Fact Sheet

Pennsylvania State and School Pension Costs

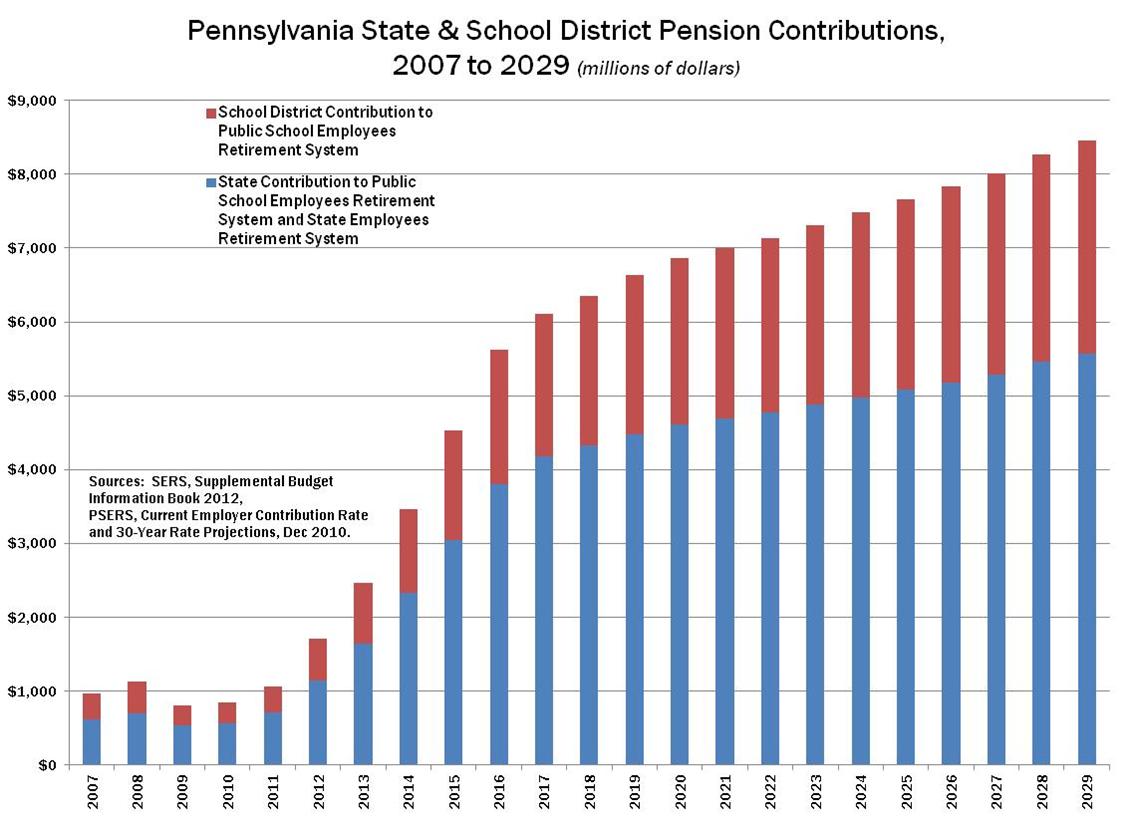

Taxpayer Pension Contributions

- Pennsylvania taxpayers fund two statewide pension plans for government employees—the State Employees’ Retirement System (SERS) for state employees and the Public School Employees’ Retirement System (PSERS) for school employees.

- With taxpayer money, state government pays the entire employer contribution for SERS, and more than half of the PSERS costs.

- PSERS and SERS project total taxpayer contributions for these two plans will increase from $1.7 billion in 2011-12 to more than $6.1 billion in 2016-17—a 257% increase.

- The Independent Fiscal Office estimates pension payments in 2016-17 will represent 12% of the state General Fund budget, up from 4% this year.

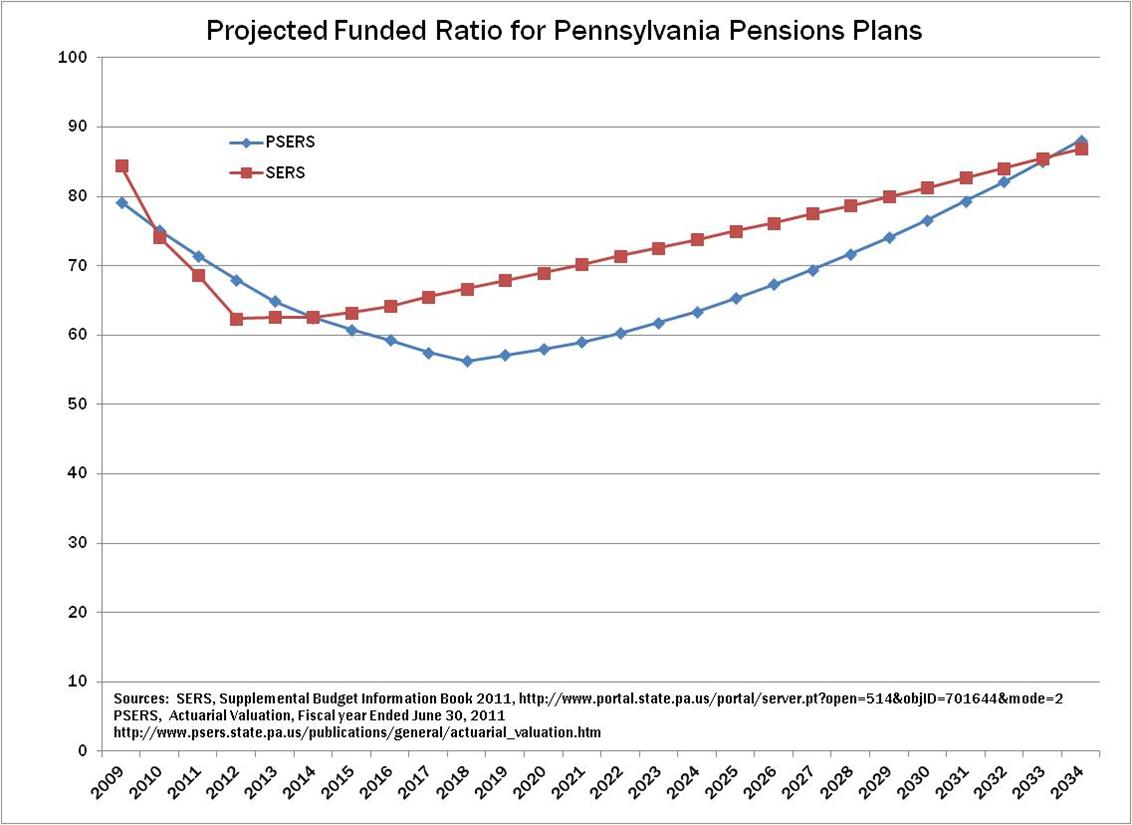

Pension Funding and Investment Return

- Under current projections, SERS’ funded ratio—the ratio of assets to accrued pension liabilities (how much the funds needed to make future payouts)—will dip to 60.1%. PSERS’ funded ratio is expected to decline to 59.1%.

- All projections assume 8% annual rate of return on investment for SERS’ and 7.5% for PSERS’ funds.

- Any investment losses or earnings less than this rate, as happened during the last recession, will reduce the funded ratio and require additional taxpayer contributions.

- The dramatic increase in taxpayer pension contributions is due to three main factors:

- Legislative increase in pension benefits in 2001, followed by a cost-of-living adjustment in 2002;

- Pension fund investment losses during 2001-02 and 2008-09; and

- Legislation in 2003 and 2010 to delay pension contributions, requiring higher future payments.

- In addition to SERS and PSERS, there are more than 3,200 local government pension funds.

# # #

For more information on the Pennsylvania State Budget, visit CommonwealthFoundation.org/Budget.