Media

Schools Get Property Tax Referendum Exemptions for Pension Costs

Last year, the Pennsylvania General Assembly passed, and Gov. Corbett signed, legislation reducing the number of exemptions to the school tax referendum requirement. But as noted this week, the Pa. Department of Education approved exemptions for nearly 200 districts, allowing them to increase taxes above the “index” without seeking voter approval.

The total value of exemptions granted was more than $159 million. Not all schools will use the full amount of the exemptions granted, but they have the authority to increase local property taxes up to the index—the base index is 1.7 percent, but is higher in many districts—plus any exemptions received.

| Act 1 Referendum Exemptions Granted by PDE | ||||||

| 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | |

| Base Index | 3.40% | 4.40% | 4.10% | 2.90% | 1.40% | 1.70% |

| Total Districts Granted Exemptions: | 210 | 102 | 61 | 133 | 228 | 197 |

| (Exemptions fully cover proposed tax increase in preliminary budget) | 123 | 69 | 44 | 76 | 139 | 107 |

| (Exemptions do not fully cover proposed tax increase in preliminary budget) | 35 | 33 | 17 | 57 | 89 | 90 |

| (That submitted preliminary budget within index) | 52 | 0 | 0 | 0 | 0 | 0 |

| Exemptions Used | 66 | 18 | 84 | 135 | ||

| Exemption Amount Approved | $143,189,572 | $84,853,037 | $192,420,114 | $265,830,906 | $159,942,625 | |

| Exemption Amount Used | $41,093,962 | $13,072,387 | $67,647,774 | $95,538,548 | ||

| http://www.portal.state.pa.us/portal/server.pt/community/referendum_exceptions/7456/report_on_referendum_exceptions/510336 | ||||||

The number of exemptions this year is in fact higher than in several previous years (but less than in 2011). There are two key reasons. First, the index is lower than in past years—in 2008 and 2009, every school district could increase property taxes by more than four percent without referendum or exemption. Second, pension contributions are one of the three exemptions remaining, and school pension costs continue to rise.

Of the 197 school districts to receive exemptions for 2012-13, 194 received an exemption for increased pension contributions. And almost half of the amount approved was for increased pension costs (another 41 percent for special education costs).

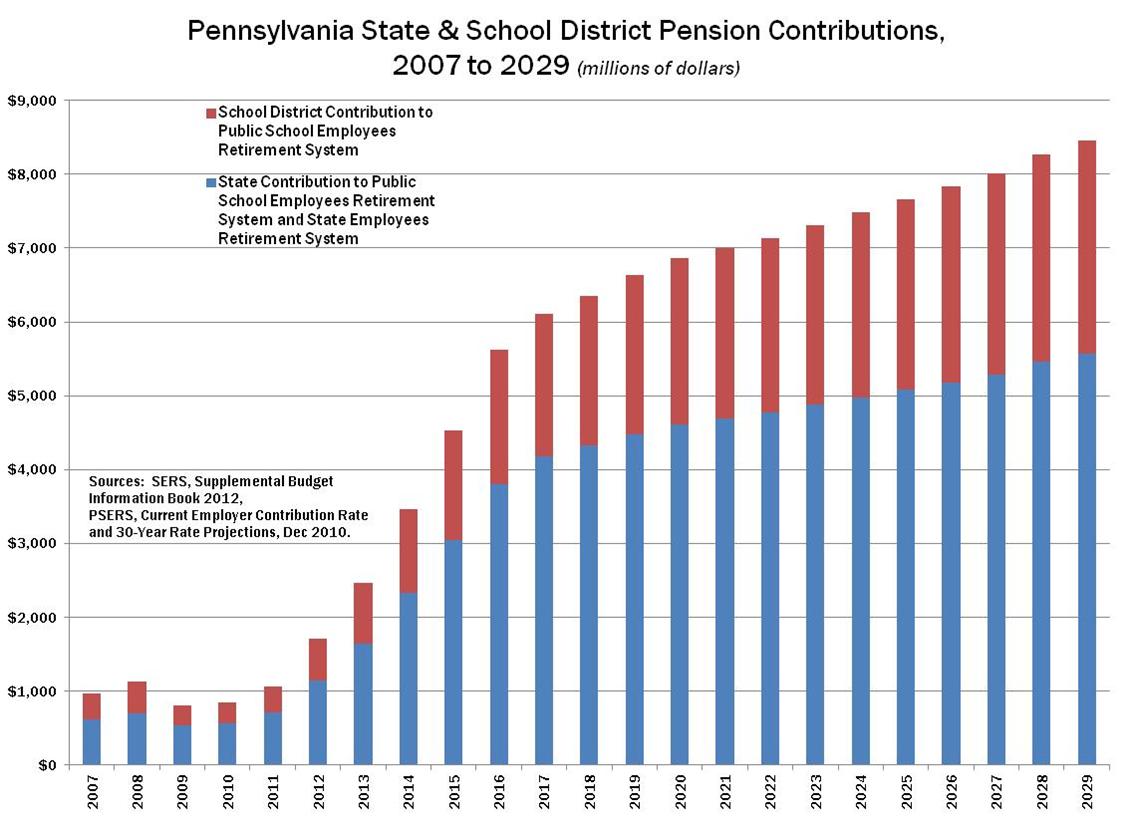

Unfortunately for taxpayers, pension contributions will continue to skyrocket for years to come, as the chart below illustrates.