Media

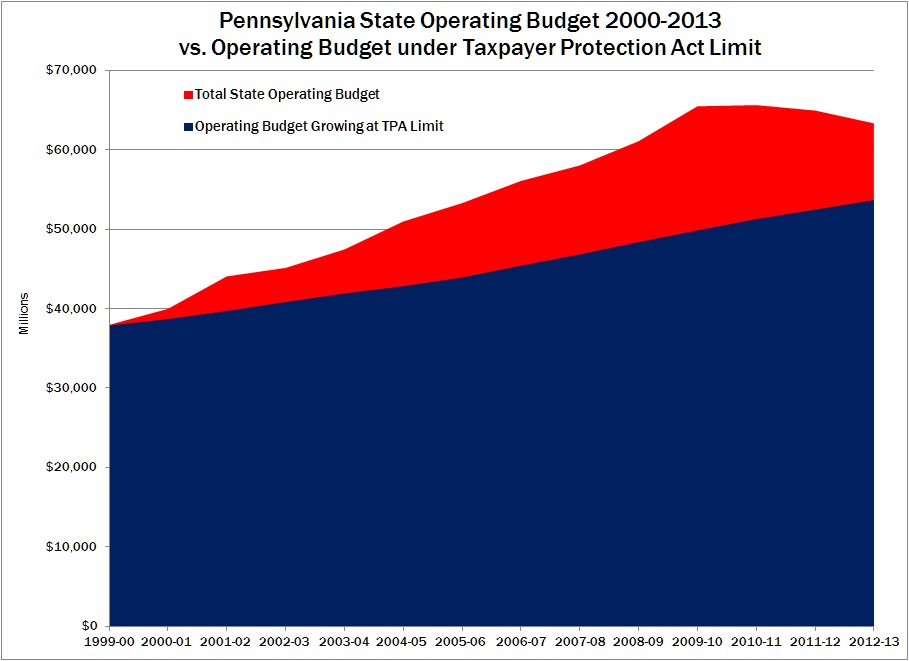

Why Pennsylvania Needs Spending Limits

In a Capitolwire story (subscription), Senate Appropriations Chair Jake Corman notes that the proposed version of the state budget the Senate will take up this week increases spending by less than the rate of inflation and population growth. He also suggests that is the standard for all future budgets.

“We believe the budget should never increase higher than TABOR would allow, so we can be sure we have sustainable growth in the budget” Corman said.

However, to realistically control state spending growth, lawmakers need to enact a spending limit like the Taxpayer Protection Act, especially a constitutional amendment version to prevent future tampering. Matt Mitchell explains why fiscal guardrails like the TPA are needed to constrain overspending in Heritage Insider Magazine:

Spending growth threatens to push both federal and state debt-to-gross domestic product ratios past 90 percent in a matter of years. That is the level at which the largest and most comprehensive studies suggest debt begins to dramatically reduce economic growth.

It might seem that the natural solution is to elect politicians committed to reining in spending, especially on the entitlement programs and pensions at the heart of state and federal overspending. The problem, however, is that even fiscally conservative politicians face significant perverse incentives to spend beyond their constituents’ means. And even if they do manage to trim the budget, today’s cuts can be reversed by tomorrow’s leaders.

Luckily, there is hope. Political incentives are shaped, in part, by institutions, i.e., the rules that govern budgeting, electioneering, and legislating. These rules influence the decisions of legislators, governors, presidents, bureaucrats, voters, and even lobbyists. So if we can improve the institutions, we can enduringly diminish the incentive to overspend.

Indeed, due to decades of overspending, even modest growth in this year’s budget isn’t enough to protect Pennsylvania’s fiscal house. The proposed Senate budget would spend about $300 million more than net revenue collections next year (based on Independent Fiscal Office projections), and doesn’t begin to address cost drivers in corrections, welfare, and government workers’ pensions.

When the economy rebounds, and tax revenues start increasing, future lawmakers will be tempted to repeat the same mistakes and overspend taxpayers’ money. Passing the Taxpayer Protection Act now would limit the growth in government spending, prevent future fiscal disasters, and provide tax relief to families.