Media

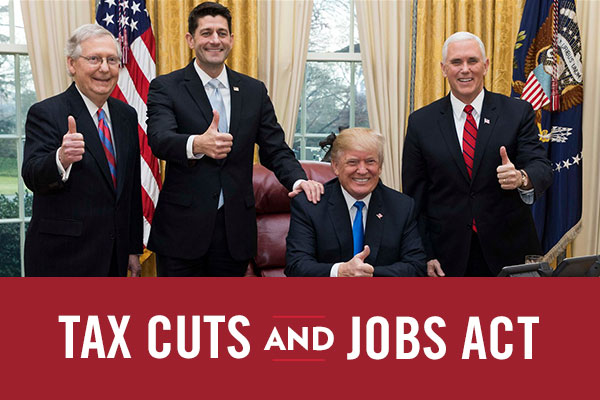

The Tangible Benefits of Tax Reform

One of the many benefits of federal tax reform kicked in earlier this month in the form of lower utility bills for Pennsylvania residents. Back in May, the Pennsylvania Public Utility Commission issued an order requiring a “negative surcharge” or monthly credit to the customers of 17 major electric, natural gas, water, and wastewater companies.

At the time, officials estimated the projected annual savings to be approximately $320 million. Since then, the estimate has been revised upward to around $400 million. But the benefits of tax reform extend far beyond lower utility bills.

As Americans For Tax Reform has documented, numerous Pennsylvania-based companies have raised wages, distributed bonuses, and boosted retirement and charitable contributions. Across the country, at least 660 companies (as of July 12) have made investments in their employees and communities.

And these benefits aren’t accruing to just the wealthiest Americans. An analysis from the Tax Foundation finds the Tax Cuts and Jobs Act will boost after-tax incomes for people of all income levels. This is one reason lawmakers should make the individual income tax cuts permanent. Doing so would increase GDP growth by 2.2 percent, wages by 0.9 percent, and add 1.5 million jobs to the economy.

State officials should not be content with the progress seen thus far. Pennsylvania’s tax code needs a major overhaul, given the state has one of the highest tax burdens in the country. Our commonwealth should follow the lead of states like North Carolina and embrace comprehensive tax reform.

Tax reform has paid dividends for the Tar Heel State, which has experienced the eighth fastest job growth over the last year and seen incomes rise by 3.7 percent. This is unsurprising given the positive correlation between low tax burdens and economic growth. Lawmakers should build on the good work done at the federal level and embrace the North Carolina model of tax reform, which coupled tax reductions with spending restraint.

Reducing the amount of money diverted to Harrisburg will give Pennsylvania’s entrepreneurs and community leaders more resources to make the state a better place to live and work for everyone.