Media

Will a $22 Million Film Tax Credit Revitalize “Stanton, PA”?

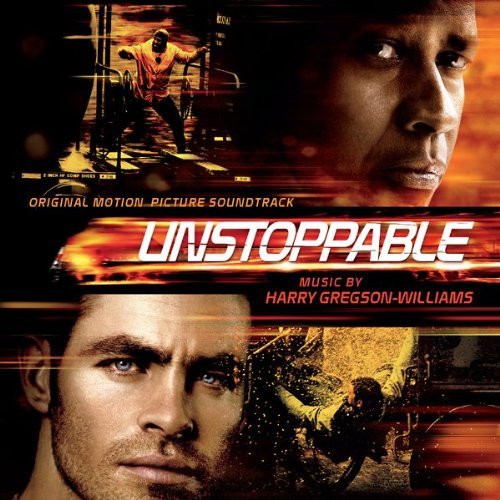

This weekend I watched the film Unstoppable, in which Denzel Washington and the new Captain Kirk attempt to stop a runaway train before it derails along “The Curve” in a major Pennsylvania city. If, like me, you jumped to the conclusion “Hey, that’s Altoona,” you’d be wrong.

This weekend I watched the film Unstoppable, in which Denzel Washington and the new Captain Kirk attempt to stop a runaway train before it derails along “The Curve” in a major Pennsylvania city. If, like me, you jumped to the conclusion “Hey, that’s Altoona,” you’d be wrong.

Instead, they try to save “Stanton, PA”, a city in “Southern Pennsylvania” of 750,000—more than double the population of Pittsburgh and rivaling Philadelphia as the largest city in the state, though it doesn’t appear on any maps.

The studio, 20th Century Fox, received $22 million from Pennsylvania’s Film Tax Credit program to film in the state. For those who might think that the film tax credit creates an economic boost by promoting tourism (it doesn’t), wouldn’t it help if the movies being subsidized mention an actual location in Pennsylvania?

On the off chance that someone watching the movie thought, “Hey, I’d like to go see the curve where Denzel and Captain Kirk try to control a runaway freight train,” they would have no idea where to go, in part because that scene was filmed in Ohio, and because at no point during the film is Altoona or any other real Pennsylvania city mentioned by name.

For $22 million from Pennsylvania taxpayers, would it kill the moviemakers to just say “Altoona”? Overall, I’d say it was a waste of money—both the $4.99 video-on-demand charge, and the $22 million tax credit.