Media

Moody’s Sounds the Four Alarms

Yesterday, Moody’s Investor Services downgraded Pennsylvania’s bond rating one level. The downgrade implies Pennsylvania bonds are riskier than previously assessed, and it could make it more expensive for the commonwealth to borrow because of the resulting higher interest rates. As the state plans to issue more than $1.5 billion in bonds over the next year, this could result in millions in additional interest payments each year.

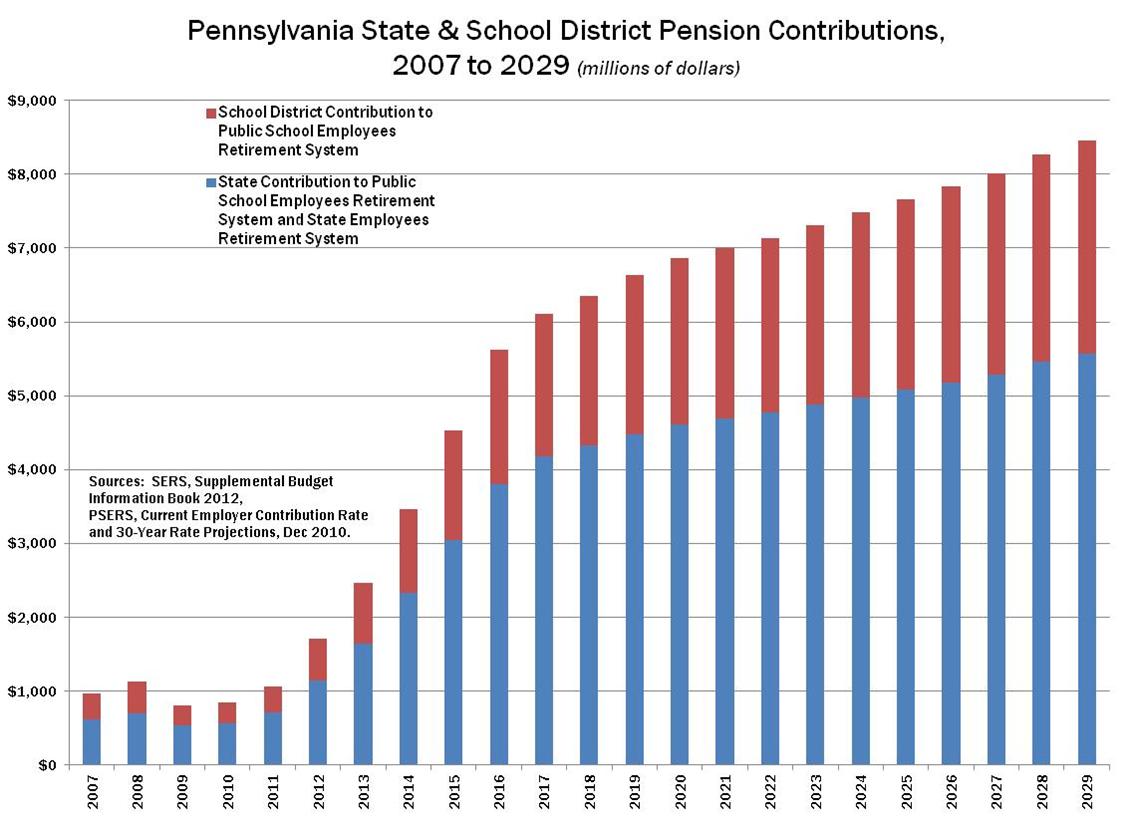

The downgrade was based on the substantial unfunded pension liabilities and required future payments to fund state and school employees’ pensions. The rating action also criticizes Pennsylvania for spending more than revenue (dipping into reserves) over the past few years. According to Moody’s, Pennsylvania’s challenges include:

- A financial position that remains weak, made worse by needing to use budget reserves to cover spending.

- High debt driven by unfunded pension obligations, coupled with underfunding pension systems for seven years. Over the next few years, higher pension payments will consume more state dollars and reduce flexibility.

- Slow economic growth due to demographic trends. Population growth is below average, and Pennsylvanians are older than average, factors that will diminish future tax revenues.

Effectively, Moody’s is sounding the alarm for the Four Alarm Fire the Commonwealth Foundation has been warning about. Our policy points on pension costs notes the state government and school district contributions to pensions will nearly triple over the next five years.

On the other hand, Moody’s praises “recent improvements in governance,” including passing a budget on time for the second year, and a willingness to be proactive when fiscal challenges arise. It will take more of that to fireproof Pennsylvania’s economy.