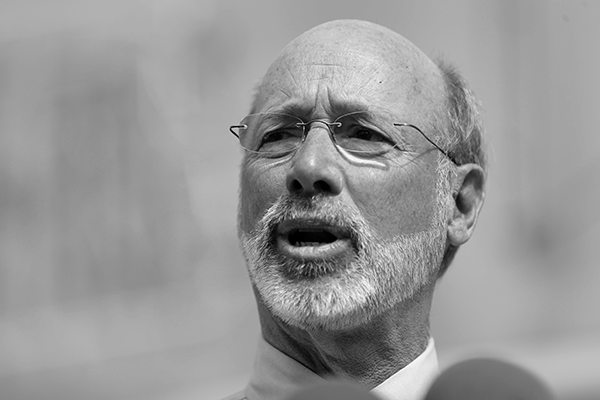

Media

Which Wolf Was It? Gov. Wolf’s Hypocrisy on Education Tax Credits

Tom Wolf the private citizen and business owner benefited from and lauded private school choice and the EITC program. But Governor Tom Wolf has used his political clout to deny less fortunate families from receiving the same benefits.

Question: Which Wolf attended an elite, private boarding school, thanks to his parents’ educational choice?

Answer: Tom Wolf the student, who attended The Hill School in the 1960s. This Tom Wolf was set up for success in life, thanks to the quality private education he received.

Question: Which Wolf ran a company that donated to the EITC program?

Answer: Tom Wolf the CEO of the Wolf Organization, which donated $60,000 to EITC from 2001 and 2005 and received $54,000 in tax credits.

Question: Which Wolf said, “The EITC program has been an effective tool to invest in education and support student learning in a multitude of educational settings,” and “I will not interfere with the EITC program”?

Answer: Tom Wolf the gubernatorial candidate in 2014.

Question: Which Wolf said, “a child’s zip code should not determine what kind of education he or she can get?”

Answer: Governor Tom Wolf, speaking at the 2018 Budget Address in 2018.

Question: Which Wolf withheld funding from EITC and OSTC, costing over 8,000 students their scholarships?

Answer: Governor Tom Wolf withheld tax credits for student scholarships in 2015, claiming the budget impasse as justification.

Question: Which Wolf called the EITC program a “distraction” which lacks “fairness and accountability?”

Answer: Governor Tom Wolf in 2019, speaking after the General Assembly passed HB 800. With 49,000 student scholarship applications denied last year, HB 800 would have provided immediate relief for Pennsylvania students by expanding the number of tax credits available for scholarships.

Question: Which Wolf vetoed student opportunity and claimed that all students should be educated through the public school system?

Answer: Governor Tom Wolf vetoed HB 800, which would have expanded Pennsylvania’s popular Educational Improvement Tax Credit, on June 18, 2019.

Despite Gov. Wolf’s recent veto, lawmakers in Harrisburg can stand up for students by demanding a substantial increase in tax credit scholarships as part of the state budget negotiations. Educational opportunity for all students is a bipartisan issue. Our kids deserve to be in schools where they’ll thrive, not on waiting lists.