Memo

School Choice Expansion in Pennsylvania

The fiscal year 2012-13 state budget increases the Educational Improvement Tax Credit by $25 million to $100 million and creates a new $50 million tax credit for Opportunity Scholarships—effectively doubling in size the amount of money available to provide scholarships to help students escape violent and failing public schools and attend safer and better private schools.

Background

Pennsylvania’s Educational Improvement Tax Credit (EITC) program began in 2001, and has a decade of success giving children access to greater educational opportunities. The EITC gives businesses a tax credit for donations to non-profit Scholarship Organizations that award scholarships to children to attend private schools, or to Educational Improvement Organizations that provide programs in public schools, such as Junior Achievement and performing arts programs. The Department of Community & Economic Development registers organizations and tracks contributions.

- The state gives each donating business a tax credit of 75% of their donation amount (or 90% if they pledge the donation for two consecutive years) against what they owe in state taxes. Businesses would pay more under this program in state taxes plus contributions than if they chose not to participate.

- Currently, more than 40,000 students receive scholarships annually, with the average scholarship amount at $1,100. Participating families had an average income of less than $29,000.

- Until fiscal year 2012-13, the EITC had been capped at $75 million a year, limiting the scope of the program. Waiting lists for scholarships are long. For example, the Children’s Scholarship Fund Philadelphia turns away 7,000 applicants each year due to lack of EITC-funded scholarships.

School Choice Expansion

Legislation enacted as part of the state budget increases the EITC limit from $75 million to $100 million in 2012-13. This includes $60 million for Scholarship Organizations, $30 million for Educational Improvement Organizations, and $10 million for Pre-K Scholarship Organizations.

A new tax credit, the Opportunity Scholarship Tax Credit (OSTC), provides businesses with the opportunity to contribute an additional $50 million to Opportunity Scholarship Organizations.

- Under the OSTC, Opportunity Scholarship Organizations would provide scholarships to children residing within the attendance areas of the lowest-achieving 15% of public schools.

- Opportunity scholarships could be used at private schools and neighboring public school districts, should those schools choose to accept scholarship students.

- The maximum opportunity scholarship would be capped at $8,500 for students without disabilities and $15,000 for students with disabilities, or the actual tuition and fees of the receiving school, whichever is less.

- Priority for scholarships would be given to students who received a scholarship in the prior year; students with family income below 185% of the federal poverty threshold; and students with family income in the preceding year below 185% of the federal poverty threshold who also reside in Philadelphia or financially distressed school districts.

| Educational Tax Credit Limits, in Millions | ||||||

| Educational Improvement Tax Credit | Opportunity Scholarship Tax Credit | Total Educational Tax Credits | ||||

| Year | Scholarship Organizations | Pre-K Scholarship Organizations | Educational Improvement Organizations | Total EITC Credits | ||

| 2006-07 | $36.00 | $5.00 | $18.00 | $59.00 | $59.00 | |

| 2007-08 | $44.70 | $8.00 | $22.30 | $75.00 | $75.00 | |

| 2008-09 | $44.70 | $8.00 | $22.30 | $75.00 | $75.00 | |

| 2009-10 | $38.00 | $6.40 | $15.60 | $60.00 | $60.00 | |

| 2010-11 | $40.20 | $6.40 | $13.40 | $60.00 | $60.00 | |

| 2011-12 | $44.70 | $8.00 | $22.30 | $75.00 | $75.00 | |

| 2012-13 | $60.00 | $10.00 | $30.00 | $100.00 | $50.00 | $150.00 |

The changes also increased the income cap for students to receive scholarships.

- Beginning in 2013-14, students with family income less than $75,000 plus $15,000 per dependent child (e.g., $105,000 for a family with two children) would be eligible for either EITC scholarships or OSTC scholarships.

- The income threshold is higher for special needs students whether in traditional schools (support level 1) or attending specialized schools for special needs (support level 2).

- Beginning in 2014-15, income limits will be adjusted for inflation.

| Scholarship Income Limits | ||||||

| Traditional Students | Special Needs Students Level 1 | Special Needs Students Level 2 | ||||

| Year | Base Family Income | Additional Income Per Child | Base Family Income | Additional Income Per Child | Base Family Income | Additional Income Per Child |

| 2010-11 | $50,000 | $10,000 | $50,000 | $10,000 | $50,000 | $10,000 |

| 2011-12 | $60,000 | $12,000 | $93,000 | $18,600 | $179,580 | $35,916 |

| 2012-13 | $60,000 | $12,000 | $93,000 | $18,600 | $179,580 | $35,916 |

| 2013-14 | $75,000 | $15,000 | $116,250 | $23,250 | $224,475 | $44,895 |

| 2014-15 | $75,000 + CPI | $15,000 + CPI | $116,250 + CPI | $23,250 + CPI | $224,475 + CPI | $44,895 + CPI |

Tuition Grants by School Districts

- The budget legislation also allows school districts to create their own “Tuition Grants” using the state per-pupil aid to send kids to another public or private school.

- Grants shall be paid to parents of students by a check that may only be endorsed to the selected school.

School Choice Costs Taxpayers Less

- Pennsylvania school districts spent $14,865 per student in 2010-11. By contrast, tax-credit scholarships fund students for anywhere between $1,100 (the average EITC scholarship) and $8,500, the maximum opportunity scholarship for non-special needs students.

- The average Catholic school tuition (the dominant non-public school choice in Pennsylvania) is $3,500 for elementary schools and $6,500 for high schools, according to the Pennsylvania Catholic Conference.

- Under this expansion, businesses could give 10,000 students a $5,000 opportunity scholarship under the OSTC. These scholarships would educate each child for almost $10,000 less than the average spending of school districts, a net savings to taxpayers of $99 million.

- The expansion of existing EITC scholarships could provide an additional 14,000 students with a $1,100 scholarship. Compared with school district spending, this would save taxpayers an additional $191 million.

- Combined, the EITC/OSTC program will likely serve at least 64,000 students in 2012-13.

- EITC and opportunity scholarships do not affect or diminish current public education spending, as the program is funded through voluntary contributions from businesses and not current public school revenues.

FAQs

How much would the average opportunity scholarships be?

- It is up to the donating businesses and scholarship organizations rather than politicians to determine how much scholarships should be to serve the most students and use dollars efficiently.

- It is likely that the lowest-income families would need larger scholarships to afford private school, but parents typically pay some of the cost. The average scholarship amount would likely fall between the current $1,100 average for EITC scholarships and the average tuition of Catholic schools ($3,500 for elementary and $6,500 for high school).

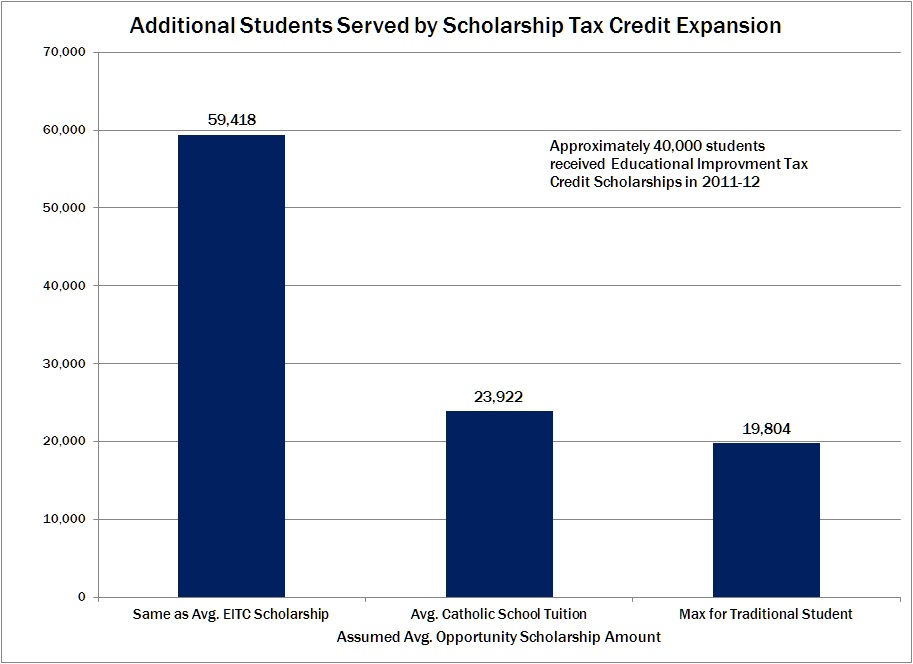

How many students will the expanded tax credits help?

- Depending on the average OSTC scholarship amount, between 20,000 and 60,000 additional students (on top of the 40,000 already benefiting from the EITC) could receive scholarships under the expansion.

- In comparison, the fiscal note under previously considered voucher proposals estimated that 2,200 students would receive scholarships in the first year and 10,000 in the second year.