Media

Obama: More Green for Green Energy

Recently when speaking about greening the nation’s energy supply in Pittsburgh, President Obama remarked:

[A]nd it means rolling back billions of dollars in tax breaks to oil companies so we can prioritize investments in clean energy research and development.

There seems to be a misconception that “big oil” has been receiving huge government handouts while renewable energy has been treated as the ugly step child.

While the federal Energy Policy Act of 2005 did provide around $2.6 billion (over an 11 year period) in tax reductions for oil and natural gas companies, it also included about $2.9 billion in tax increases over that same time period. The tax cuts occurred in certain production and distribution areas whereas the tax increases occurred in the oil spill liability tax and the Leaking Underground Storage Tank financing rate. The Congressional Research Service (CRS) calculated that the oil and gas industry received a net tax increase of $1.36 billion.

On the other hand, that same law allocated over $5 billion in tax cuts for renewable energy and energy efficiency programs.

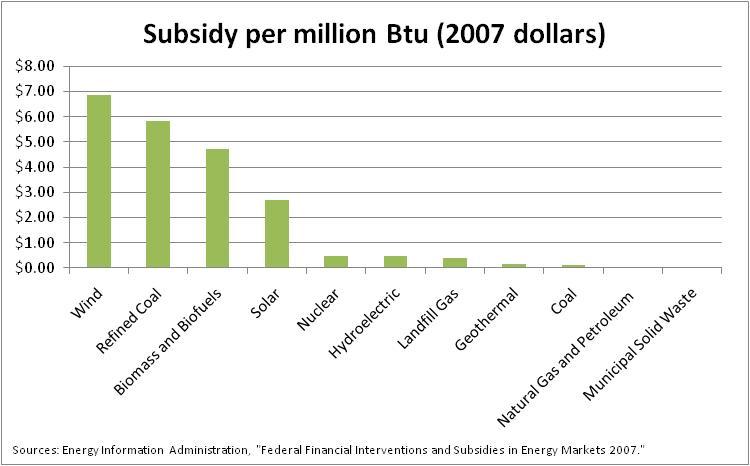

The Energy Information Administration (EIA) calculated federal subsidy and support for each energy source, listed below. Keep in mind, this EIA report does not take into account the stimulus package which allocated billions more to alternative energy.

The truth is solar and wind energy have an abundance of government support – alternative energy receives considerably more subsidy per consumption than oil and natural gas. Currently, these sources aren’t sustainable, and we’re not going to stimulate our economy by shoveling more taxpayer subsidies their way.