Fact Sheet

Budget Facts 2010: Pennsylvania State Budget Overview

Pennsylvania faces a projected General Fund tax revenue shortfall of at least $500 million. Governor Rendell proposed a $29 billion General Fund budget for 2010-11, that increases businesses taxes, imposes new taxes on natural gas and tobacco products, and expands the sales tax to many goods and services currently exempt. This is the first in a series of fact sheets on the state budget.

How much does the state spend?

- State Government’s Total Operating Budget (proposed) = $66.4 billion (FY 2010-11)

- General Fund Budget (proposed) = $29.0 billion

NOTE: Most “budget” references are to this portion of the Commonwealth’s Operating Budget, which represents less than half of the state’s total spending. - Other/Special State Funds (estimate) = $14.4 billion

NOTE: This spending includes the Lottery Fund, Motor License Fund, Gaming Fund, and other such dedicated funds. - Federal Funds (estimate) = $23.0 billion

NOTE: These funds from the federal government are spent by the state (excluding stimulus funds used to support the state General Fund).

- General Fund Budget (proposed) = $29.0 billion

- Local government spending (projection) = $67.8 billion (FY 2010-11)

- Pennsylvania state and local governments will spend approximately $10,800 for every man, woman, and child in FY 2010-11.

- State government spending per capita = $5,344

- Local government spending per capita = $5,455

How large is the state budget deficit?

- Following January’s collection, Pennsylvania General Fund revenues are $374 million below estimate for FY 2009-10, according to the Department of Revenue.

- Gov. Rendell has proposed “freezes” of $135 million in approved FY 2009-10 spending.

- Reductions have not keep pace with revenue declines.

- Pennsylvania is on the edge of a fiscal cliff.

- Gov. Rendell’s FY 2010-11 budget relies on $2.8 billion in one-time federal stimulus funding, which includes about $850 million that has not yet been approved by Congress. Even if approved, this funding vanishes in FY 2011-12.

- In FY 2012-13, state pension contributions are projected to skyrocket seven-fold, a $3.5 billion increase, from $551 million in FY 2009-10 to $4.1 billion in FY 2012-13 (increasing in future years).

- Last year’s budget deal exhausted the state’s Rainy Day Fund and other one-time sources of revenue.

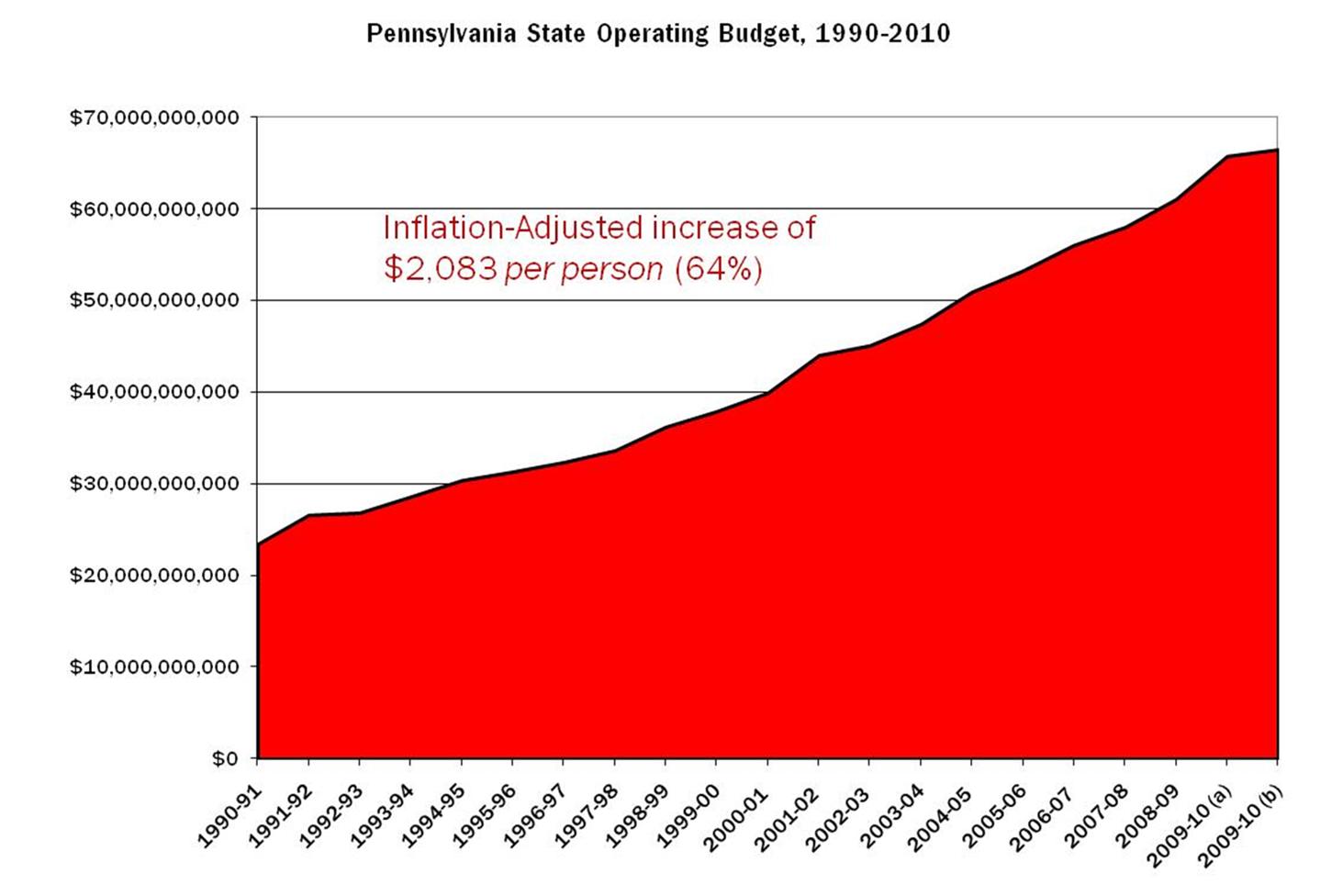

Government spending has grown faster than the rate of inflation

- Despite declining revenues, Gov. Rendell’s FY 2010-11 budget increases spending by $1.1 billion, or 4.1%.

- During Gov. Ed Rendell’s tenure (2003-2009), General Fund spending has increased by 42%, more than double the rate of inflation (19.5%). Total state spending has grown by an even higher rate, over 47%.

- Since 1990, total state spending has increased by $43 billion-an inflation-adjusted increase of almost $2,100 per person, or $8,400 per family of four.

Is Pennsylvania a high tax and high debt state?

Is Pennsylvania a high tax and high debt state?

- Pennsylvania moved from 24th out of the 50 states in tax burden in 1990 to near the top, according to the Tax Foundation. Today, Pennsylvania has the 11th highest state and local tax burden. At the beginning of Rendell’s tenure, Pennsylvania ranked 17th.

- Pennsylvanians pay $4,463 per capita in state and local taxes (representing 10.2% of their income).

- Pennsylvania ranks 20th or higher in state and local total taxes, spending, property taxes, income taxes, corporate taxes, and debt per capita.

- Pennsylvanians owe $116 billion in state and local government debt as of Dec. 2009.

- That debt amounts to over $9,000 for every resident, or over $36,000 for the average family of four.

- Under Gov. Rendell, total state debt increased $18 billion, or 78%, to $42 billion.

- Annual General Fund payments on debt has nearly tripled, from $349 million in FY 2002-03 to an estimated $1 billion in 2010-11.

# # #

For more information on the Pennsylvania State Budget, visit CommonwealthFoundation.org/Budget