Media

Deficit Hypocrisy

Much has been made of the state’s structural deficit, which amounts to about 3 percent of Pennsylvania's total operating budget.

Unfortunately, Gov. Wolf can't envision a scenario in which government adopts reforms to bring expenditures in line with revenues, even if it means just a 3 percent “cut” (more on that below).

Instead, the governor cites the deficit endlessly as a justification for imposing tax increases on working people. In fact, he issued a dire warning about the state’s budget deficit during his budget address on Tuesday:

This deficit isn’t just a cloud hanging over Pennsylvania’s long-term future. It is a time bomb, ticking away, right now, even as I speak.

He went on to reprimand the legislature for failing to deal with this “time bomb”:

But instead of finding a sustainable way to deal with our deficit, Harrisburg chose to paper over the problem with a series of budgetary gimmicks and quick fixes.

The two quotes above give the impression that the governor understands the deficit and has a real plan to eliminate it. However, a seemingly innocuous line from a Capitolwire story (paywall) shatters such an impression:

Budget Secretary Randy Albright did note that even if all of Wolf’s proposals are adopted, more work will be necessary to control growing government costs as a structural deficit is projected to return in the 2017-18 fiscal year.

This is an amazing admission. Even if the legislature agreed with Gov. Wolf’s plan to raise taxes by $3.6 billion, the projected deficit would return in the following fiscal year. And because Gov. Wolf has been unwilling to enact the reforms necessary to make government leaner, we should expect more tax increase proposals in 2017.

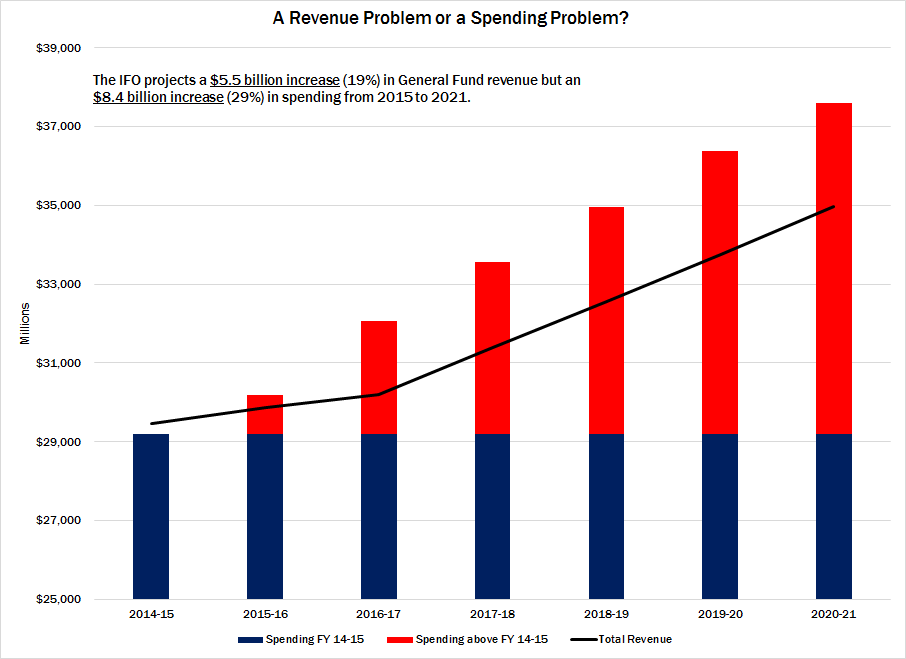

The governor’s nonexistent plan to eliminate the deficit isn’t the only problem. He’s also misrepresenting what the deficit is. Simply put, the deficit is the gap between projected revenues and spending. In the chart below, the blue shade represents the spending level for the 2014-15 budget year. The red shade represents all new spending above the 2014-15 level.

As the chart shows, the state could increase spending every year and still balance the budget. All lawmakers would need to do is slow the growth in spending. However, more can be done to reduce the cost of government. In a recently released policy memo, we suggest redesigning government not only to avoid tax increases but to start reducing Pennsylvania’s suffocating tax burden.

If Gov. Wolf wants to put Pennsylvania on a sound fiscal footing, raising taxes and increasing spending at the fastest pace in a quarter of a century is not the solution. As his own budget secretary admits, his plan will put us right back in the same predicament next year. How is that a break from the status quo?