Media

Senate Must Insist on Real Pension Reform

The state pension time bomb is taking front stage again in the waning days of the 2009-2010 legislative session. The Senate is revisiting HB 2497—the $27 billion pension deferral plan passed by the House in June.

The basic problem with pension funds, from Pittsburgh, to Reading, to Harrisburg is the political nature of the defined-benefit pension funds. It is politically fruitful to increase benefits. But reducing benefits, despite economic realities, is always unpopular (even for new employees). Additionally, it is politically easy to manipulate pension funding and defer costs to future generations.

This is what HB 2497 will do, forcing the next generation to foot the bill for this generation’s retirement. This bill in no way qualifies as reform. In fact, it is more of the same procrastination that is responsible for the current situation, in which increased payments required for the SERS and PERS pension fund—just to pay for unfunded liabilities—will result in an estimated $1,360 in higher taxes per household in 2012.

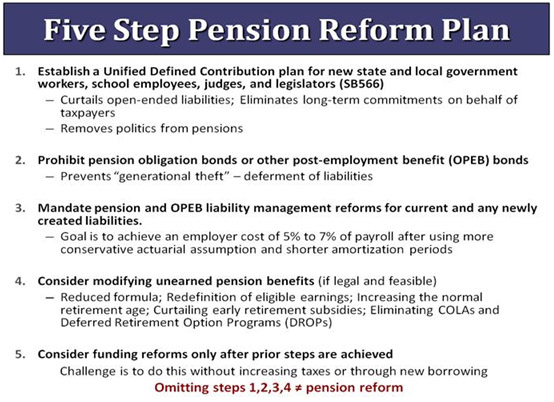

In a memo sent to legislators this week, CF urged lawmakers to consider true pension reform. Below are five keys to real pension reform:

In a recent public opinion poll, a majority of Pennsylvanians agreed the state needs to enter the 21st century, and shift employee retirement from defined-benefit to defined-contribution (401k) plans.

For more information on state pensions, and HB 2497, see this presentation from CF pension expert Rick Dreyfuss.