Media

State Tax Reform Will Improve Pennsylvanians’ Lives

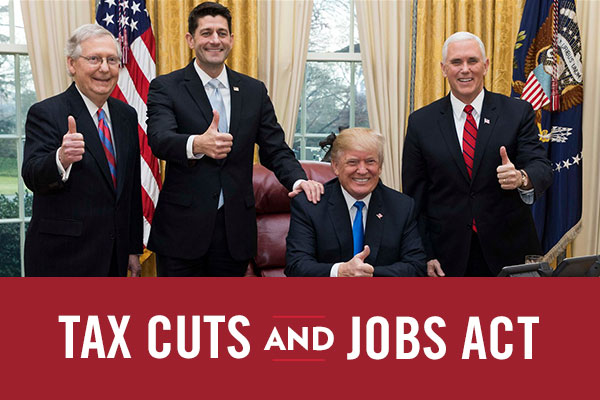

Federal tax reform is having a positive impact on working people throughout the country, including right here in Pennsylvania.

Companies have announced bonuses, wage increases, and enhanced retirement benefits for a countless number of employees. CF documents these instances in our recent policy points on the impact of tax reform in Pennsylvania.

At least 17 companies headquartered in the commonwealth have committed to increasing compensation for their employees. The number is even higher—29 in total—when accounting for businesses with locations in the Keystone State.

Preliminary data from the Bureau of Economic Analysis (BEA) projects tax reform boosted wages and salaries by at least $30 billion in January. The BEA also estimates the Tax Cuts and Jobs Act will provide much-needed tax relief for families, reducing current personal taxes by $115.5 billion annually.

Yet, tax reform is about more than dollars and cents. It’s about improving the quality of life for every person working hard to provide for themselves and their families. Ken Wilson, a project foreman in Western Pennsylvania, explains how federal tax cuts will help his family, “I think it’s great if somebody like me gets that kind of opportunity to have that kind of savings. It’ll go a long way throughout the year. With my daughter getting ready to graduate high school in a year, I’ve got to start thinking about the future for her.”

It’s this kind of personal impact that should drive lawmakers to overhaul the state tax code. Pennsylvania has one of the highest tax burdens in the country, and it is taking a toll on workers like Ken—both through burdensome tax loads and through fewer opportunities.

Too many communities across our state have been hollowed out by big government policies, leaving people to search for jobs elsewhere. To revitalize these areas and help those looking for a better life, lawmakers should dramatically reduce taxes, overhaul the regulatory environment, and control government spending.

These changes will boost economic growth and put the state on a pathway to prosperity. Harrisburg’s focus should be on removing government roadblocks preventing Pennsylvanians from creating, innovating, and serving each other. That’s how revitalization begins.