Memo

Governor Wolf’s Proposed Natural Gas Extraction Tax

A Severance Tax Harms Pennsylvanians

- The gas industry is already pulling out of Pennsylvania due to low gas prices and better opportunities elsewhere. Energy companies have laid off thousands of Pennsylvanians and cut back investment. Among them are Noble Energy, Chevron Corp., Universal Well Services and Halliburton.

- The severance tax would drive away more investment, resulting in 4,138 fewer private sector jobs in 2017, according to an economic modeling program developed by the Beacon Hill Institute.

- Low and middle income families in Pennsylvania—those earning less than $100,000—will pay $180 million more in utility bills due to the severance tax, according to the Independent Fiscal Office (IFO).

Do Drillers Pay Their Fair Share?

- The IFO estimates Pennsylvania drillers pay an effective 4.7% tax rate on natural gas through the state’s impact fee.

- Governor Wolf’s severance tax proposal and price floor, under current market conditions, is equivalent to a 17% tax, far above any other state’s severance tax.

- The natural gas industry has paid:

- More than $800 million in impact fees since 2011;

- More than $300 million in other state taxes since 2009;

- About $7.7 billion in royalties to landowners from 2007-2012;

- State income taxes collections on those royalties netted $235 million;

- $582 million from the lease of state forest land through 2012;

- Fees, bonds, and fines levied by the Department of Environmental Protection (DEP).

- Pennsylvania drillers pay many taxes that do not exist in other drilling states.

- There is no corporate income or personal tax in Texas or Wyoming, and the corporate income tax in West Virginia is 6.5%, compared to Pennsylvania’s 9.99% rate.

- Of states that collect more than $200 million in severance taxes, three have no individual income tax, two have no corporate income tax, five have no death tax, and two have no sales tax.

- If lawmakers want Pennsylvania’s tax rate to reflect other energy producing states, they should cut or eliminate other state taxes.

| Tax Collections by State in thousands | ||||

| Individual Income Taxes | Corporation Net Income Taxes | Death and Gift Taxes | Sales and Gross Receipts Taxes | |

| Pennsylvania | $10,809,736 | $2,301,589 | $849,194 | $9,497,906 |

| Texas | $0 | $0 | $0 | $32,336,032 |

| North Dakota | $498,528 | $250,438 | $15 | $1,320,196 |

| Alaska | $0 | $408,938 | $0 | $0 |

| New Mexico | $1,297,493 | $205,702 | $0 | $2,098,676 |

| Wyoming | $0 | $0 | $0 | $765,543 |

| Louisiana | $2,753,680 | $481,212 | $150 | $2,923,336 |

| West Virginia | $1,770,466 | $203,508 | $0 | $1,221,966 |

| Oklahoma | $2,962,128 | $397,290 | $1,056 | $2,599,203 |

| Montana | $1,063,261 | $150,139 | $4 | $0 |

| Colorado | $5,658,457 | $717,506 | $434 | $2,615,601 |

| Kentucky | $3,749,258 | $674,464 | $45,844 | $3,131,157 |

| Utah | $2,889,912 | $307,910 | $0 | $1,823,355 |

Source: US Census Bureau

Tax Proposal puts Politics before Education

- None of the proposed severance tax revenue is dedicated for education, but $225 million is earmarked for subsidizing alternative energy projects.

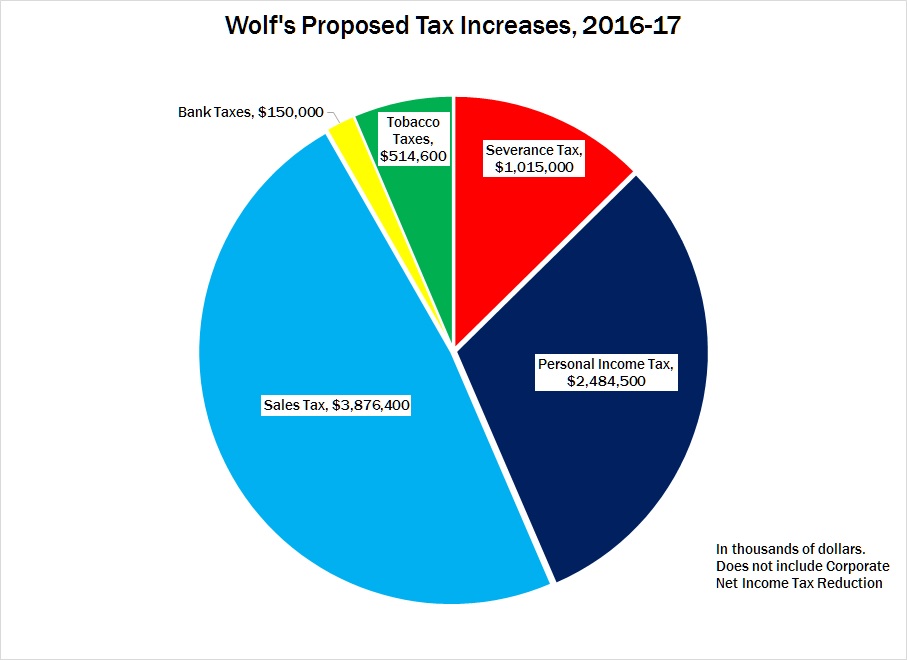

- According to the governor’s own estimates, his income tax and sales tax increases will cost taxpayers several times more than his severance tax. His proposal collects more funding from taxing health care services and day care than from taxing natural gas.

|

Natural Gas Severance Tax Rates |

|||||

|

Top Natural Gas Producing States 2013 |

States |

Severance Tax on Natural Gas |

Exemptions and Incentives for Unconventional Wells |

Top Corporate Net Income Tax Rate |

State and Local Tax Burden (as a percentage of State income/national rank) |

|

1 |

Texas |

7.5% of market value |

Rate reduction appr. 2% for up to 10 years |

none |

7.5% / 47 |

|

2 |

Pennsylvania |

4.7%* |

|

9.99% |

10.3% / 10 |

|

3 |

Louisiana |

$0.03-0.13 per MCF |

Severance tax suspension on horizontally drilled well for 2 years or until payback |

8% |

7.6% / 46 |

|

4 |

Oklahoma |

7% plus 0.095% excise tax |

Exempt from severance tax for 4 years or until gas production pays for the cost of the well |

6% |

8.5% / 39 |

|

5 |

Wyoming |

6% of taxable value |

Gas transportation costs subtracted from the taxable value |

none |

6.9% / 50 |

|

6 |

Colorado |

2% – 5% based on gross income |

Allows producers to deduct 87.5% of their property taxes paid to gov. from severance tax to state |

4.63% |

9% / 32 |

|

7 |

New Mexico |

3.75% |

|

7.3% |

8.6% / 37 |

|

8 |

Arkansas |

5% |

1.5% on new discovery wells for 24 months and on high cost wells for 36 months (can get extension) |

6.5% |

10.3% / 12 |

|

9 |

West Virginia |

5% + $0.047 per MCF |

|

6.5% |

9.7% / 19 |

|

10 |

Utah |

3% – 5% |

6 months exemption for development wells |

5% |

9.4% / 28 |

|

11 |

Alaska |

25% – 50% net value |

Reduction for all drilling in Cook Inlet basin and when gas in used in state; Limited tax credits for exploration |

9.4% |

7% / 49 |

|

12 |

Kansas |

8% on gross Value severed from earth |

3.67% tax credit for ad valorem taxes paid, effectively reducing the severance tax to 4.33% |

7% |

9.4% / 26 |

|

13 |

California |

<0.01 per MCF |

|

8.84% |

11.4% / 4 |

|

*Pennsylvania levies an impact fee (akin to a tax) based chiefly on the number of natural gas horizontal wells. Sources: Energy Information Administration, Independent Fiscal Office, Tax Foundation |

|||||