Media

Failing to Understand Liquor Store Revenues

Virginia Governor Bob McDonnell unveiled his state store privatization plan yesterday. This is obviously an issue to watch for in Pennsylvania, where liquor store privatization is also a hot topic.

Virginia Governor Bob McDonnell unveiled his state store privatization plan yesterday. This is obviously an issue to watch for in Pennsylvania, where liquor store privatization is also a hot topic.

A Washington Post blogger attempts to prove that other states did not see much revenue from privatization. Unfortunately, she muddles a number of issues in an incoherent analysis by:

- Failing to account for state size or type of liquor sold by state store (for instance, Virginia stores only hold a monopoly on hard liquor, whereas Pennsylvania state stores control both wine and spirits),

- Mixing up annual vs. one-time revenues,

- Comparing actual revenues vs. expected revenue (rather than before and after),

- and focusing primarily on license fees rather than liquor taxes or other taxes paid by liquor stores.

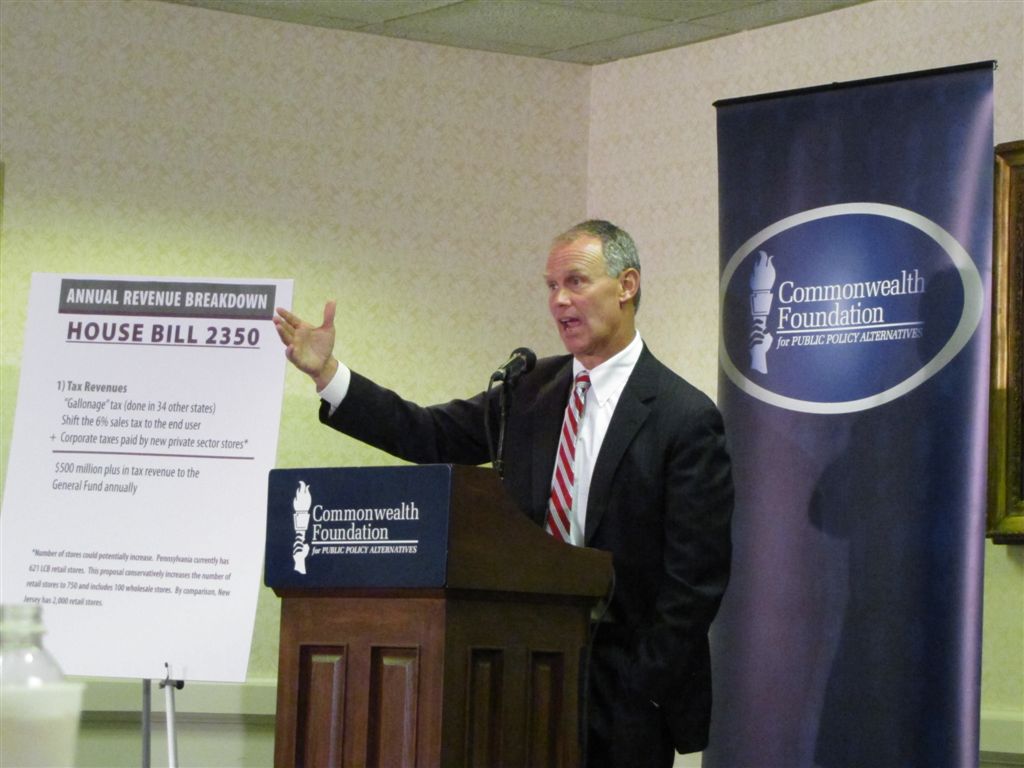

There are two main sources of revenue currently in Pennsylvania — liquor taxes and state store’s “profits” transferred to the General Fund. There would be two sources of one-time revenue from privatization: license fees and revenue from divesting assets. Finally, the annual revenue for the state after privatization would include liquor tax revenue, annual license fee renewals, and other taxes paid by private liquor stores (i.e., corporate income taxes, property taxes, and the like not paid by government entities).

For comparison purposes, Pennsylvania’s liquor store revenues are about triple Virginia’s ($1.4 billion to $500 million), but liquor tax collections are only about 60% more ($294 million vs. $180 million), according to the latest Census data on government spending.

| Pennsylvania State Liquor Store Revenue (in thousands) | |||

| Source | Annual Before Privatization | One-Time | Annual After Privatization |

| Liquor Tax Revenue (includes sales tax on liquor) | $378,000 | 0 | $450,000 |

| License Fees | 0 | $2,000,000 | ??? |

| State Stores “Profit” | $95,000 | 0 | 0 |

| Other Taxes by Private Liquor Stores | 0 | 0 | $50,000 |

| Funds from Divestiture | 0 | ??? | 0 |

| Total | $473,000 | $2,000,000 | $500,000 |

| Estimates for future revenue from office of Rep. Mike Turzai, replacing current tax structure with a “gallonage tax” | |||