Fact Sheet

Governor Wolf’s Natural Gas Tax Proposal

Governor Wolf continues to press for a natural gas severance tax despite ongoing layoffs and potential bankruptcies in the natural gas industry.

Severance Tax Proposals

- Gov. Wolf proposed a 6.5% severance tax (starting July 2016) on the value of natural gas, minus a credit for the impact fee, generating an estimated $218 million in revenue.

- The Independent Fiscal Office (IFO) estimates the current impact fee represents an effective severance tax rate of 5.5% (based on current gas prices and drilling production).

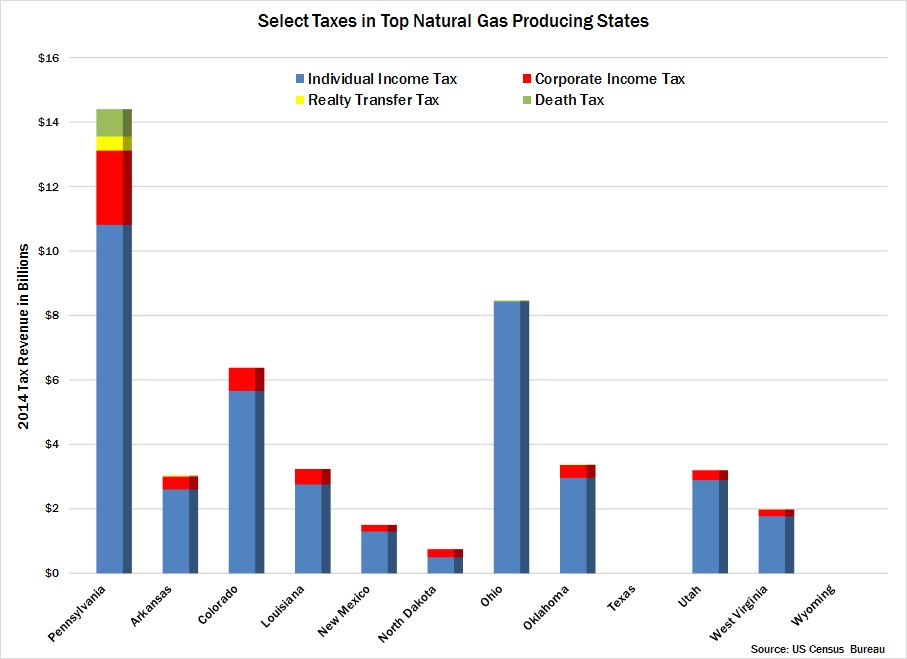

- While Pennsylvania is the only major natural gas producing state without a “severance tax,” it’s also the only state with an “impact fee.” In addition, Pennsylvania drillers pay taxes that do not exist in top natural gas producing states.

- There is no corporate or personal income tax in Texas or Wyoming. The corporate tax in West Virginia is 6.5%, while Pennsylvania’s is 9.99%.

- Of the top ten natural gas producing states, two have no individual income tax, two have no corporate income tax, and only four collect death taxes. Pennsylvania levies all three.

- If lawmakers want Pennsylvania’s tax burden to reflect other energy-producing states, they should cut or eliminate other state taxes.

Fair Share or More Revenue

- With an effective tax rate of 5.5%, natural gas producers are paying more than Wolf’s original 5% severance tax proposal.

- In addition to higher taxes, the administration is revising drilling regulations with an estimated cost of $41 million to $73 million in the first three years. The Marcellus Shale Coalition estimates these rules will cost significantly more, at $2 billion a year.

- At the same time, the Department of Environmental Protection is developing new methane emission regulations that will impose additional costs.

| Top Natural Gas Producing States 2014 | States | Severance Tax on Natural Gas | Exemptions and Incentives for Unconvential Wells | Top Corporate Net Income Tax Rate | State and Local Tax Burden (as a percentage of state income/ national rank) |

| 1 | Texas | 7.5% on market value | Rate reduction appr. 2% for up to 10 years | none | 7.6% / 46 |

| 2 | Pennsylvania | 5.5%* | 9.99% | 10.2% / 15 | |

| 3 | Oklahoma | 7% plus 0.095% excise tax | Exempt from severance tax for 4 years or until gas production pays for cost of the well | 6% | 8.6% / 40 |

| 4 | Louisiana | $0.03-0.13 per MCF | Severance tax suspension on horizontally drilled well for 2 years or until payback | 8% | 7.6% / 45 |

| 5 | Wyoming | 6% of taxable value | Gas transportation costs subtracted from the taxable value | none | 7.1% / 48 |

| 6 | Colorado | 2% – 5% based on gross income | Allows producers to deduct 87.5% of their property taxes paid to gov. from severance tax to state | 4.63% | 8.9% / 35 |

| 7 | New Mexico | 3.75% | 7.3% | 8.7% / 37 | |

| 8 | Arkansas | 5% | 1.5% on new discovery wells for 24 months and on high cost wells for 36 months (can get extension) | 6.5% | 9.8% / 17 |

| 9 | West Virginia | 5% + $0.047 per MCF | 6.5% | 9.8% / 18 | |

| 10 | Ohio | $0.025 per MCF | none | 9.8% / 19 | |

| *Pennsylvania levies an impact fee (akin to a tax) based chiefly on the number of natural gas horizontal wells. Sources: Energy Information Administration, Independent Fiscal Office, Tax Foundation |

|||||

Natural Gas Industry Recession

The industry is in the midst of a recession.

- There are fewer drilling rigs operating in Pennsylvania today than in 2008, the year before the shale boom. According to Baker Hughes, the number of drilling rigs has declined by over 60 percent in the past year.

- The latest IFO report on natural gas production finds production is growing at a much slower pace. In addition, the second half of 2015 experienced a 20% increase in “shut in wells” (completed wells that are not producing). In other words, poor economic conditions are convincing companies to leave gas in the ground.

- Increasing the cost to do business will exacerbate ongoing layoffs and further reduce investments in local businesses.

- Chesapeake Energy Corp. ceased all drilling in the Marcellus shale and continues to sell assets to pay off debts.

- Cabot Oil & Gas Corp. cut back from two drilling rigs to one and reduced its capital budget by 47% this year.

- Chief Oil & Gas closed its Wexford office in October.

- Consol Energy Corp. announced plans to extend a drilling hiatus through 2016.

- EQT Corp., a Pittsburgh-based company, is cutting the number of wells they will drill this year by a third.

- Range Resources laid off 55 employees last winter, including 31 in Washington County. Overall, the company cut 11% of its workforce last year, including offices in Meadville, and reduced Pennsylvania drilling rigs from 15 to 3.

- Seneca Resources is operating one rig for the next year, down from three last year, and delayed finishing a pipeline to western New York.

- Southwestern Energy Co. recently laid off 40% of its workforce, including 200 in Pennsylvania, about 100 workers in the southwest, and 100 in the northeast.

- States around the country that rely on oil and gas severance taxes are facing tough decisions.

- North Dakota is looking to cut about 4% of the state budget to make up for a $1 billion loss in oil and natural gas revenues.

- States like West Virginia, Alaska and Oklahoma are also struggling to cope with significant drops in severance tax revenue.

###

The Commonwealth Foundation transforms free-market ideas into public policies so all Pennsylvanians can flourish.