Media

Don’t Balance the Budget on the Backs of Working People

With little time left until the new fiscal year and fewer than two weeks to avoid another budget impasse, informal budget proposals are floating throughout the state Capitol.

One proposal would authorize large spending increases and tax hikes on tobacco products—neither of which should be acceptable to taxpayers.

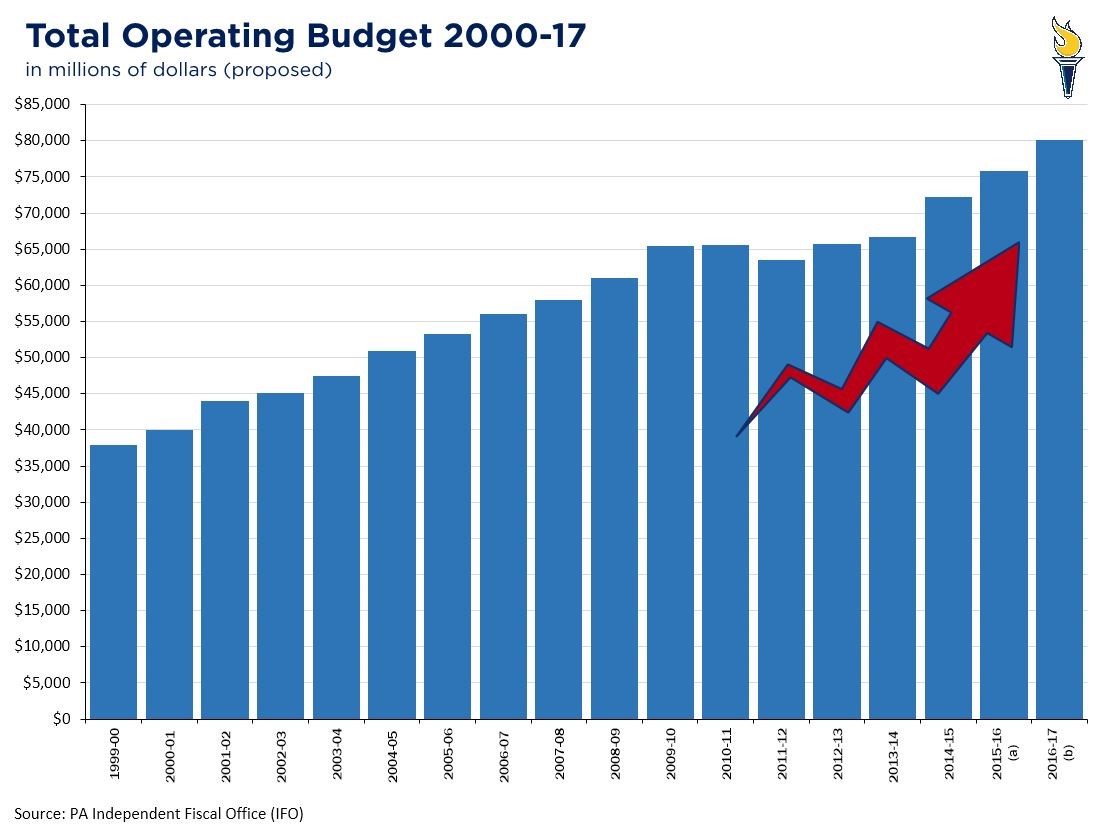

Growing government is what Pennsylvania has always done, with state spending rising consistently for the last 46 years. Unsurprisingly, this has put a strain on working people, who shoulder the 15th highest tax burden in the country.

Raising tobacco taxes only adds to this burden, balancing the budget the on the backs of the poor while relying on an unsustainable revenue source to meet spending projections. This is neither necessary nor fair.

Pennsylvania’s fiscal struggles don’t stem from state government taking too little out of taxpayers’ pockets but from the excessive growth of government spending. Unaddressed, this spending penchant will exacerbate the state’s fiscal, demographic, and economic troubles

Lawmakers can balance the budget by keeping spending within the parameters of the Taxpayer Protection Act index—based on inflation plus population growth. This year, the index is 1.02 percent, which would allow for a $300 million increase in government spending.

To keep spending in check, CF has proposed a litany of reforms, including:

- Eliminating corporate welfare,

- Reducing public employee compensation inequality,

- Reforming welfare, and

- Reprioritizing non-General Fund spending.

These and other measures would avoid doubling-down on the same old formula of higher taxes and unsustainable spending increases.

Pennsylvania’s job, income, and population growth has been near the bottom in the nation over the last four decades, while the costs of government have gone largely unchecked. That’s not a coincidence.

If we’re going to change Pennsylvania for the better, business as usual is not good enough.