Media

Step Forward for School Choice

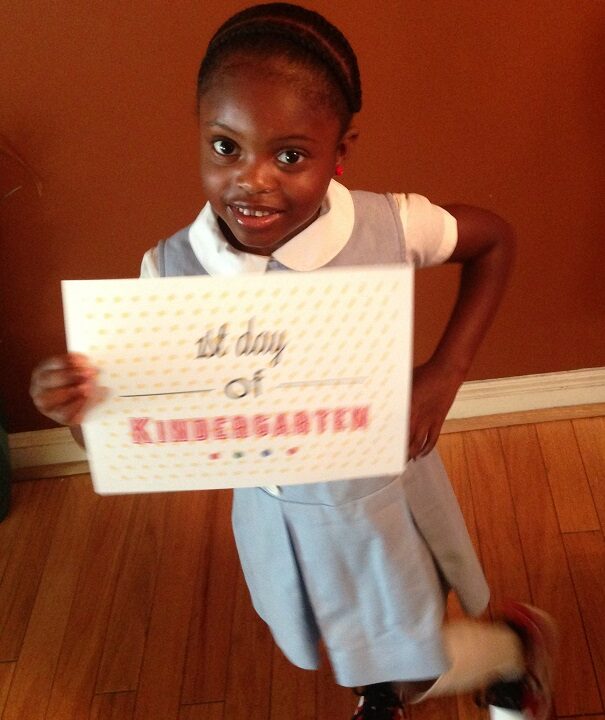

Geronda Montalvo did not want to send her daughter Zayda to the low-achieving schools in her neighborhood. Thanks to an Educational Improvement Tax Credit (EITC) scholarship, Zayda is thriving at Holy Child Academy. And thanks to the passage of HB 91, more mothers like Geronda will have educational options.

HB 91 consolidates the EITC and Opportunity Scholarship Tax Credit (OSTC) into one statute, which will simplify and streamline the application process. Businesses are now able to apply for an alternate credit if its preferred credit is unavailable, and the Department of Community and Economic Development now has the authority to transfer unused credits between programs.

In 2001, Pennsylvania became the first state in the country to enact an education tax credit program. Since that time, the EITC has provided more than 430,000 scholarships to students and families seeking schooling options.

Here’s how the EITC program works. First, businesses make donations to registered, vetted charities that award scholarships. The business receives a tax credit worth 75 percent of the donation, while the charity organization uses the donated funds to award scholarships for students to attend schools of choice. The OSTC was added in 2012—a program designed specifically for students who reside in the lowest performing school districts in the commonwealth.

Ultimately, HB 91 allows more credits to be utilized, more scholarships to be offered, and more lifelines for students trapped in failing schools.