Media

No School Tax Referendums in Pennsylvania this Year

Remember the gnashing of teeth over “cuts” in state education subsidies (driven by the end of federal stimulus money)? The education establishment and partisan critics of Gov. Corbett insisted this would result in massive property tax increases.

Remember the gnashing of teeth over “cuts” in state education subsidies (driven by the end of federal stimulus money)? The education establishment and partisan critics of Gov. Corbett insisted this would result in massive property tax increases.

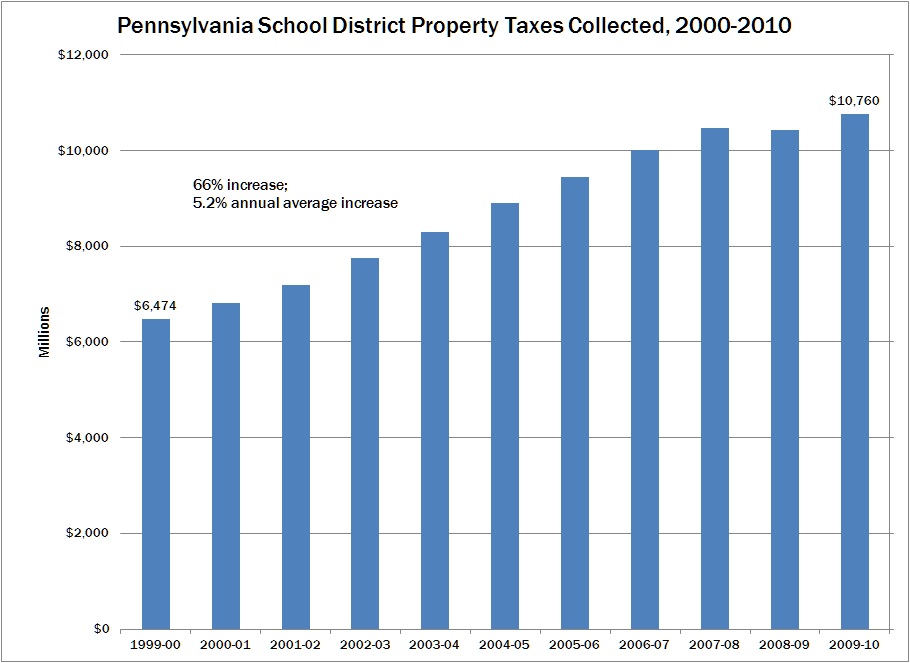

You will also remember that the General Assembly passed legislation reducing the number of exemptions to the school tax referendum requirement. Add to that the fact that the base “index”— the level above which school districts must seek voter referendum on tax increases— is only 1.7 percent. This contrasts to recent school district property tax increases, which averaged 5.2 percent per year over the past decade, even factoring in “relief” from gambling revenue (see chart below).

Surely this combination of factors would result in a bevy of school tax referendums in 2012. But the Reading Eagle reports that not a single district in Pennsylvania is seeking a tax referendum this year.

In other words, schools, thanks to decades of funding increases, are able to make ends meet without going to local taxpayers for significant tax hikes (except for pension increases, which remain exempt, and will be a cost driver for decades).

But that doesn’t mean we shouldn’t help school districts stretch their budgets further. Matt Brouillette and Pennsylvania School Boards Association Executive Director Thomas Gentzel’s recent op-ed in the Allentown Morning Call explains how prevailing wage reforms and economic furloughs will allow districts to do more with less.