Fact Sheet

Pennsylvania Welfare Spending

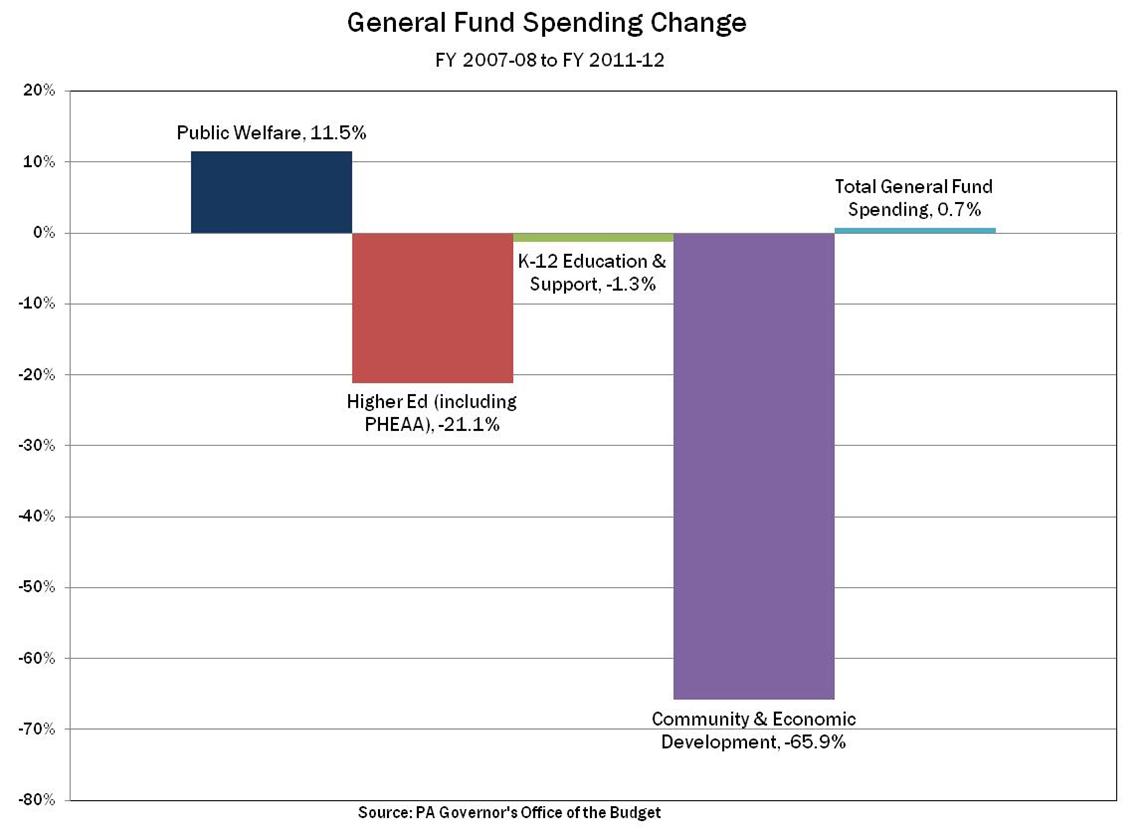

The FY 2011-12 total operating budget of $63.4 billion, which included $27.1 billion in General Fund spending, represented the first year-to-year reduction in state spending in at least 40 years. However, as the economy continues to struggle out of a recession and with increasing costs in public welfare, corrections, pensions, and debt, the FY 2012-13 budget will require even more difficult decisions by the General Assembly and Governor Corbett to put Pennsylvania on a path to prosperity.

Skyrocketing Welfare Costs

- For the first time in history, Pennsylvania spends more on Public Welfare than Education in the General Fund Budget.

- Public welfare spending is on a financially unsustainable path in Pennsylvania.

- Since FY 2002-03, total Public Welfare spending, including federal funds to the state, rose 52%, from $17.9 billion to an estimated $27.2 billion for FY 2011-12.

- State welfare spending has grown three times faster than the rest of the state budget since FY 2002-03, reaching $10.6 billion in FY 2011-12.

- Medicaid alone consumes 31% of the total state operating budget-the second largest share of any state, according to the National Association of State Budget Officers.

- Absent reform, welfare spending will grow faster than government revenues, threatening to crowd out education and every other government program.

Waste & Abuse Harm the Truly Needy

- Auditor General Wagner found welfare error rates of more than 15%. Reducing the error rate in Medicaid by just one-tenth would save the state $439 million this year and $1.9 billion in the next four years!

- In 2002, approximately 47,000 cases of suspected welfare fraud were referred to the Inspector General. Under the Rendell administration, the number of referrals for suspected fraud was cut in half even as caseloads increased.

- During FY 2010-2011, the Office of Inspector General saved and collected more than $66.5 million by investigating 27,373 applications for benefits and determining applicants did not qualify.

- The Office of Developmental Programs in Public Welfare was established to serve those with intellectual disabilities. Audits of ODP providers reveal tax dollars were used to lease luxury vehicles and purchase items such as a chandelier, landscaping, and a six-person hot tub.

Higher Spending has Failed to Serve the Poor

- Instead of promoting self-reliance, current welfare programs in Pennsylvania disserve the poor by promoting dependency and incentivizing perpetual poverty.

- A myriad of programs discourage families from escaping the welfare trap, where a family’s total income declines as their salary increases and their benefits are taken away.

- Pennsylvania’s poverty rate has been climbing since 2000, regardless of economic conditions. In 10 years, the number of citizens in poverty increased nearly 50% from 8.8% in 2000 to 12.2% in 2010.

- Under Medicaid-government health insurance for the poor-patients receive worse care or have to wait longer to receive treatment than those with no insurance at all.

- A study comparing cancer patients and different forms of health insurance found one-year cancer survival rates for prostate, breast, and lung cancers were higher among the uninsured than those with Medicaid.

- A study of Ohio Medicaid patients diagnosed with cancer found that Medicaid enrollees were twice as likely as likely as non-enrollees to die from their disease within five years.

Principles for Welfare Reform

- Protect the safety net for the truly needy. Reform must ensure welfare programs are affordable and sustainable while reducing dependence on taxpayer-funded programs. This requires ensuring only those eligible for programs and in need of aid receive taxpayer funds.

- Policy Recommendations:

- Reduce waste and abuse by enforcing eligibility standards, strengthening whistleblower protections, and enacting recovery audits (allowing private contractors to find fraud and keep a portion of what they recover).

- Close eligibility loopholes in Long-Term Care to prevent wealthy households from benefiting from government-paid nursing care and encourage the purchase of private long-term care insurance

- Demand Medicaid flexibility from the federal government. Federal rules are tying the hands of state officials, preventing any adjustments to eligibility, despite budget deficits or innovations that can improve the quality of services.

- Promote the dignity of work. Welfare programs should help able individuals transition to the workforce rather than promote dependency on taxpayers by discouraging efforts to find employment.

- Policy Recommendations:

- Enhance work requirements and structure time limits to promote temporary assistance and prepare recipients for independence.

- Restructure Medicaid as a voucher system where patients are given a subsidy based on income and health and have the ability to choose their own healthcare insurance.

- Foster true charity care. Government welfare is not the price of civil society, but the failure of society to be civilized. True charity does not come from tax dollars coerced from Pennsylvanians, but from individuals and organizations working to help needy individuals in their time of need while embracing the virtues of personal responsibility and independence.

# # #

For more information on the Pennsylvania State Budget, visit www.CommonwealthFoundation.org/Budget