Media

Wolf Truth Squad: Tax Hikes on Working Families

UPDATE: Gov. Wolf offered a new tax proposal on October 6, 2015. Here is a summary of that plan

As noted yesterday, the Pennsylvania House of Representatives has scheduled a vote on Gov. Tom Wolf's latest tax proposal for Wednesday, October 7.

If you follow Gov. Wolf on Facebook, you've probably seen a slew of taxpayer-funded memes, arguing for a budget that includes a “severance tax for education. That's not what this tax plan does.

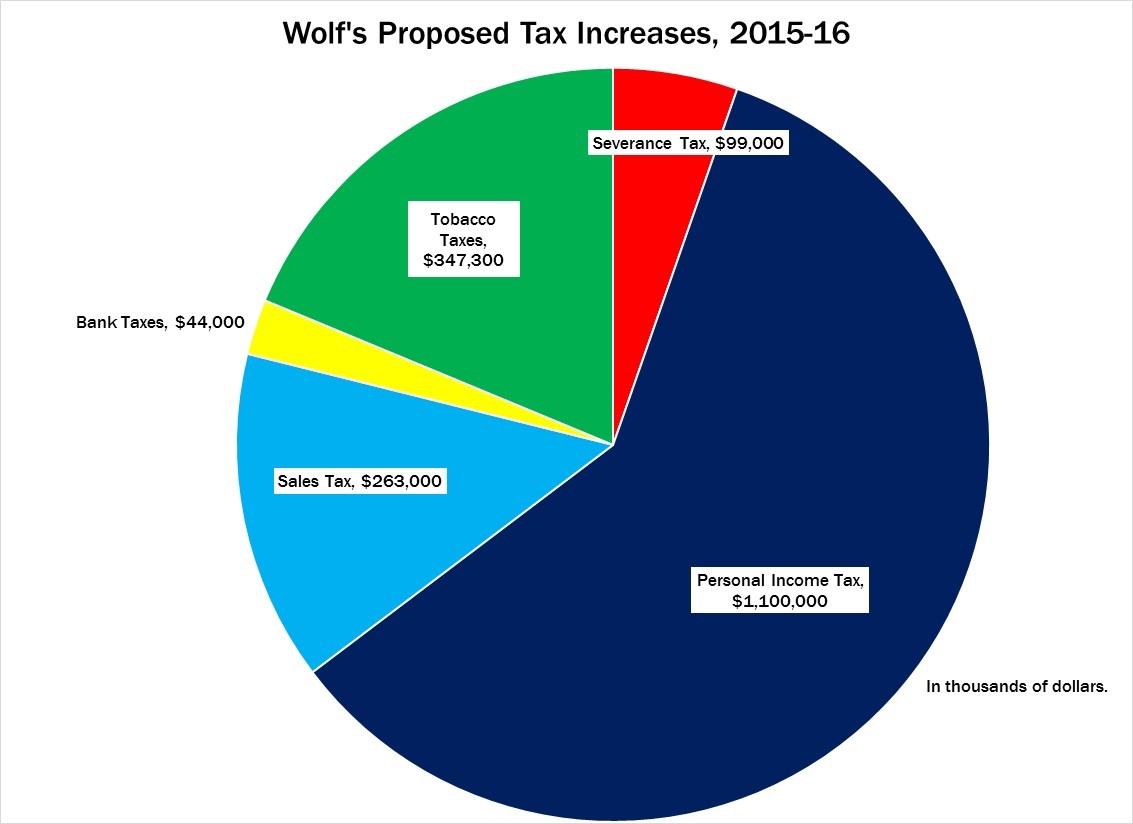

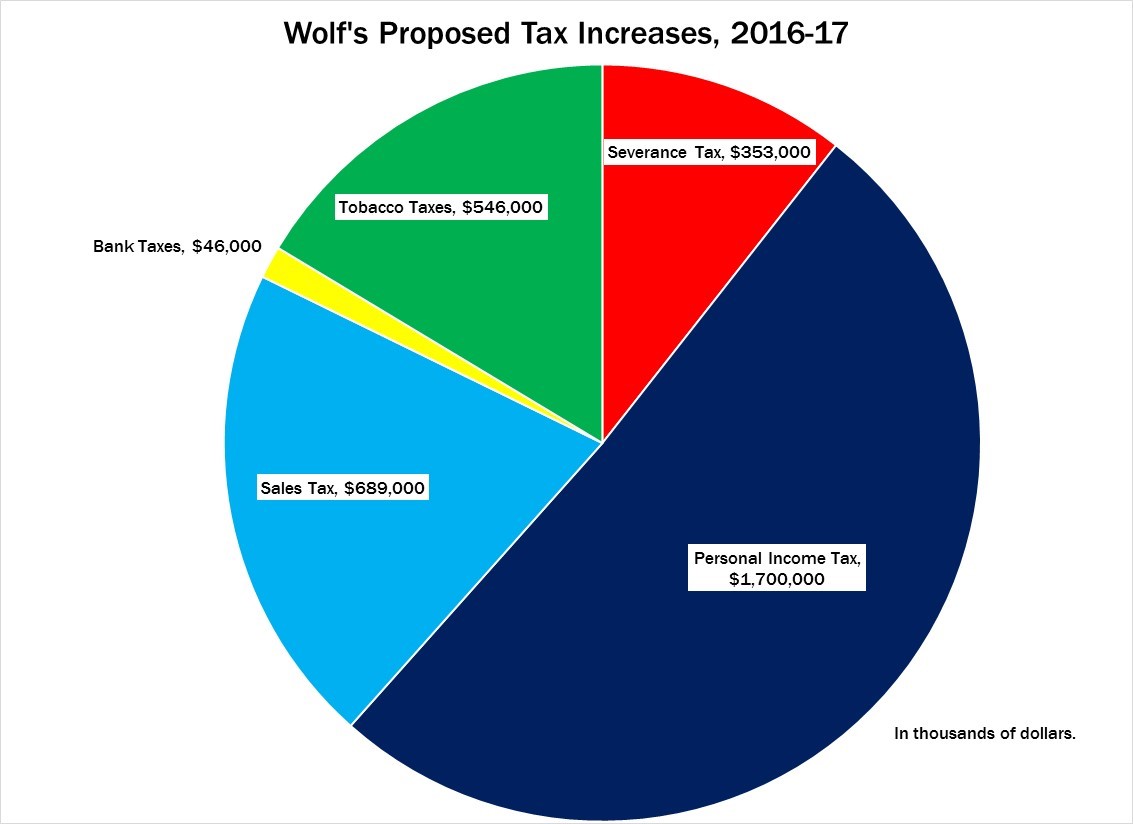

The severance tax would generate only $99 million in the first year—only 5 percent of total new revenue. In 2016-17, the severance tax—after replacing “impact fee revenues”—would generate only $353 million, or slightly more than 10 percent of the total in new taxes.

In contrast, the overwhelming majority of revenue in Wolf’s tax plan comes from income and sales tax increases—yet you won't find one mention of these things on his Facebook page.

Wolf would raise the income tax by 14 percent, and impose the sales tax on basic cable TV, dry cleaning, amusement and recreation, and other personal services. These taxes would be borne directly by working families.

- In 2015-16 Wolf would take $1.8 billion more from taxpayers—77 percent via income and sales tax.

- In 2015-16 Wolf's tax increase would yield a $3.2 billion net increase—74 percent from income and sales tax.

You can read more about this tax plan in our latest policy memo.

Governor Wolf and his special interest allies are already calling lawmakers to pressure them to vote for higher taxes They need to hear from you too.

Join us in telling your legislators and Gov. Wolf—No New Taxes!