Media

Pennsylvania Must Control Compensation Costs

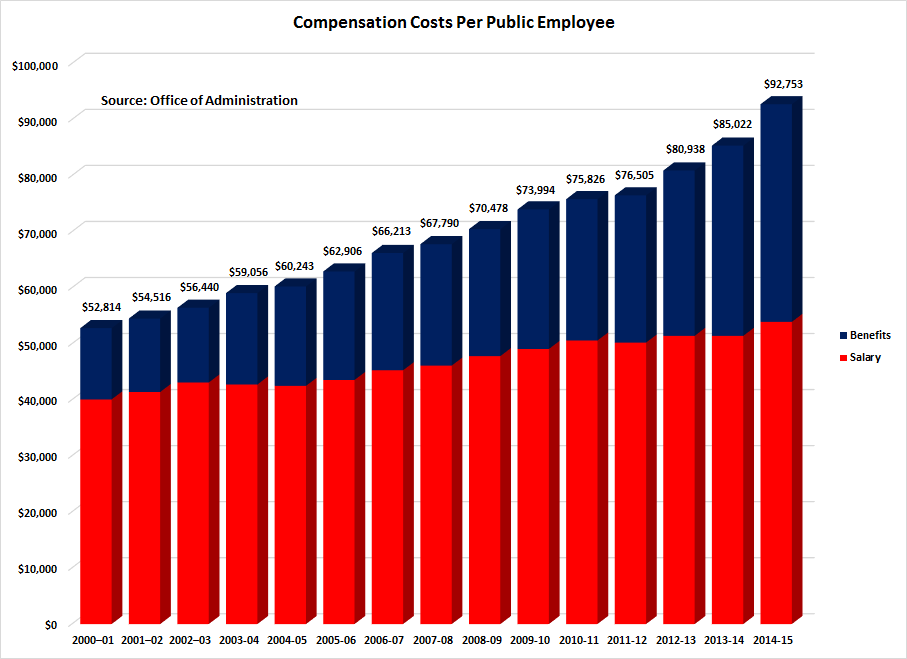

The soaring costs of public employee compensation, if left unchecked, could aggravate Pennsylvania’s financial troubles.

The growth in employee benefits, which have skyrocketed since 2006, is driving this upward trend in employee compensation.

| Commonwealth Agency Employment (inflation-adjusted 2015 dollars) | |||||

| No. of employees | Average salary per employee | Average benefits per employee | Total average compensation per employee | Benefits as % of salary | |

| 2006 | 85,956 | $51,047 | $22,683 | $73,731 | 44.40% |

| 2011 | 80,766 | $53,031 | $26,441 | $79,473 | 49.90% |

| 2015 | 79,428 | $53,924 | $38,829 | $92,753 | 72.00% |

| 10-year change | -7.60% | 5.60% | 71.20% | 25.80% | |

| Source: Pennsylvania Office of Administration, “2016 State Government Workforce Statistics,” http://www.oabis.state.pa.us/SGWS/2016/2016_SGWS_Dashboard_Charts.pdf#pagemode=bookmarks. The report details statistics for agencies under the PA governor's jurisdiction. | |||||

While public employee pay has risen by 5.6% since 2006, average benefits per employee have increased by an astonishing 71.2%, bringing the total average compensation to nearly $93,000 per employee.

With few exceptions, compensation steadily but stably increased until the last three years—when it exploded. Just last year, compensation rose by $7,700 per worker—more than $5,000 of this in benefits alone.

Benefits now make up 42 percent of the average public employee’s total compensation. In contrast, benefits in the private sector represent about 34 percent of total compensation.[1]

Beyond benefits as a percent of compensation, total compensation for Pennsylvania’s public employees is also much higher than that of private sector employees, according to Andrew Biggs of the American Enterprise Institute.

In his 2014 report, Biggs found Pennsylvania offers one of the most generous compensation packages for public employees. In fact, the state was second in terms of the inequality between public and private sector compensation, even after adjusting for factors like educational attainment. For public employees, total compensation was 35 percent higher when compared to private-sector workers.

Put plainly, this arrangement is unfair to private sector workers who are taxed to pay for the more generous compensation packages enjoyed by their public sector counterparts.

Lawmakers can address this unfairness and rein in the costs of government by making the collective bargaining process more transparent and bringing public employee benefits in line with the private sector.

Contract transparency would give taxpayers a seat at the table during collective bargaining negotiations. Currently, public officials can negotiate union contracts in secret—with their campaign contributors in many cases. This effectively denies taxpayers a voice in contract discussions.

Structuring benefits to mirror those offered in the private sector is also a critical reform. For example, moving all new employees to a 401k pension plan, which is what is offered to most private sector workers, will help the state control future costs while offering employees more control over their retirements.

Promoting parity between private and public sector medical plans is another way to close the compensation gap.

According to the Kaiser Family Foundation, private sector workers pay about 20 percent of their premium for individual coverage and 22 percent for family coverage. The total contribution of public employees for their share of medical benefits is approximately 11.7 percent. If the state increased this contribution to 20 percent, taxpayers could save at least $153 million annually.

These commonsense reforms would serve the dual purpose of reducing compensation inequality and protecting working people from paying even more in taxes.

[1] The Bureau of Labor Statistics does not provide compensation data on a state-by-state basis. However, it does provide compensation data by geographic area. The comparison above uses compensation data from the Middle Atlantic region, which includes Pennsylvania, New Jersey, and New York.