Media

Entitlement Spending Driving Federal Deficits

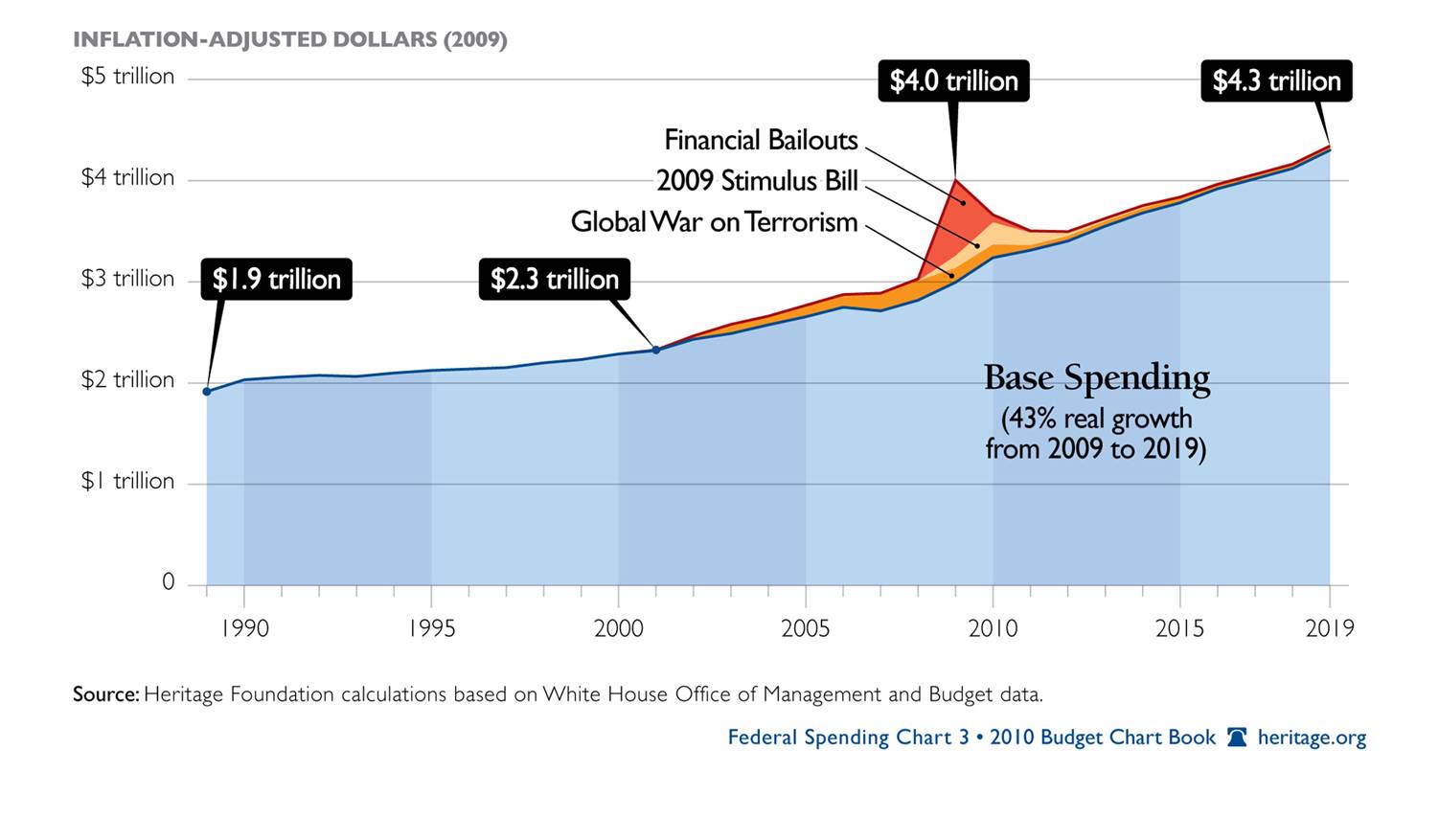

The Heritage Foundation has a new 2010 federal budget chart book, full of useful charts and data. For instance, the Obama Administration is spending more on a per-household basis than any administration before it, and as the chart below illustrates, the stimulus, bailouts and even the war on terrorism represent only a fraction of the total budget spending.

Indeed, entitlement program spending (e.g. Social Security, Medicare, and Medicaid), now represents almost 10% of GPD and has more than tripled over the pasted few decades, as a key contributor to the huge spending increase. According to a USA Today analysis, during the first quarter of this year, private wages shrank to its lowest share of personal income in history, while government transfers reached their highest level.

The National Center for Policy Analysis (NCPA) highlights the key shifts in income this year:

- A record-low 41.9 percent of the nation’s personal income came from private wages and salaries in the first quarter, down from 44.6 percent when the recession began in December 2007.

- Individuals got 17.9 percent of their income from government programs in the first quarter, up from 14.2 percent when the recession started.

- Programs for the elderly, the poor and the unemployed all grew in cost and importance.

- An additional 9.8 percent of personal income was paid as wages to government employees.

Economist Donald Grimes notes, “this trend is not sustainable because the federal government depends on private wages to generate income taxes to pay for its ever more expensive programs.”