Memo

Nine Irrefutable Facts About Education Savings Accounts

Every Pennsylvania child is unique and deserves the best education possible—no matter their income or ZIP code. School choice is giving opportunities to hundreds of thousands of Pa. kids, but too many are still waiting to be given hope. Under Sen. DiSanto’s plan, SB 2, students in underperforming schools would be eligible for an education savings account. Rep. Ward’s bill, HB 2228, would offer education savings accounts to students with special needs—those with an Individualized Education Program (IEP).

In an increasingly global economy, parents need the ability to customize and unbundle their child's education. For students stuck in a school that doesn't meet their unique needs, their situation is all the more urgent. They need options right now. Education Savings Accounts have offered lifelines to thousands of students in other states. ESAs can work here too.

This memo outlines the key truths around Education Savings Accounts in Pennsylvania.

What are Education Savings Accounts?

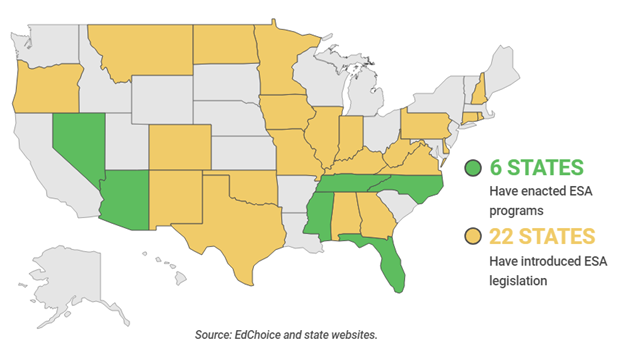

Education Savings Accounts (ESAs) are individual accounts that can be used for a variety of approved educational services. Supervised by the State Treasury and controlled by parents, ESAs offer a wide range of customizable education choices. ESA programs have been enacted in six states and are under consideration in many others. The Pennsylvania Senate is considering Education Savings Accounts under Senate Bill 2 (SB 2). Under SB 2, ESAs would be funded from a portion of the state’s per-pupil education subsidy, leaving local education funding in place. ESAs operate under two basic principles:

First, parents are the most qualified to determine their children’s needs and should have as many options as possible. We all accept this as true when it comes to groceries, auto repair, and cell phones. Why should education for our kids be any different?

Second, education funding should be focused on each child’s education, not the education bureaucracy. Opponents of school choice assume the best way to educate children is to send them to the schools in their neighborhood, but education is not a one-size-fits-all service: research shows that students in both public and private schools gain when we empower parents to choose their children’s school.

Truth: ESAs have numerous accountability measures to prevent fraud.

SB 2 would authorize the State Treasury to conduct ESA audits as necessary. Money from ESAs can be spent only on approved, authorized services. Fraudulent spenders would risk numerous penalties, including frozen or closed accounts, fines up to 300 percent of their ESA award, criminal prosecution by the Attorney General, or disqualification from future program participation. HB 2228 offers similar protections against fraud, with provisions for random account audits, referrals to law enforcement in cases of fraud, and forfeiture of account funds for violators.

Truth: ESAs offer academic accountability and transparency.

ESA recipients would have to take PSSA exams or some other recognized, standardized test to show proficiency. More important, if parents are unhappy with the level of quality provided by their child’s private school, they can withdraw the student. Likewise, parents can discontinue any à la carte education service if they’re dissatisfied. Unfortunately, parents do not always have this option if they’re dissatisfied with their neighborhood school.

Truth: ESAs under SB 2 would leave local funding in place.

Under SB 2, participating ESA families would receive the average state funding per pupil as a grant in an account supervised by the Treasury Department. Local education dollars will remain in the district. This means a child utilizing an ESA will have the same financial impact on a local district as a child who goes to a private school, homeschools, or moves out of the district. Pennsylvania School Boards Association lobbyist John Callahan acknowledged as much in a KDKA radio interview on March 13. This makes sense; if a district is not educating a child, the district should not receive state money to educate that child.

By keeping local education tax dollars in the district, ESAs could result in significantly higher per-pupil spending. In Harrisburg, for example, per-student funding was $18,846 in 2016-17. If 10 percent of students withdrew from Harrisburg schools and used ESAs, the district would then have $20,306 available to spend per pupil.

Truth: This is about the students. The money should follow the student, not uphold the public education establishment.

Under SB 2, a student would be eligible for an ESA if they live within the boundaries of a “low-achieving school” (ranked in the bottom 15 percent of the state) and attended public school the previous semester. That said, the possibility for change always exists. Each year, some schools improve and are removed from the low-achieving list. Alternatively, a family might move to a new (non-low-achieving) district.

A student should not be required to forfeit his or her account because of a move. Once a student embarks on a new, customized learning plan, it would be disruptive and even harmful to take that opportunity away. With ESAs, the focus is on funding the student’s education—not a building.

Truth: For students with special needs, parents want the best option for their child, public or private.

As the great economist Thomas Sowell once said, “The most basic question is not what is best, but who shall decide what is best.” No one knows a child’s unique educational needs better than the parents. With ESAs in place, parents decide what is best for their children.

The Individuals with Disabilities Act (IDEA) guarantees public schools provide “free and appropriate education” (FAPE) to students with special needs. For some of these students, the neighborhood school may be the best option. But students for whom this is not the best option may be forced to remain in a school that doesn’t meet their needs simply because they lack the financial resources to go elsewhere. ESAs are particularly well suited for students with special needs because they offer unbundled, customizable education plans, including private school; tutoring; and speech, behavioral, or occupational therapy.

Under SB 2, students with special needs would receive proportional grant funding according to their classification under the Public School Code (Category 1, 2, or 3). This would ensure an appropriate level of resources for families of students with special needs should they choose an ESA. Giving parents more options in no way takes away their rights. In fact, adopting such complementary measures as the ESAs under HB 2228 would ensure that families with special needs have a broad range of educational options.

Truth: All children in public or private schools deserve a quality education right now.

Measures such as ESAs and EITC actively improve public schools. Dozens of studies confirm that educational choice not only boosts student achievement but also improves public schools by creating a competitive environment. This was evident in Ambridge in 2010, when an incoming charter school with full-day pre-kindergarten and kindergarten led neighboring public-school districts to accelerate their own full-day offerings. Out of 31 empirical studies on the impact of private school choice on academics in public schools, 29 found that choice programs improved the performance of nearby public schools.

The EITC program directly benefits public schools through Educational Improvement Organizations, which are devoted to improvements and innovations in public schools.

Truth: ESAs offer the poor their best chance at a customized education.

Wealthy families have always had the option of moving to a better school district, sending their student to a private school, or hiring a private tutor. ESAs level the playing field by opening these same options to all students, regardless of their wealth or location. Hundreds of thousands of students have benefitted from the lifeline of Pennsylvania’s tax credit scholarship programs. Average K-12 scholarships range from around $1,600 to $2,600, depending on the program. These relatively small scholarships have been enough to help low-income families afford a private school. With an average award of $6,200, ESAs would go even further toward supporting the education of our children.

Truth: EITC and OSTC alone cannot meet the demand for education options.

In 2012, Philadelphia County parents Hamlet and Olesia Garcia were arrested after allegedly sending their daughter, Fiorella, to a school outside their public school district. Fiorella, who was five at the time, attended kindergarten at Pine Elementary School during the 2011-12 school year. Prosecutors offered to expunge the felony charge from the Garcias’ record, but only if Fiorella returned to her assigned district school in Philadelphia County. Their case is hardly unique. Tonya McDowell, Kelley Williams-Bolar, Myrna Winslow, and Yolanda Hill are all mothers who were willing to risk imprisonment to secure a quality education for their children. Their desperate actions demonstrate a critical need for alternatives to failing schools.

Pennsylvania’s tax credit scholarship programs have offered lifelines to hundreds of thousands of students since they began in 2001. But demand for these popular programs dramatically outpaces supply, so thousands are turned away each year. Education Savings Accounts will help solve the supply problem while also offering more customizability. While tax credit scholarships are applied exclusively at private schools, ESAs can be used for a host of educational options.

ESAs complement scholarship tax credits. For example, Arizona operates four separate scholarship tax credit programs, and each program has grown to serve more families since the enactment of ESAs. Florida’s ESA program, enacted in 2014, now serves more than 10,000 children. Notably, the number of children served by Florida’s tax credit scholarships has grown by 125 percent since the ESA program was enacted.

Truth: Double dipping Tax Credit Scholarships and ESA grants is expressly prohibited under SB 2.

In addition to requiring that ESA recipients withdraw from the public system, SB 2 specifically prohibits double dipping—that is, using both tax credit scholarships and ESAs. According to the bill:

The child will not accept a scholarship in the educational improvement tax credit program under Article XX-B or the opportunity scholarship tax credit program under Article XX-B.

This prohibition ensures educational choice is available to the greatest number of students possible. Because demand for tax credit scholarships exceeds supply, adding ESAs will help address waiting lists. For example, if students who currently utilize tax credit scholarships switch to ESAs under SB 2, more funds will be available for tax credit scholarships in other areas.

Education Savings Accounts have been a powerful tool in other states, bringing an unprecedented level of educational customization to families and students. Children deserve an education that fits their unique needs. It’s time to bring ESAs to Pennsylvania and make that dream a reality.