Fact Sheet

Budget Facts 2010: Spending Increases by Department

Pennsylvania faces a projected General Fund tax revenue shortfall of at least $500 million. Governor Rendell proposed a $29 billion budget for 2010-11, that increases businesses taxes, imposes new taxes on natural gas and tobacco products, and expanding the sales tax to include many goods and services currently exempt. This is the second in a series of fact sheets on the state budget.

The executive budget maintains above-inflation increases in spending over Rendell tenure

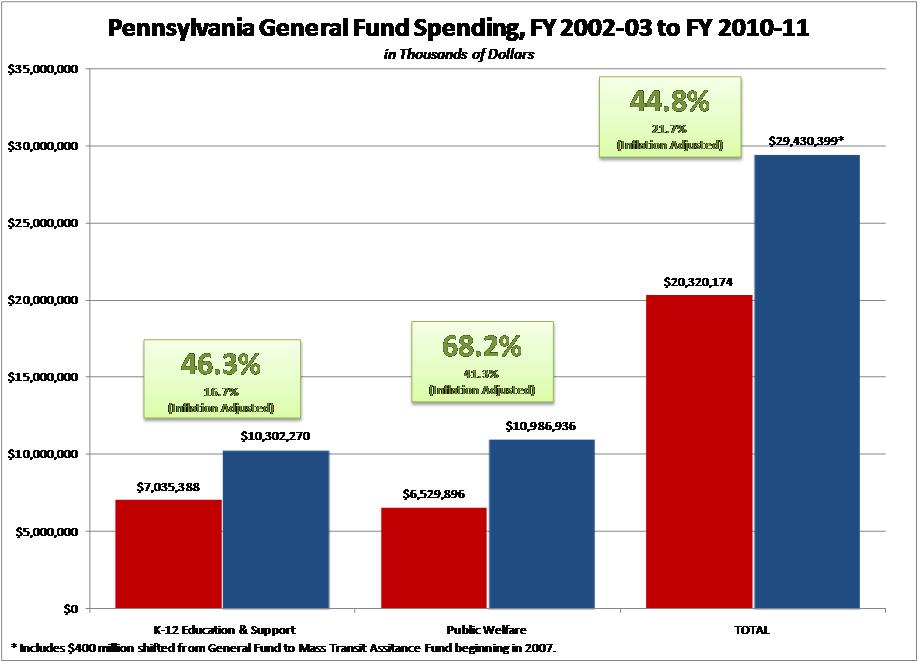

- The FY 2010-11 budget proposal represents a 44.8% increase in total General Fund spending since Rendell took office in January 2003.

- The Executive Budget increases spending over fiscal year 2002-03 by inflation and population growth, plus an additional $4.8 billion.

The executive budget proposal increases spending in K-12 Education and Public Welfare

- K-12 Education and Public Welfare-the two largest items in the General Fund Budget (representing 80% of all General Fund spending)-would receive increased funding in FY 2010-11.

- Contrary to the Governor’s claim, these programs are not “mandated spending.” The Commonwealth Foundation has suggested a variety of policy solutions, including expanding the Educational Improvement Tax Credit and Medicaid reforms (which would continue these services at a lower cost to taxpayers).

- K-12 Education would receive $443 million more in FY 2010-11 than in FY 2009-10-a 46.3% increase in spending since 2003 (16.7% in inflation-adjusted spending).

- Public Welfare would receive $482 million more in FY 2010-11 than in FY 2009-10-a 68.2% increase in spending since 2003 (41.3% in inflation-adjusted spending).

| Pennsylvania General Fund Spending, FY 2002-03 to FY 2010-11 | ||||

| in thousands of dollars | ||||

| 2002-03 to 2010-11 | ||||

| Department | 2002-03 | 2010-11 (proposed) | Change in % | Change in $ |

| Governor’s Office | $8,034 | $6,831 | -14.97% | ($1,203) |

| Executive Offices | $327,197 | $183,989 | -43.77% | ($143,208) |

| Lt. Governor’s Office | $927 | $1,053 | 13.59% | $126 |

| Attorney General | $75,058 | $85,657 | 14.12% | $10,599 |

| Auditor General | $47,634 | $48,070 | 0.92% | $436 |

| Treasury | $393,100 | $1,071,673 | 172.62% | $678,573 |

| Agriculture | $74,205 | $62,435 | -15.86% | ($11,770) |

| Community & Economic Development | $396,498 | $297,304 | -25.02% | ($99,194) |

| Conservation & Natural Resources | $105,503 | $91,375 | -13.39% | ($14,128) |

| Corrections | $1,247,059 | $1,922,079 | 54.13% | $675,020 |

| Education | $8,509,157 | $11,824,090 | 38.96% | $3,314,933 |

| Higher Ed | $1,473,769 | $1,521,820 | 3.26% | $48,051 |

| K-12 Education & Support | $7,035,388 | $10,302,270 | 46.43% | $3,266,882 |

| Environmental Protection | $241,835 | $157,013 | -35.07% | ($84,822) |

| General Services | $112,464 | $123,749 | 10.03% | $11,285 |

| Health | $252,509 | $232,183 | -8.05% | ($20,326) |

| Higher Education Assistance Agency | $412,838 | $455,170 | 10.25% | $42,332 |

| Historical & Museum Commission | $32,801 | $19,348 | -41.01% | ($13,453) |

| Insurance | $57,219 | $126,570 | 121.20% | $69,351 |

| Labor & Industry | $107,066 | $88,961 | -16.91% | ($18,105) |

| Military & Veterans Affairs | $100,992 | $115,646 | 14.51% | $14,654 |

| Probation & Parole Board | $99,369 | $125,842 | 26.64% | $26,473 |

| Public Welfare | $6,529,896 | $10,986,936 | 68.26% | $4,457,040 |

| Revenue | $210,488 | $203,881 | -3.14% | ($6,607) |

| State | $6,744 | $9,648 | 43.06% | $2,904 |

| State Police | $169,830 | $184,697 | 8.75% | $14,867 |

| Transportation* | $315,383 | $412,925 | 30.93% | $97,542 |

| Legislature | $258,100 | $301,411 | 16.78% | $43,311 |

| Judiciary | $235,012 | $276,860 | 17.81% | $41,848 |

| TOTAL | $20,320,174 | $29,430,399 | 44.83% | $9,110,225 |

| SOURCES: Governor’s Executive Budget, FY 2004-05; FY 2010-11 | ||||

| * $400 million shifted from transportation to mass transit fund. | ||||

# # #

For more information on the PA State Budget, visit CommonwealthFoundation.org/budget.