Media

A Look at Job Growth in Pennsylvania

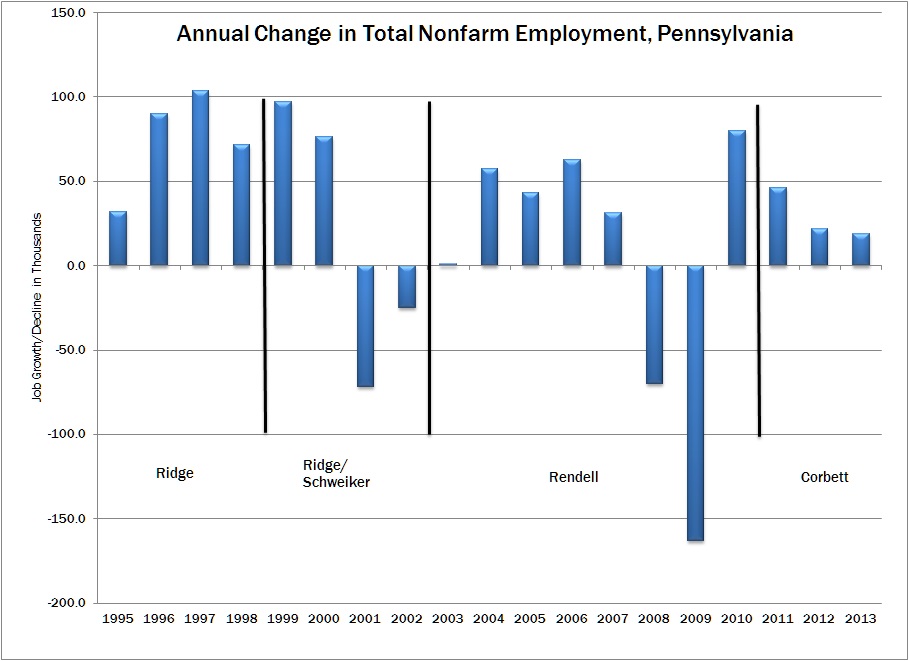

Pennsylvania’s economy is beginning to recover from the 2007 recession, according to the latest numbers from the Bureau of Labor Statistics.

Since 2010, Pennsylvania has added 86,400 jobs, ranking 21st among states. In contrast, Pennsylvania added just 41,300 jobs from 2002-2010. This lack of job growth can be attributed to a variety of things including national trends; Pennsylvania’s tax burden, which is the 10th highest in the nation; and the state’s regulatory environment and growth in government spending—issues which lawmakers need to tackle.

While Pennsylvania employment has not returned to its prerecession peak, the state is slowly making progress. Claims of Pennsylvania ranking near the bottom in job creation during the past few years are widespread but misleading. In fact, the state has ranked poorly in job growth for decades.

Policymakers in Harrisburg should consider reforms to encourage job growth. Here are just a few recommendations from our new report, Blueprint for a Prosperous Pennsylvania:

End Corporate Welfare and Lower the Tax Burden: Pennsylvania will spend approximately $1.6 billion on corporate welfare this fiscal year. Instead of handing out loans, tax credits, and special favors to privileged companies, policymakers should end these programs and use the savings to cut Pennsylvania’s corporate tax rate, which is the second highest in the world.

Enact Welfare Reform: Pennsylvania’s welfare budget continues to grow at an unsustainable rate. To prevent burdening Pennsylvanians with even higher taxes, policymakers should crackdown on the fraud and waste inherent in welfare programs, and demand flexibility from the federal government to restructure the welfare system’s incentives, which only hurt those trying to escape poverty.

Enact Spending Limits: In order to put Pennsylvania on a sustainable path, lawmakers should adopt fiscal restraints, such as spending limits for core functions of government. The limits would control the growth of government spending by tying increases to inflation and population growth. Had state spending limits been enacted in 2000, taxpayers could have seen savings of $4,000 per family of four.