Media

Are Gas Drillers Paying Their “Fair Share”?

The Scranton Times-Tribune and the Patriot-News criticize HB 1950 (the natural gas fee proposal) for not taxing gas drillers enough, yet fail to include basic information about natural gas taxes in Pennsylvania and throughout the country.

States like Texas and Wyoming have higher natural gas taxes compared to HB 1950’s, but these states also have friendlier business climates and lower taxes across the board. For instance, Texas and Wyoming have neither personal income nor corporate income taxes. Pennsylvania currently has the 10th-highest tax burden in the nation and is one of the most expensive states in which to drill: It costs $1 million more to drill a shale well in Pennsylvania than in Texas.

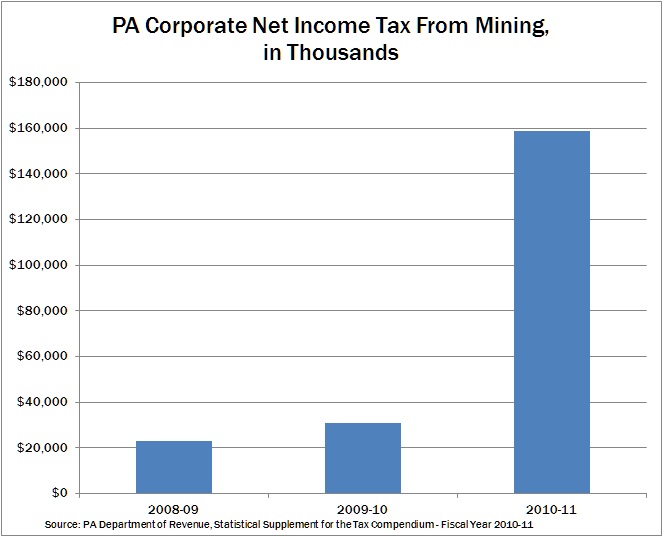

Pennsylvania doesn’t need a unique and extra tax on drillers to benefit from the shale boom. The Pennsylvania Department of Revenue reports tax collections from mining corporations, which include natural gas drilling, increased by a whopping 592 percent over two years. All other industries’ tax payments increased by a mere 1 percent.

This growth of close to $140 million in two years is on top of what the industry pays in personal income tax, sales tax, Capital Stock and Franchise Tax, and fees to the state and local governments. Not to mention the billions drillers have paid in royalties to landowners—which are also taxed.

Natural gas companies are paying their “fair share.”