Media

Faculty Benefits Driving Up Tuition Costs

APSCUF—the union representing faculty at state-owned universities—has begun a vote to authorize a strike.

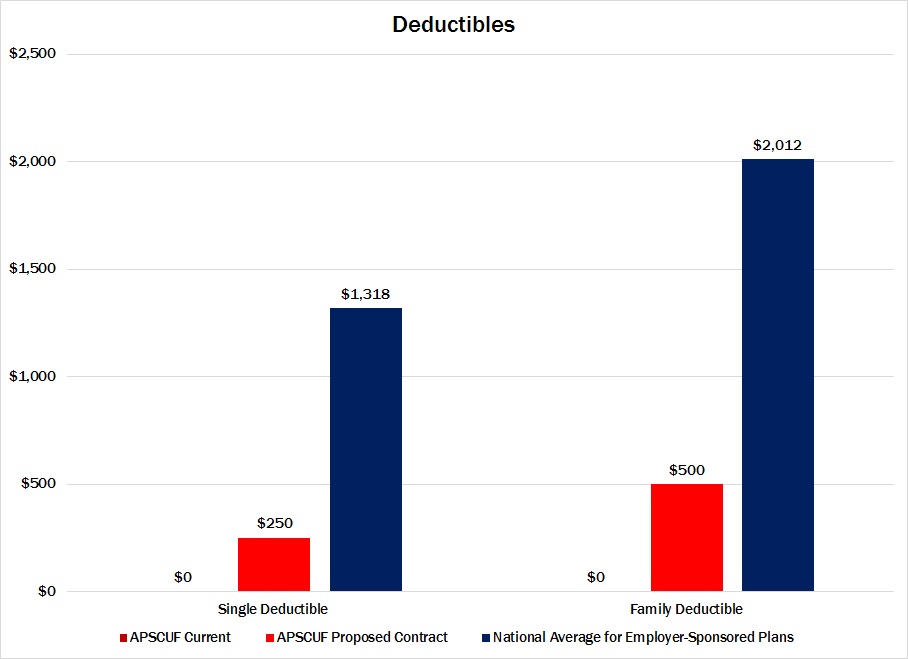

One of APSCUF's complaints with the proposed contract is higher health care expenses. In a recent email to faculty members, APSCUF touted the fact that employees would now have a deductible with their health insurance plans–$250 for singles and $500 for families. That is, their current contract offers a ZERO deductible.

In contrast, the average deductible nationwide for employer-provided coverage is more than $1,300 for single coverage and more than $2,000 for family coverage, according to the Kaiser Family Foundation.

Likewise, APSCUF is complaining about out-of-pocket limits on health care since employees currently pay $0 out-of-pocket. The proposed contract would limit out-of-pocket expenses to $1,000 for single coverage and $2,000 for family coverage.

Nationwide, 83 percent of employee-sponsored individual plans have an out of pocket maximum of more than $2,000, according to the Kaiser Family Foundation.

If students and parents wonder why tuition costs so much, they should look to faculty health care benefits that are out of whack compared to the private sector.