Media

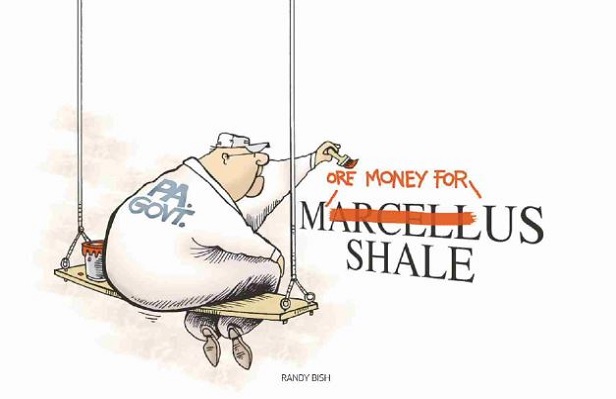

The Fair Share Fallacy

What is the natural gas industry's “fair share” of taxes? The answer depends on the calendar year.

An analysis from the Independent Fiscal Office (IFO) finds the current “impact fee” is effectively a 5.5 percent severance tax due to a 16-year-low in natural gas prices. In other words, the natural gas industry is already paying a higher tax rate than what the Governor Wolf proposed in 2014.

As a reminder, Governor Wolf called for a 5 percent severance tax during his campaign to replace the impact fee and “put Pennsylvania in line with other natural gas producing states.” Of course, many of those states do not have individual income taxes, corporate income taxes or death taxes.

Natural gas prices continued to fall in 2015, so Governor Wolf redefined “fair share” by adding a price floor. Under this policy, natural gas companies pay taxes on gas at $2.97 per Mcf (thousand cubic feet), even though the actual price of natural gas was below that number . . . and still is.

According to testimony by the IFO, Wolf's original plan would establish an effective 17.3 percent severance tax rate in 2016, by far the highest rate in the nation.

Now the Governor is redefining fair share once again by proposing a severance tax of 6.5 percent to collect an estimated $218 million in revenue. For context, that's about four times higher than Ohio's natural gas severance tax and higher than neighboring West Virginia's 5 percent severance tax.

On top of a severance tax proposal, the administration is formulating new natural gas drilling regulations and adding methane emission requirements. The cost of these rules is not yet known.

If the governor and lawmakers want Pennsylvania’s tax rates to reflect other energy producing states, they should cut the impact fee or eliminate other state taxes.