 2016 (one month prior to the proposal), forcing Pennsylvanians to pay additional taxes on money they had already earned. This tax proposal received no support, not even from Wolf’s own party.

2016-17 Tax Hike (Enacted)

In July 2016, Wolf signed a state budget that collected $650 million in new taxes. Although lawmakers evaded broad based taxes, they expanded the income tax on lottery winnings and approved new taxes on tobacco, digital downloads, and bank shares. This tax hike passed with 28 votes in the state Senate and 116 votes in the Pennsylvania House.

Although less destructive than Governor Wolf’s $2.7 billion proposal, this $650 million tax increase still demanded more of workers in a weak economy. The tax hike accompanied a $1.6 billion increase in spending—$204 per family of four.

Currently, Pennsylvania faces a $1.1 billion revenue shortfall this fiscal year, thanks in large part to unsustainable taxes and overly rosy revenue projections.

Tax Hike Proposal #8

During his third budget address, Wolf laid out a seventh tax hike plan. He relented on demands to raise the income or sales tax rate, two cornerstones of previous budget proposals. However, Wolf’s budget proposed to increase taxes by more than $1 billion—$315 per family of four.

Again, Wolf sought to impose an additional severance tax on the natural gas industry, accompanied by sales tax expansions to custom programming, design and data processing, commercial storage, and other previously untaxed items. Wolf also wanted to expand the tax on insurance premiums and move Pennsylvania businesses toward “mandatory combined reporting.”

This plan will increase Pennsylvania’s tax burden, already 15th highest in the nation. Evidently, Wolf still prefers tax increases over reducing spending to balance the state budget. To his credit, Wolf has proposed a few reforms that will legitimately streamline government, but these reforms do not go nearly far enough.

Elected officials must promote smart spending and encourage structural reforms to boost economic growth and protect Pennsylvanians from more tax hikes.