Commentary

How to Balance the 2017-18 Budget Without Tax Hikes

Last year’s $650 million tax increase failed to end the cycle of budget shortfalls, showing that only meaningful reforms, not borrowing or new taxes, will lead to financial stability.

Here’s how the Pennsylvania House can stop the Senate tax hikes and protect taxpayers from tax hikes and borrowing.

End Horse Racing Subsidies

The Race Horse Development Fund is funded by an assessment on slot machines. Horse racing receives nearly $250 million annually, almost one third of the $800 million spent on corporate welfare. Since 2006, Pennsylvania taxpayers have spent $2.7 billion on horse racing subsidies.

Legalizing slot machines was intended to reduce property taxes, yet a chunk of the revenue from gambling taxes is diverted to corporate welfare, such as horse racing.

A Tribune-Review analysis found a bulk of the prize money went to out-of-state owners, including at least $1 million to the multi-billionaire vice president of the United Arab Emirates. Additionally, an Independent Fiscal Office report found more than 20% of prize money was spent outside Pennsylvania.*

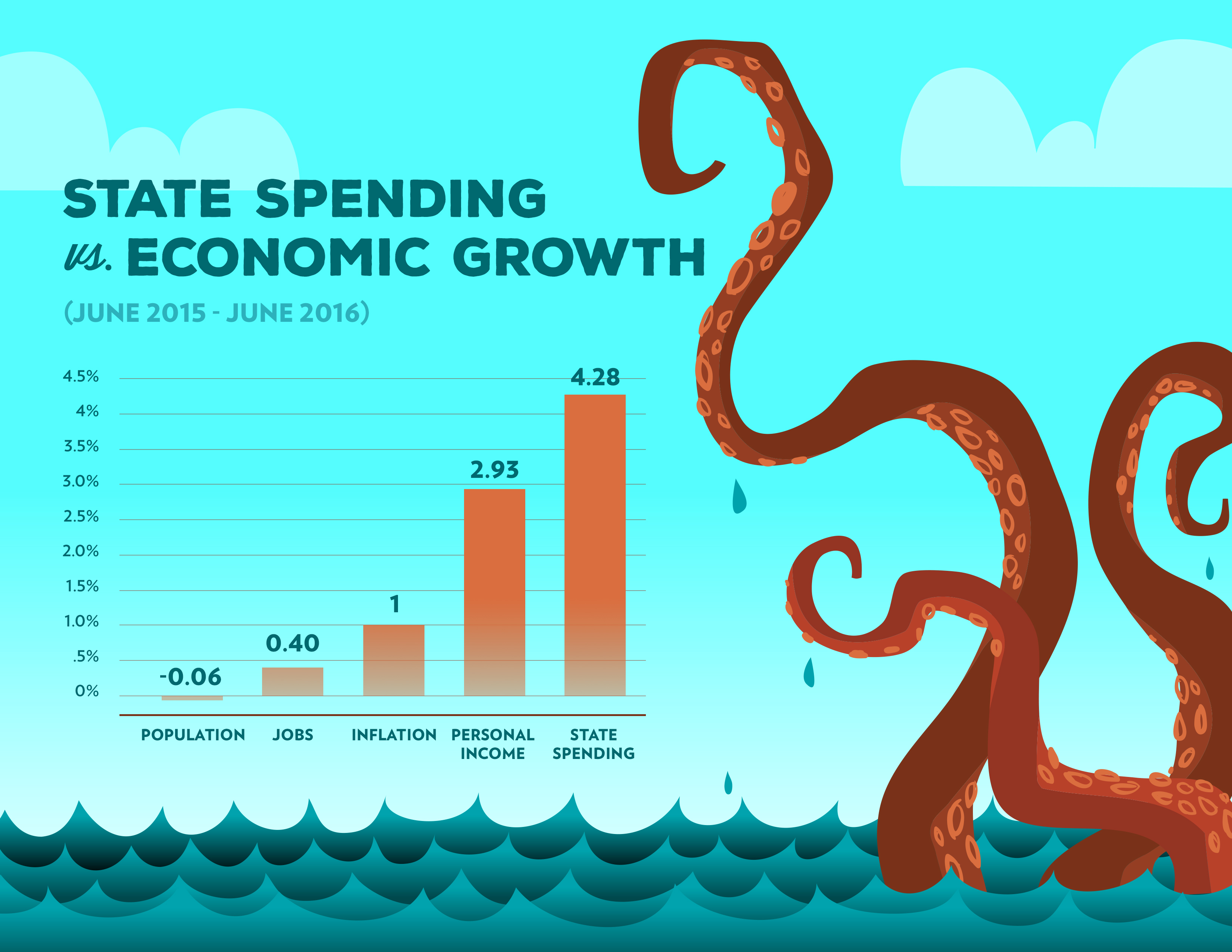

Pennsylvania’s economy is struggling due to a high tax burden, excessive government spending, and corporate handouts. We lead the nation in economic development subsidies, but they aren’t working: In 2016 we lost population for the first time in 31 years.

Continue Liquor Privatization

Privatizing alcohol sales would not only increase revenue, but also reduce PLCB costs. These proposals generate between $1 million and $1 billion in upfront revenues, as well as annual license fees and tax revenues from reduced border bleed.

Prioritize All Spending

CF has identified roughly $2 billion outside the General Fund for reprioritization. These funds include the Keystone Recreation, Park and Conservation Fund and the Public Transportation Trust Fund.

Adopt Meaningful Long-term Welfare Reforms

If we are to put our fiscal house in order, addressing long-term growth in welfare, while improving the quality of programs, must be a top priority. The budget calls for $350 million in Medicaid savings, which will require significant reforms. One solution is meaningful work requirements. When enacted in other states, these requirements reduced welfare rolls because more individuals found jobs—both saving money and helping families transition from poverty to prosperity.

Both the Senate and House passed work requirements for able-bodied Medicaid recipients as part of a budget-related bill called the Welfare Code. The Code still requires one more vote from the House.

The state’s budget deficit isn’t the result of taxes being too low. Rather, the state’s troubles stem from surging government spending, which has contributed to slow economic growth and a shrinking population. Lawmakers need to address spending and tax reform to end our perpetual budget crisis.