Media

Pennsylvania’s Tax Burden Ranks 10th (Again), but Pension Bomb Ticking

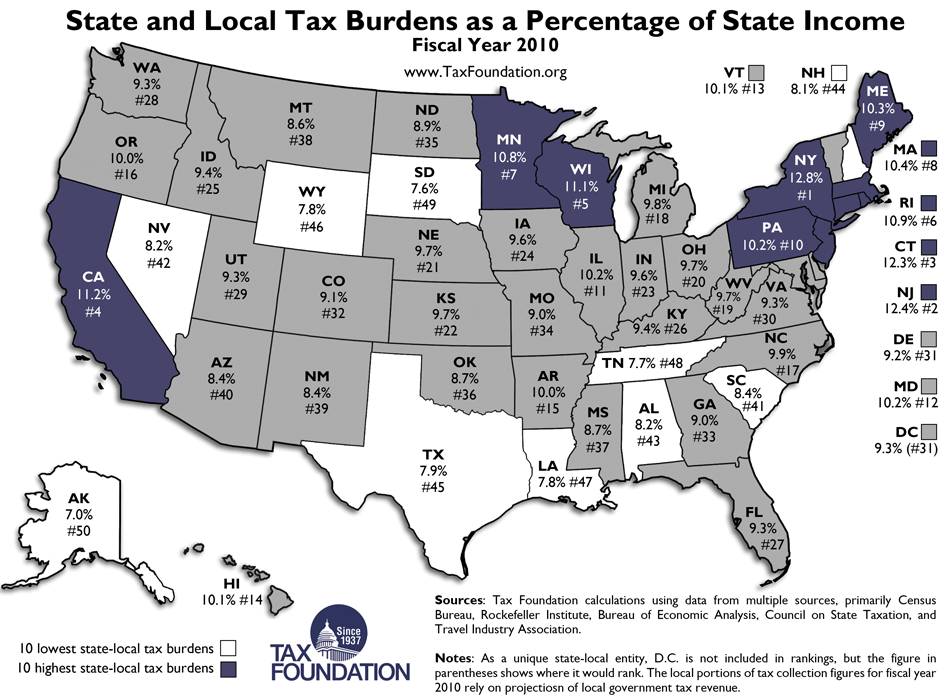

Last week, America kept its president and Congress, and Pennsylvania’s legislature stayed largely the same too. There’s another thing that Pennsylvanians can count on—ranking 10th in the United States for heaviest state and local tax burden, according to the latest analysis of 2010 figures from the Tax Foundation.

Last week, America kept its president and Congress, and Pennsylvania’s legislature stayed largely the same too. There’s another thing that Pennsylvanians can count on—ranking 10th in the United States for heaviest state and local tax burden, according to the latest analysis of 2010 figures from the Tax Foundation.

Pennsylvania’s 10.2 percent tax burden translates to more than $4,000 per person every year. New York taxes its residents most heavily, at a rate of 12.8 percent, while Alaska’s tax burden is the lowest, at 7 percent. Unfortunately, it looks like Pennsylvania will move up in its dismal ranking, not down, where lower taxes would spur better job and economic growth. That’s because the Keystone State’s public pension bomb is set to explode.

The state’s Independent Fiscal Office just released its five-year budget outlook, and revenue is projected to grow an average 2.6 percent a year. If Pennsylvania only had to worry about its current programs, such as welfare, education, and corrections, the projected revenue growth would be enough.

But pension costs are set to increase by $500 million each and every year for the next few years. Pension contributions’ share of the state’s general fund will more than double, from 4.2 percent this year to 9.6 percent by 2017. According to the IFO, rising pension costs will drive the state budget into a $2.2 billion deficit by 2017-18.

We’ve calculated that the total state and local taxpayer bill from the state’s two main pension systems, the State Employees Retirement System, and the Pennsylvania School Employees Retirement System, will balloon from a current $1.7 billion to $6.2 billion by 2016, which will amount to more than $1,000 in additional taxes per household. That’s why comprehensive pension reform is so urgent.

In the meantime, we should enjoy being the number 10 state in taxation while we can.