Media

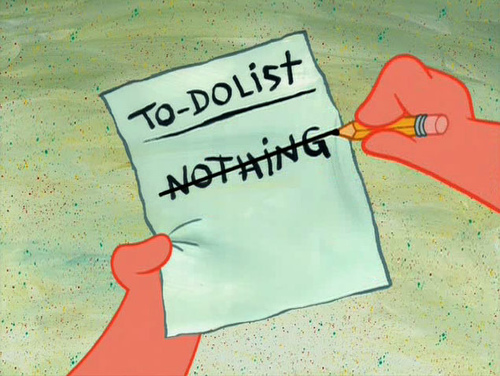

Best Legislative Session Ever?

Jan Murphy of the Patriot-News notes that the 2009-10 Pennsylvania Legislative Session had the fewest new laws passed in 24 years.

Jan Murphy of the Patriot-News notes that the 2009-10 Pennsylvania Legislative Session had the fewest new laws passed in 24 years.

Since most pieces of legislation are a new regulation, additional spending, or higher taxes/fees, this should be considered a rousing success.

Among the things that didn’t happen? Higher taxes and fees for motorists (ostensibly to fix roads, but likely to be diverted to mass transit), a new tax on natural gas, higher taxes on cigarettes, new taxes on cigars, a $1 billion sales tax increase and higher business taxes.

Bi-partisan conversations were held on the state’s need to replace the dollars lost from the federal rejection of tolling Interstate 80 to fix its roads and bridges and fund mass transit, but no plan resulted.

Lots of debate occurred over issues associated with the state’s burgeoning natural gas industry but no law resulted. Lawmakers at one point agreed in principle on placing a tax on natural gas drilling, but Democrats and Republicans clashed over the size of the tax. In the end, lawmakers couldn’t agree to impose a tax.

Many voiced concern about the anticipated $4 billion to $5 billion budgetary hole the state faces next year from the loss of federal stimulus funds and other big bills coming due.

Rendell proposed lowering the state’s sales tax from 6 percent to 4 percent and taxing more items to help address the state’s financial challenges, Tuma said. Along with that, he called for taxing cigars and smokeless tobacco and some business tax changes to generate more revenue. But Senate Republicans stood firmly against those ideas.

Hurray!

Dave Patti sums it up well:

“If we could just get it down to zero, we’d be in good shape,” quipped David Patti, president & CEO of the Pennsylvania Business Council in Harrisburg.