Media

Federal Funds Aren’t “Free”

There’s no such thing as a free lunch—meaning everything in life, including government programs, must be paid for. Unfortunately, many advocates of government health insurance expansion explain the Affordable Care Act as a free lunch. But what is the effect on the state budget? And how much of the “free lunch” will come out of your pocket through higher taxes?

Gov. Tom Corbett discussed yesterday the cost of the proposed Medicaid expansion to the Pennsylvania budget. As PA Independent reports, Gov. Corbett said there is no way the state can absorb those costs:

While costs for newly eligible residents will be covered by the federal government in full, costs for residents who join and were previously eligible are not.

Without opting into the expansion, these “woodwork” costs would be $134 million, Corbett said, reading off notes he brought up to the podium ahead of time. A limited expansion would cost an estimated $178 million in that year, and full expansion would be almost $222 million, Corbett said.

By 2021, the state would need to spend more than $4 billion in connection with a full expansion, Corbett said.

In contrast, Sen. Vincent Hughes tells Capitolwire (paywall) that Pennsylvania should expand Medicaid in order to get the federal funds that come with it.

“We’re disappointed that the administration is talking like this and not making what seems to be a very simple decision to provide health insurance coverage to at least 500,000, maybe even close to 750,000, people that the federal government is completely going to pay for, at least in years one, two and three,” said state Sen. Vince Hughes, D-Philadelphia, minority chairman of the committee. …

– if – I gotta find a way to spend $200 million and then get $3 billion, and the use of that $3 billion is to provide health insurance to 500,000 to 750,000 people in Pennsylvania, I’m gonna figure out a way to get it done,” said Hughes.

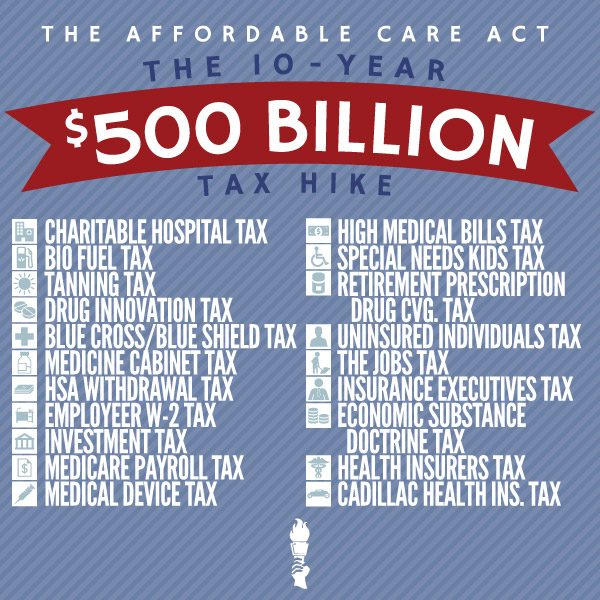

But where does the federal government get that money? It comes through taxes on individuals, families and businesses—including individuals, families and business in Pennsylvania. In fact, the Affordable Care Act included more than 20 new taxes with a price tag of more than $500 billion, or $6,363 per family of four, through 2022.

Moreover, Sen. Hughes is incorrect when he tells Capitowire, “at least for the next four years, while President [Barack] Obama is President of the United States of America, [the ACA Medicaid expansion plan] is not changing.”

In fact, President Obama’s 2013 budget proposal included a reduction of the federal share of the Medicaid expansion, meaning states like Pennsylvania would have to pay even more.

It is for these reasons that many states have already announced they will reject the Medicaid expansion, and why 45 Pa. House Members asked Gov. Corbett to do the same in a July letter.

Simply put, you can’t spend money you don’t have. Instead of looking for more money from taxpayers for Medicaid, lawmakers should focus on reforms to save money, deliver better care for the poor and preserve the safety net.