A policy agenda to help

Pennsylvanians

prosper

America’s story began in Pennsylvania, but our state has fallen behind. Families are leaving for better jobs, educational opportunities, and quality of life in other states. But policymakers can usher in a new era of prosperity for Pennsylvania.

Building on the fiscal responsibility of recent years, these policy ideas that provide educational opportunities for our children, protect families’ paychecks, help Pennsylvania businesses compete, and respect our workers.

By championing these policies at the start of a new administration, lawmakers can unleash Pennsylvania’s potential to lead the nation and usher in a new era of prosperity for future generations.

1 – Expansion of Tax Credit Scholarships

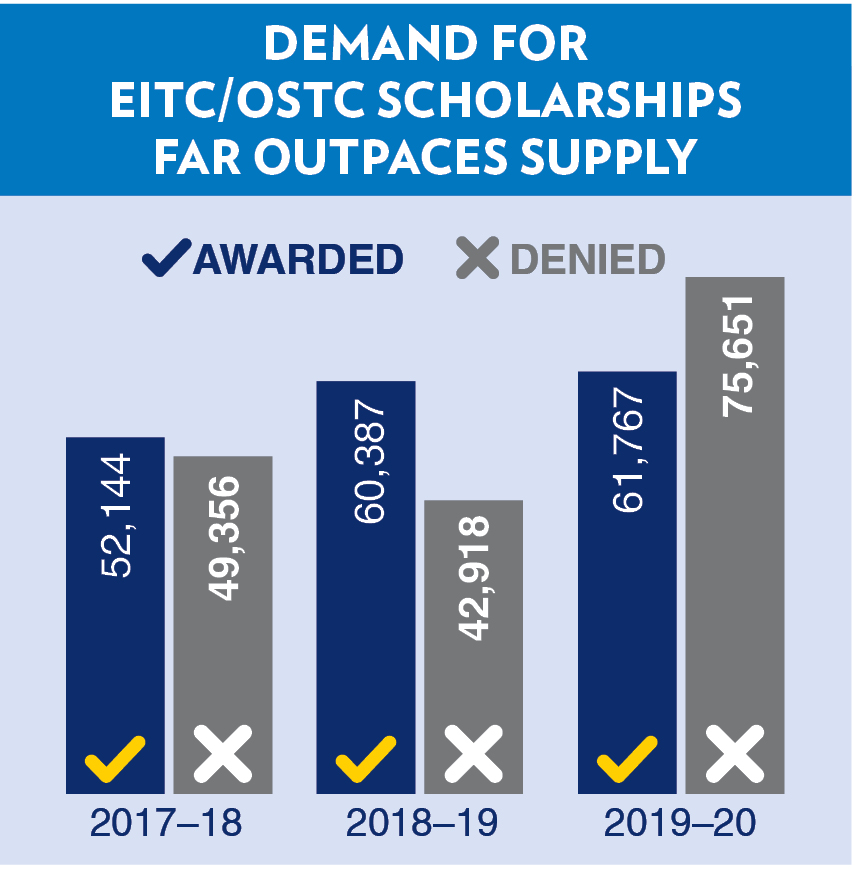

The Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) provide a lifeline for thousands of low-income and middle-income Pennsylvania students. Funding for these scholarships comes from businesses that receive a tax credit when they donate. In 2019–20, arbitrary program caps denied over 75,000 K–12 student applications and turned away $116 million in business donations. Pennsylvania should implement an escalator that allows credits to automatically grow in proportion to student needs.

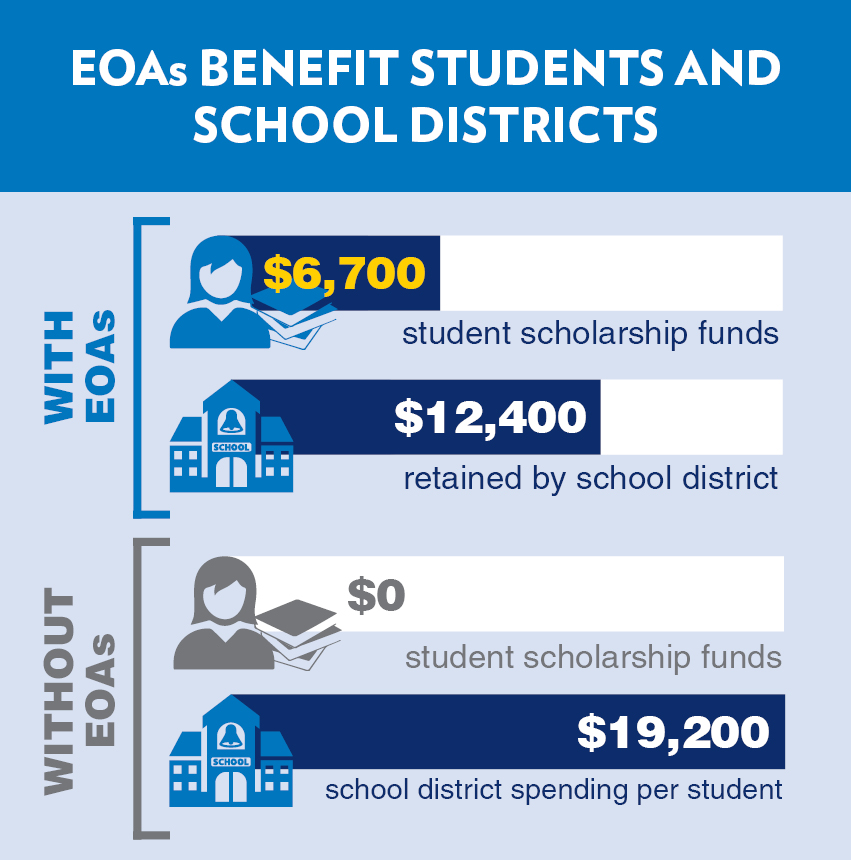

2 – Education Opportunity Accounts

Education Opportunity Accounts (EOAs) are restricted-use accounts that empower families by providing them with flexible funds for educational use. The state deposits a portion of the per-pupil education funding into accounts families can use for approved educational expenses, like tuition, tutoring, and special education services. School districts would no longer receive the student’s portion of per-pupil state education funding but would retain all local and federal funding.

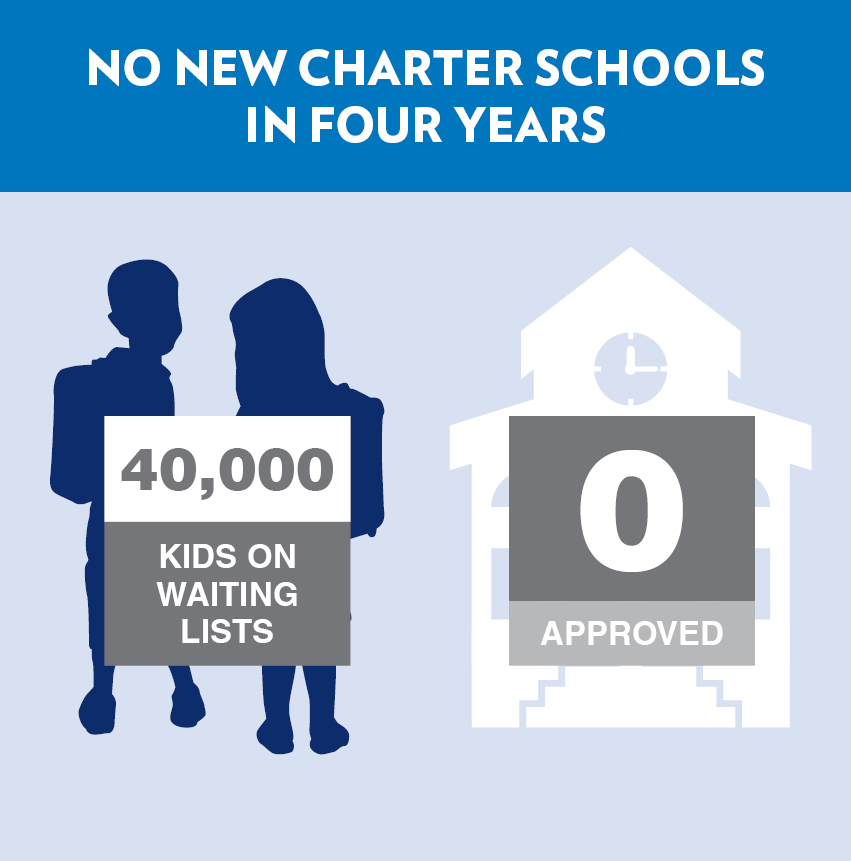

3 – Charter School Independent Authorizer

School districts alone have a monopoly on authorizing brick-and-mortar public charter schools, creating an inherent conflict of interest that stifles charter growth. As a result, Philadelphia area charters maintain a vast waiting list of over 40,000 children. Twenty-four states have some form of independent authorizer, whether an independent board, a higher education institution, or a nongovernmental agency.

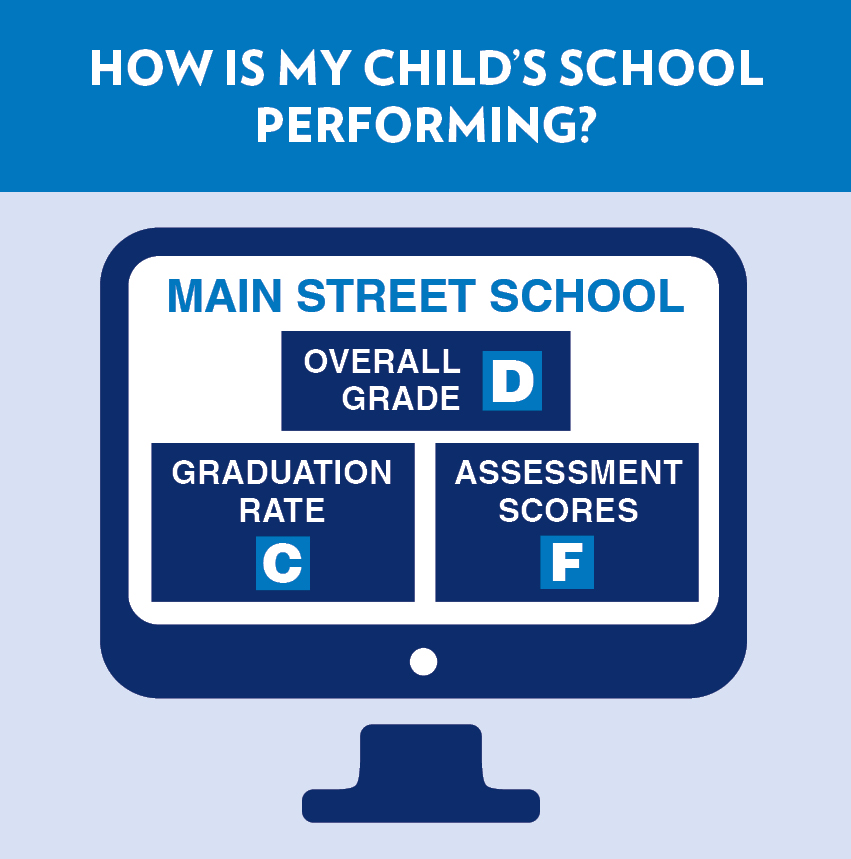

4 – Report Card for All Public Schools

Already, 16 states, including Florida, apply an A–F grading system to schools. Florida’s scoring system considers state achievement and learning gains in assessment scores, graduation rates, and graduates earning college credit or certifications. Offering a similar A–F letter grade scoring system in Pennsylvania would provide our parents with transparent, easy-to-understand public school rankings and empower them to hold their local schools accountable.

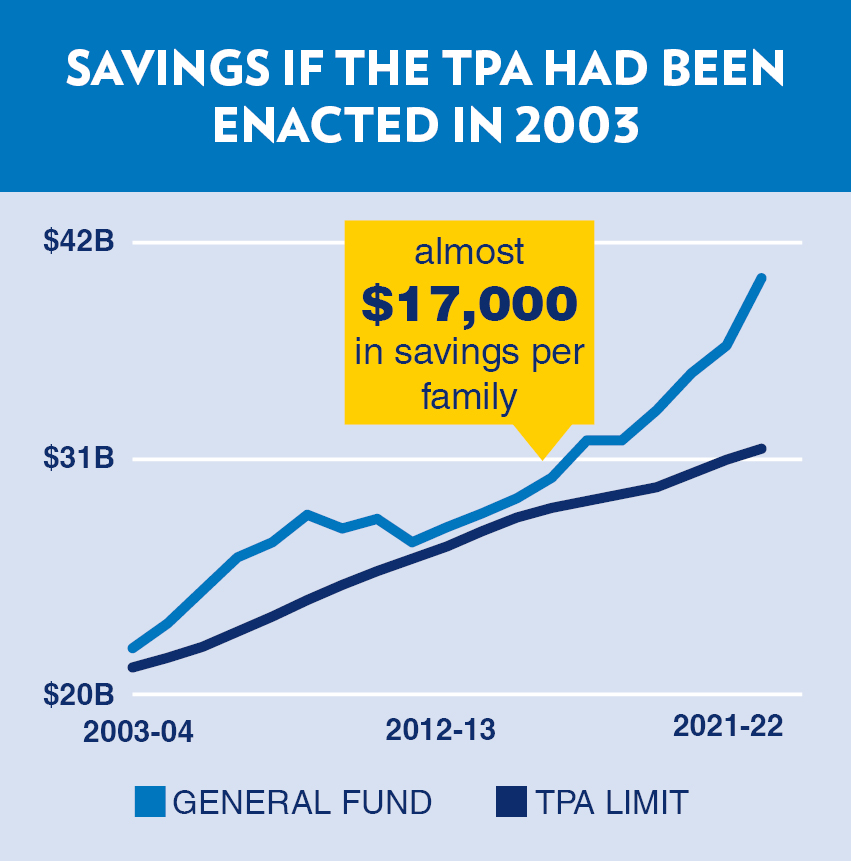

5 – Taxpayer Protection Act (TPA)

Pennsylvania state government has historically overspent in good economic times, requiring tax hikes following recessions. The TPA is a constitutional amendment, based on successful reform in Colorado, that will provide a long-term solution by controlling spending. The TPA limits spending growth to an index based on inflation and population growth to keep government spending in line with taxpayers’ ability to pay.

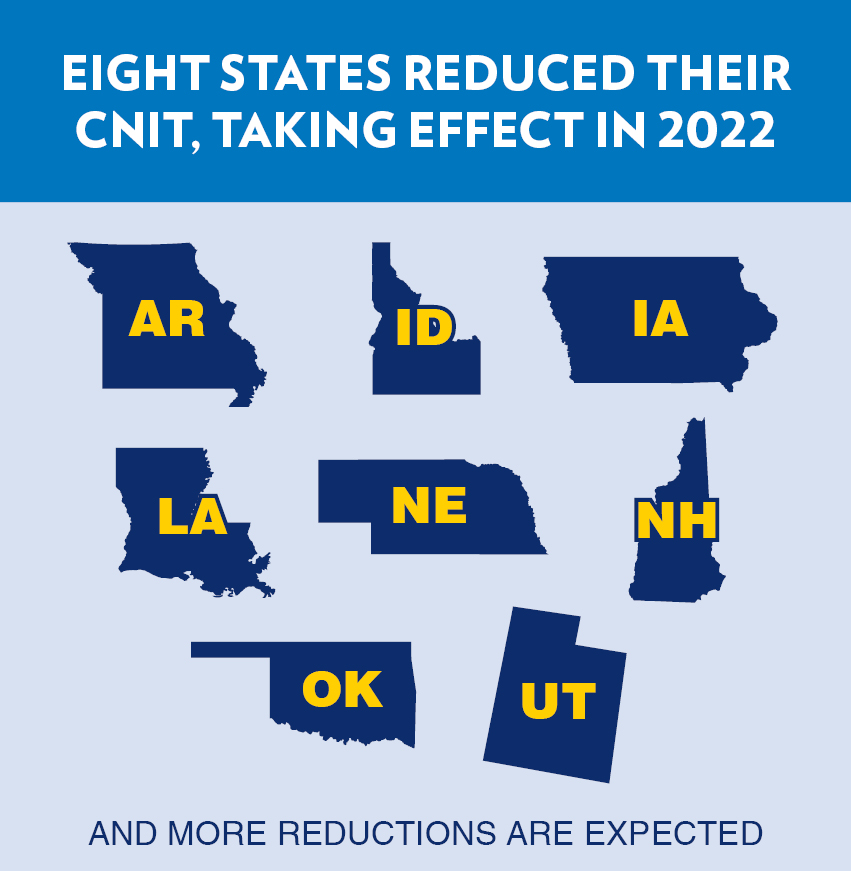

6 – Replace Corporate Welfare with Business Tax Cuts

Pennsylvania’s business tax climate stifles opportunity and job creation. In addition to having the second-highest corporate net income tax (CNIT) rate in the nation at 9.99 percent, Pennsylvania limits small businesses from carrying forward their losses to offset taxes in future years. Meanwhile, politicians dole out nearly $1 billion annually in corporate welfare handouts. Instead, Pennsylvania should redirect these dollars to reduce the CNIT to 7.29 percent and lower taxes for all businesses, making our state more competitive for investment and jobs.

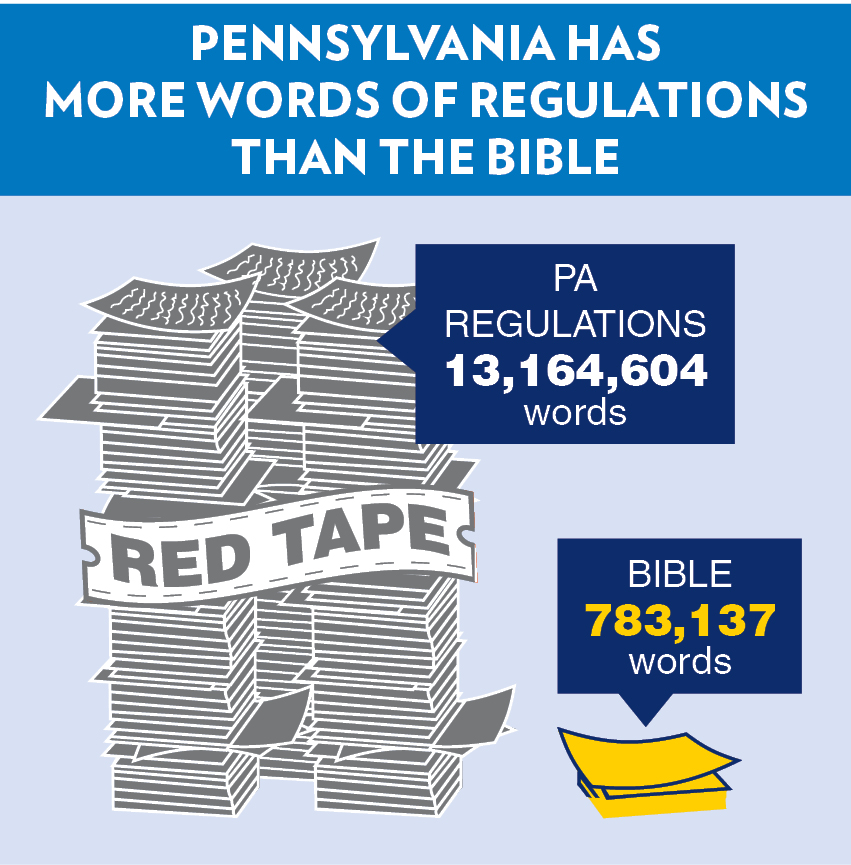

7 – Reduce Regulatory Red Tape

Pennsylvania imposes roughly 164,000 regulations, which exert a significant drag on the economy. Any regulation costing more than $1 million should require legislative approval. Pennsylvania should also establish an Office of Repealer that would regularly review and initiate the repeal of harmful regulations.

8 – End RGGI Immediately

The Regional Greenhouse Gas Initiative (RGGI) is a multi-state agreement that seeks to put caps on energy production and charges generators for CO2 emission allowances. This effectively represents a new tax on electricity consumers that leads to lost jobs, and higher energy costs for households and businesses, without significantly impacting emissions.

9 – Welfare Community Engagement Requirements

More than one million healthy adults in Pennsylvania receive SNAP (food stamps) and Medicaid benefits. A work, community service, or education requirement in order to maintain benefits can help individual beneficiaries regain independence and boost their incomes. The requirements would apply to healthy, working-age adults (19–64) without children.

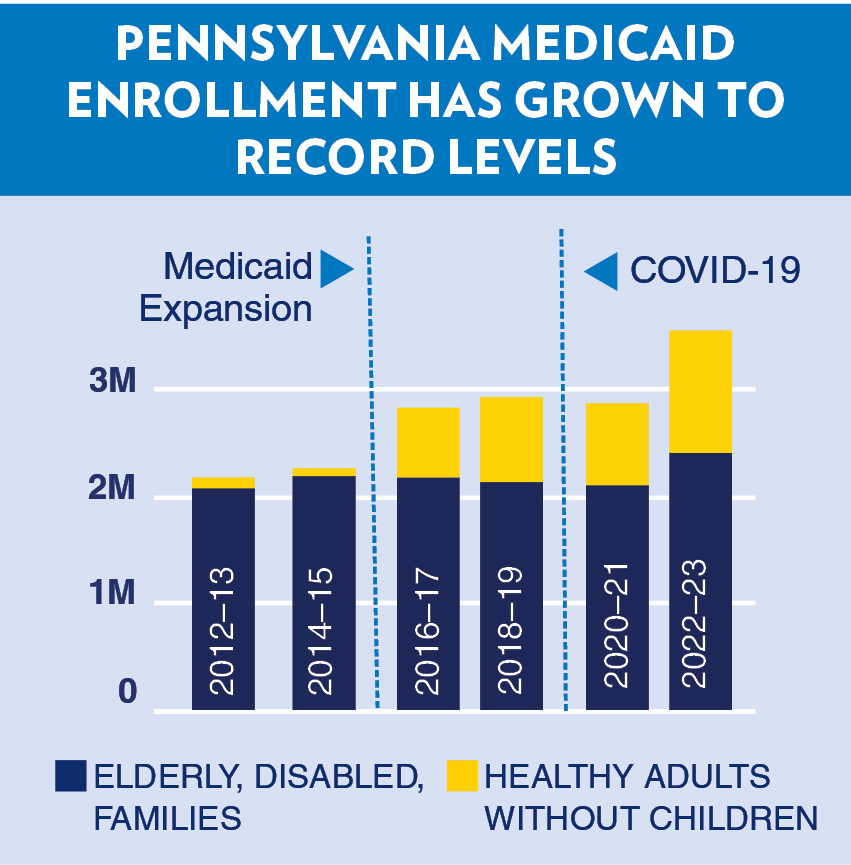

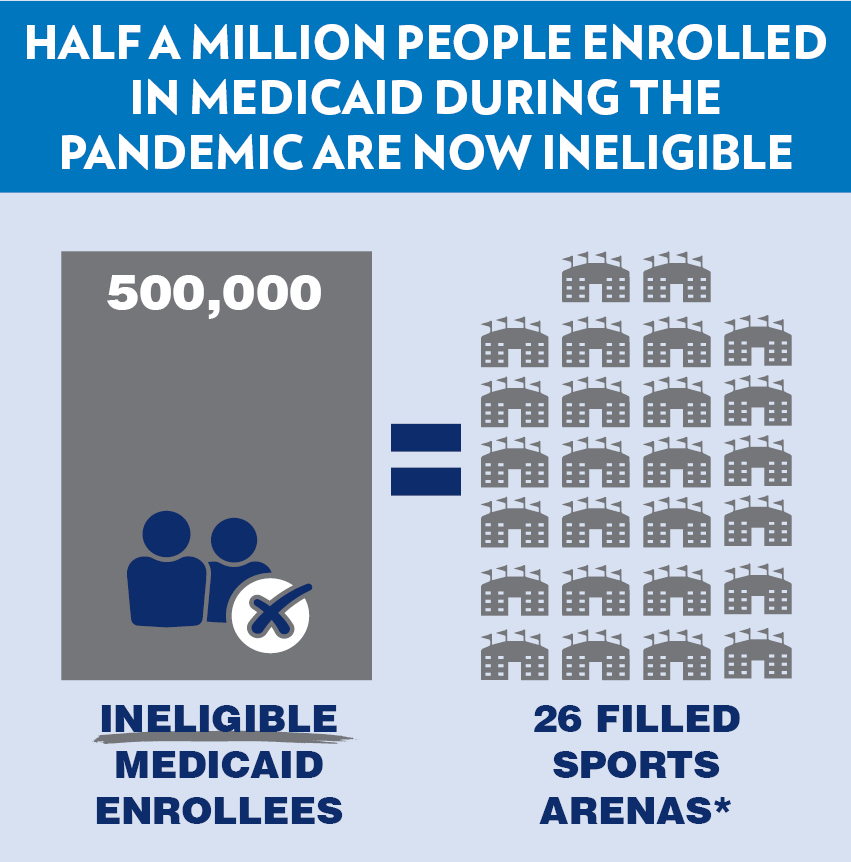

10 – Regular Welfare Eligibility Verification

Welfare programs, like Medicaid, base eligibility on income or medical status. The state should verify income, residency, and household composition information twice a year and regularly cross-check death, residency, and wage records.

*based on occupancy of Philadelphia’s Wells Fargo Center

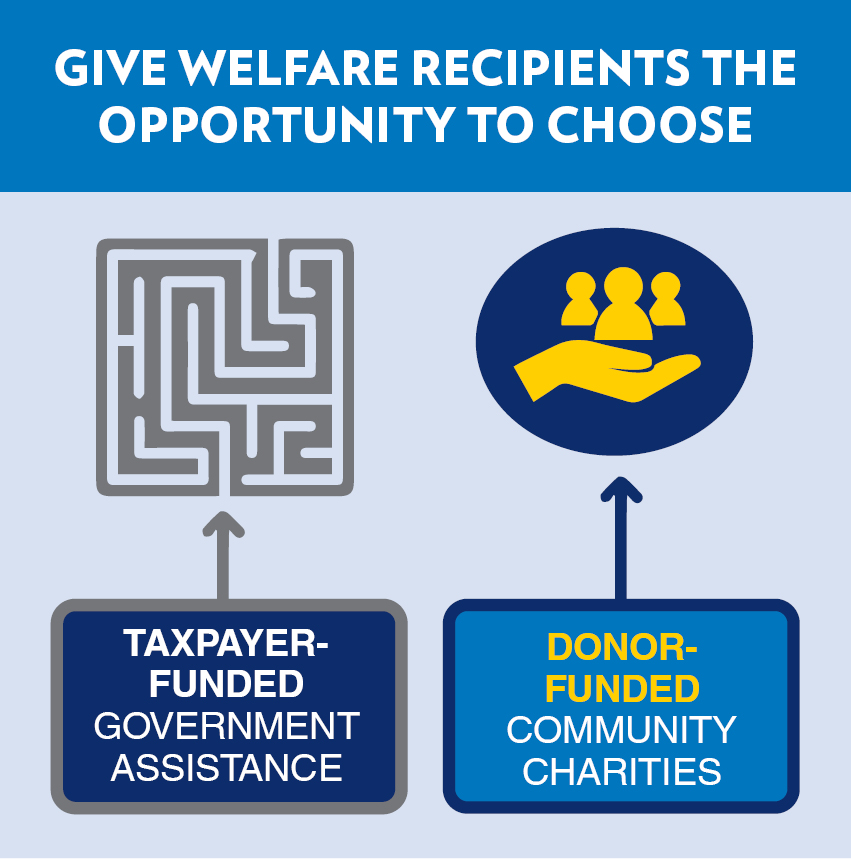

11 – Human Services Tax Credit

Modeled after the education tax credit programs (EITC and OSTC), this tax credit breaks the government monopoly on social welfare programs by granting businesses and individuals tax credits for donations to approved charitable organizations that provide basic needs such as childcare, medical care, food, clothing, shelter, and job placement.

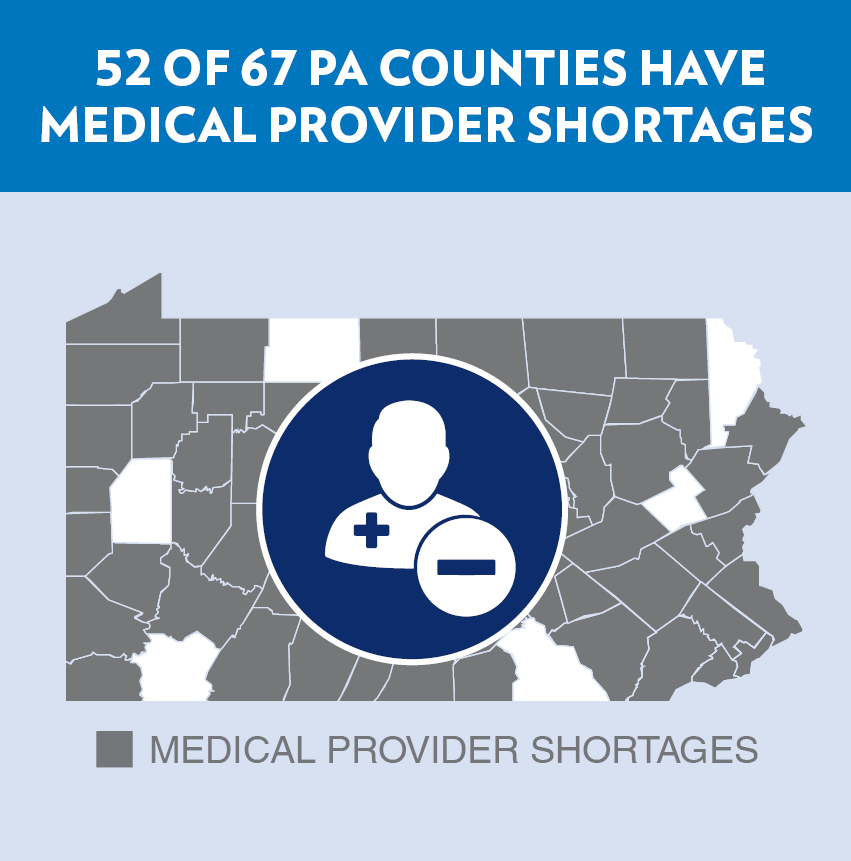

12 – Expand Scope of Practice

Nurse practitioners (NPs) are highly trained medical professionals and can provide comparable services to a physician in their specialty. In Pennsylvania, NPs can only practice if they enter into expensive collaborative agreements with physicians. Allowing NPs to practice independently, as is done in 24 other states, will increase access to primary care providers.

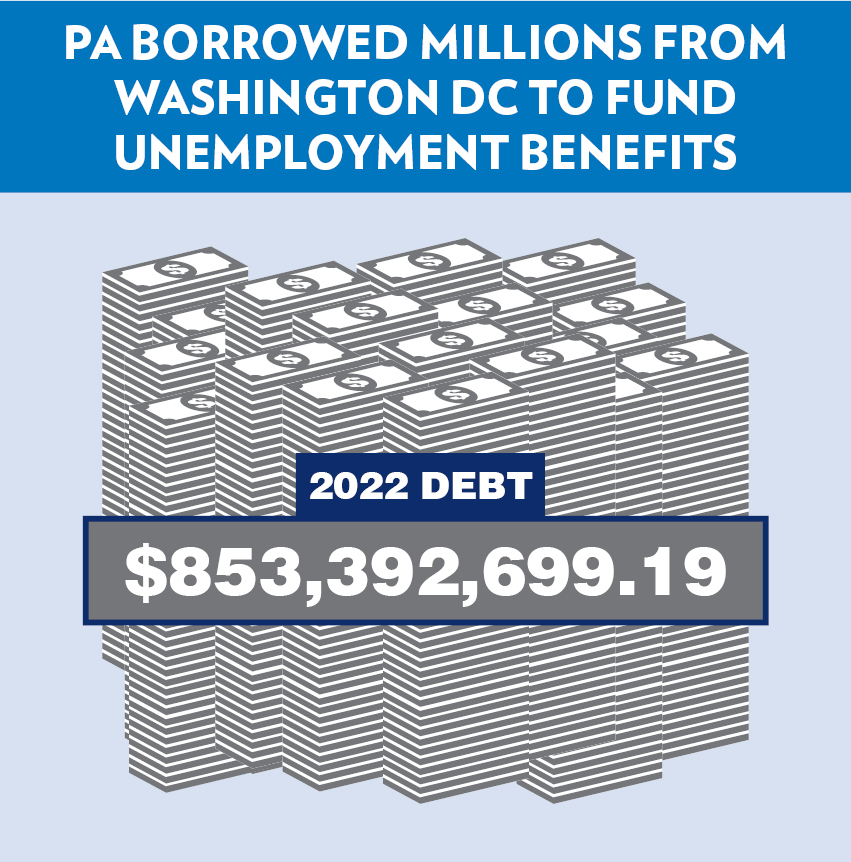

13 – Unemployment Compensation Benefits

A depleted Unemployment Compensation Trust Fund triggers tax hikes on businesses. By shortening the duration of unemployment benefits in good economic times, Pennsylvania could shore up its depleted trust fund to avoid tax hikes and put people back to work more swiftly.

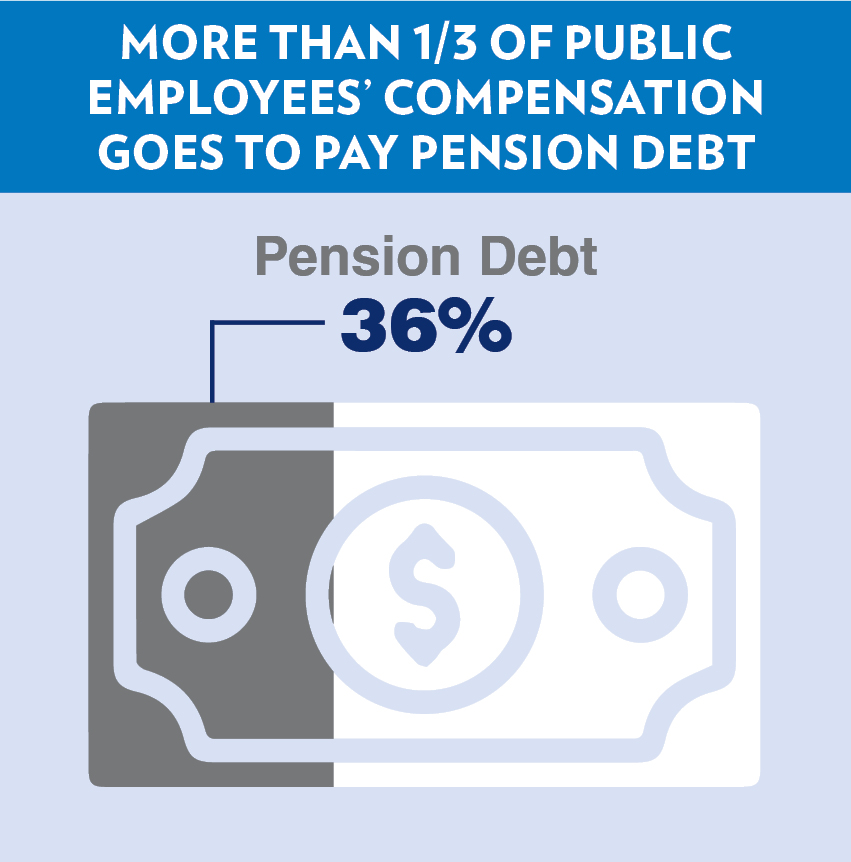

14 – Defined Contribution Plans

Pennsylvania’s defined benefit pension systems remain seriously underfunded. Switching to 401(k)-style defined contribution retirement plans presents less risk to taxpayers and benefits workers, allowing them to change jobs and not worry about losing retirement savings. Additionally, defined contribution plans offer similar levels of retirement income as defined benefit plans.

15 – Privatize Liquor and Wine Sales

The current government-run liquor monopoly is a financial drain and a consumer headache. The Pennsylvania Liquor Control Board (PLCB) holds a $1.3 billion liability. Moreover, the PLCB constantly loses customers to other nearby states through “border bleed.” A private system would increase choice, convenience, and customer service.

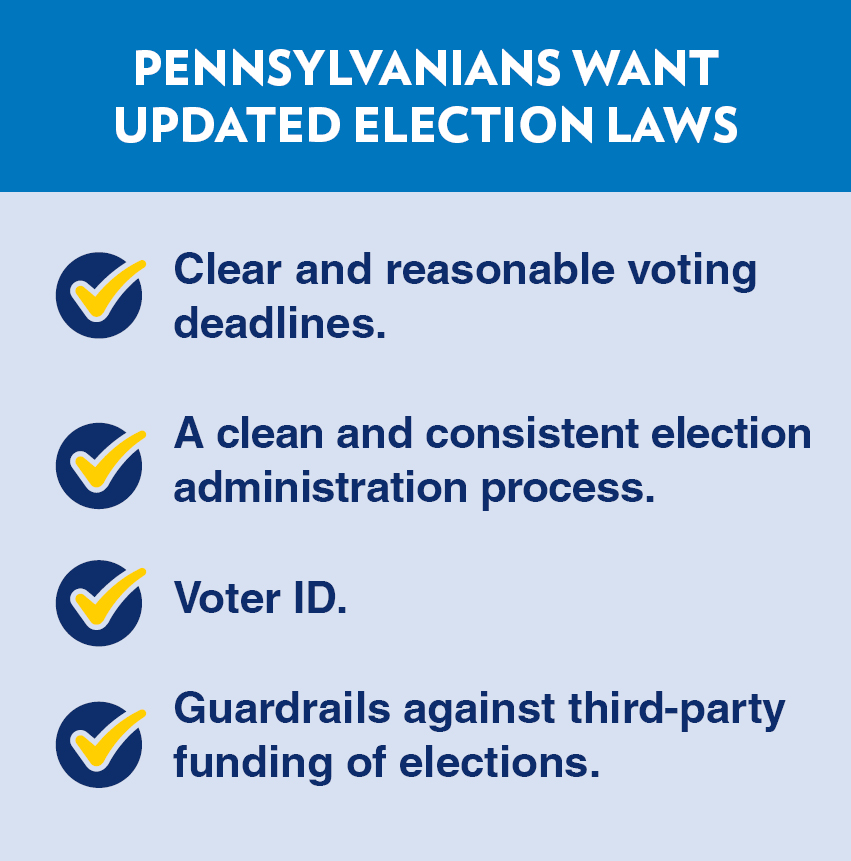

16 – Modernize Election Law

Most Pennsylvania voters believe that the state needs to update its election laws. Measures that make it easy to vote and hard to cheat include voter identification, clear and reasonable voting deadlines, a clean and consistent election administration process, and guardrails around third-party funding of elections.

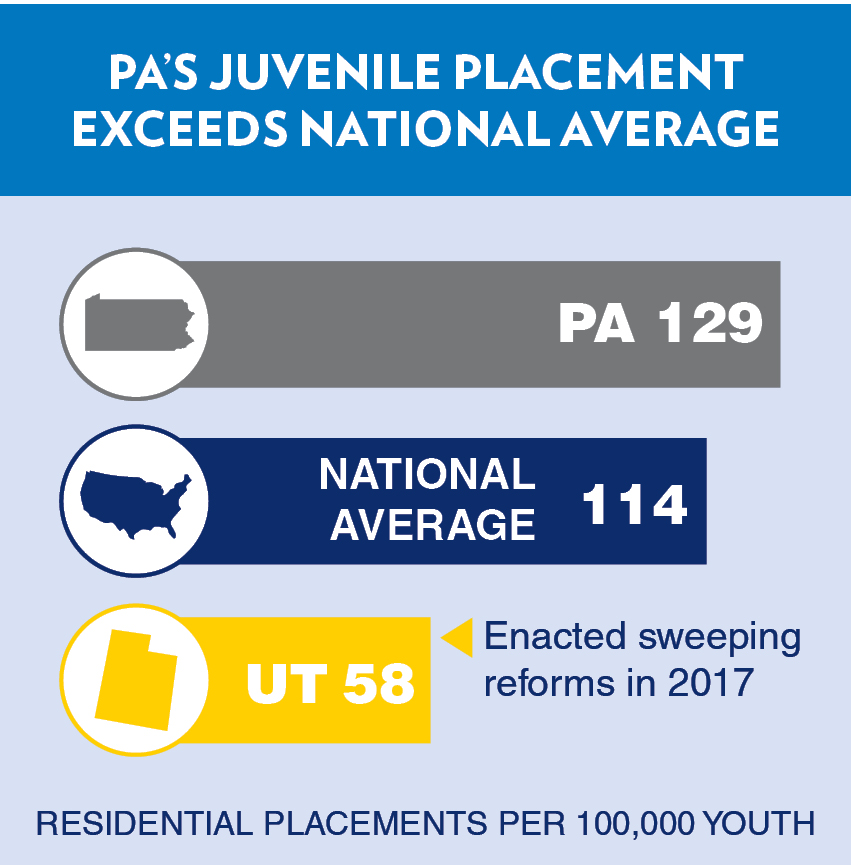

17 – Juvenile Justice Reform

Pennsylvania’s juvenile justice system is quick to institutionalize youth for their first offense, yet research shows community supervision can better reduce the chance of a juvenile committing another crime. Reforming the system to encourage safe diversion for first-time offenders along with supervision options in the community can prevent crime and preserve resources for high-risk offenders.

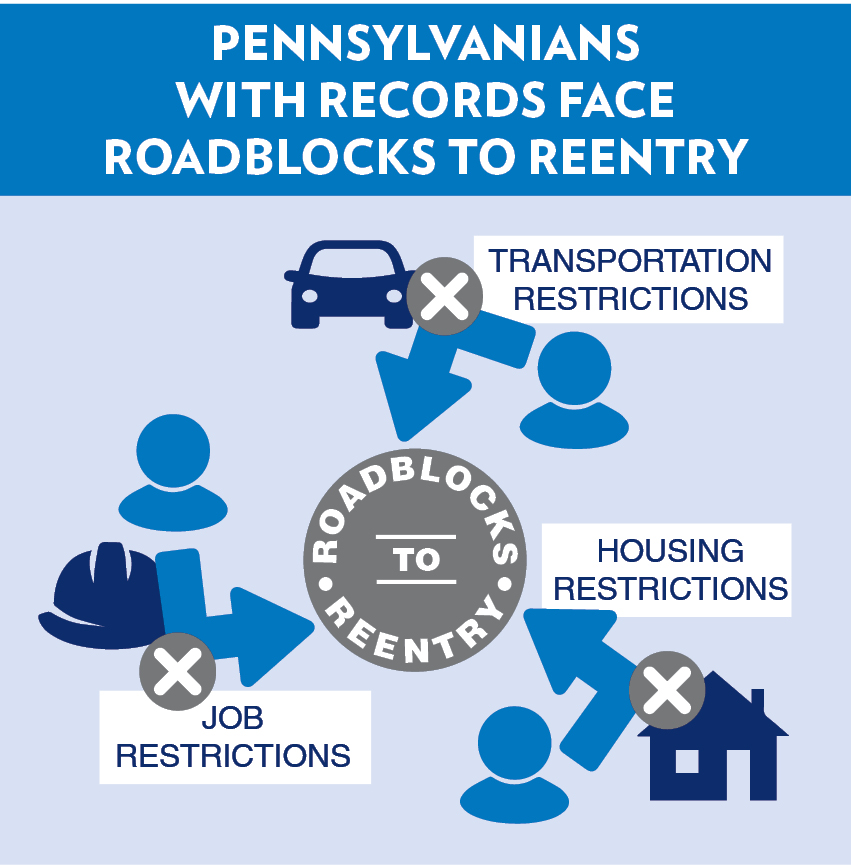

18 – Continue Addressing Barriers to Employment

Pennsylvanians with a past criminal record face hundreds of collateral consequences and restrictions on finding work and housing after they pay their debt to society. Pennsylvania should continue to reduce or eliminate outmoded licensing laws and restrictions that prevent those with a criminal conviction from obtaining gainful employment.

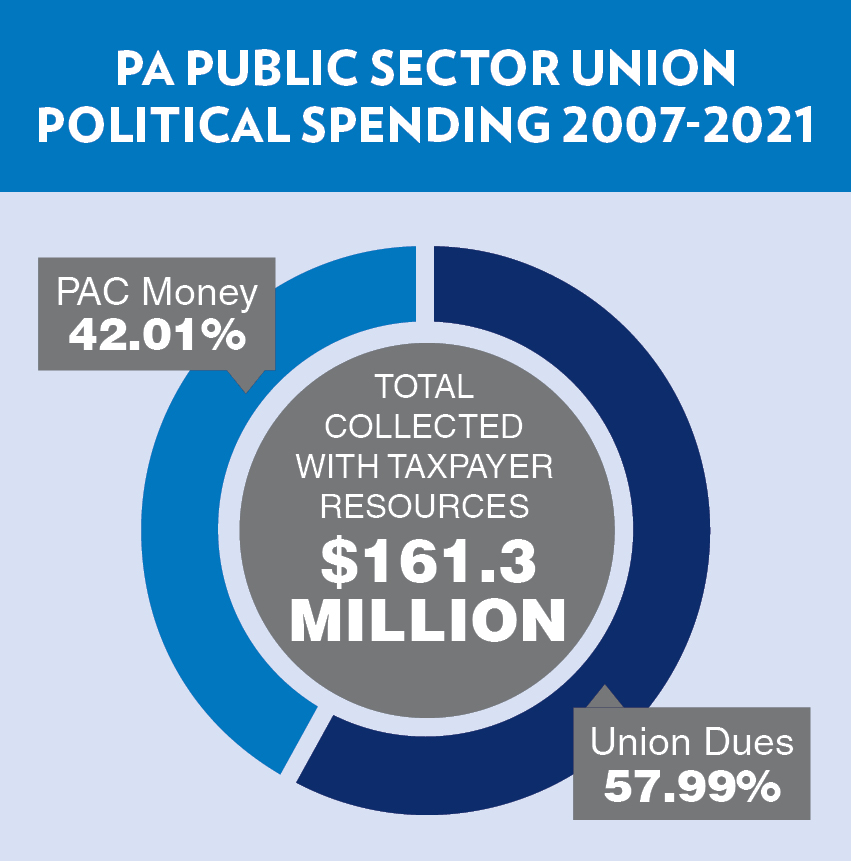

19 – Paycheck Protection

Paycheck protection would stop government unions from using taxpayer-funded resources to collect money used for politics. Using taxpayer resources to collect political contributions is already illegal for elected officials. Government labor union executives should not have access to this special privilege.

*Most 2021 dues spending not available

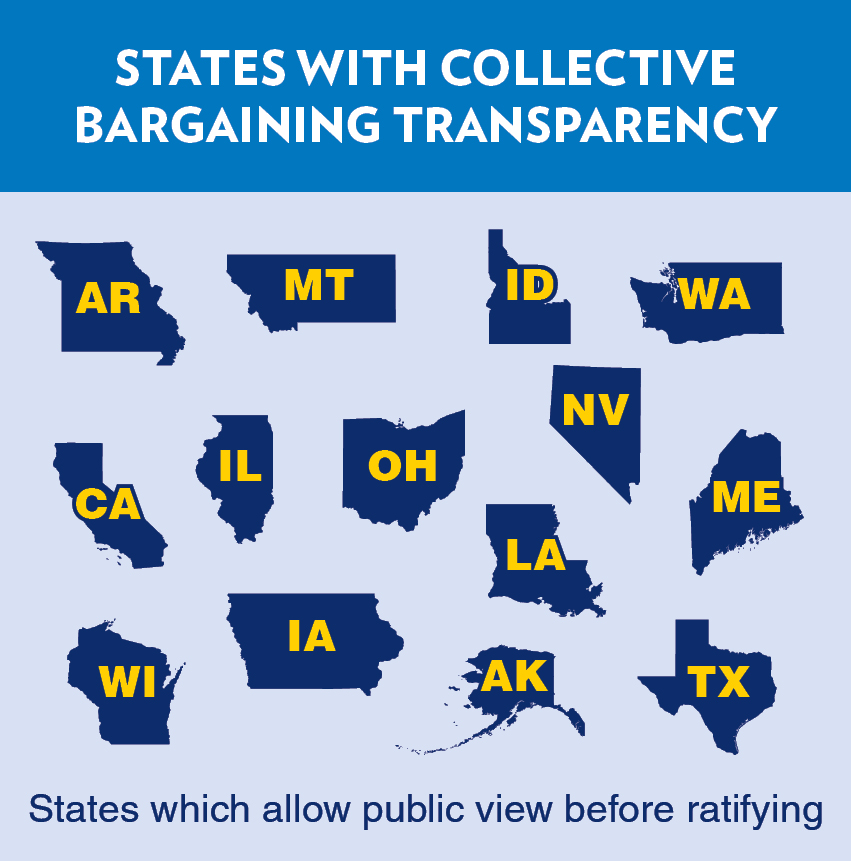

20 – Collective Bargaining Transparency

Collective bargaining agreements with government unions cost taxpayers billions of dollars every year. Currently, negotiations and preliminary contracts are exempt from the state’s Sunshine Law. Taxpayers deserve “open and public” deliberation before their hard-earned money is spent on government union contracts.

21 – Workers’ Choice

The initial unionization votes by teachers and most other government employees occurred more than 30 years ago. None of the teachers working in our largest school districts had the opportunity to vote on selecting the union representing their interests. Workers deserve to choose who represents them.

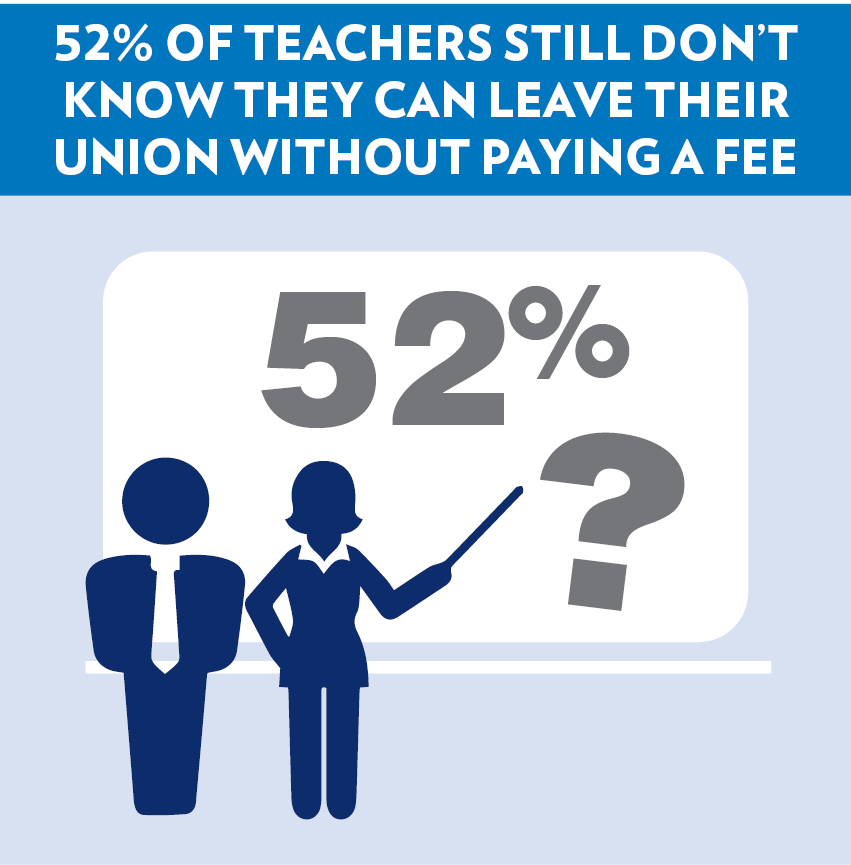

22 – Notification of Employee Rights

A 2018 U.S. Supreme Court decision ended mandatory “fair-share fees” for public employees who chose not to join a union. Years later, many public employees remain unaware of their rights. Employees deserve the right to be fully informed when making decisions about union membership.

23 – Freedom to Resign

In Pennsylvania, government union executives benefit from the “maintenance of membership” clause, which limits member resignations to a brief 15-day period at the end of an often-multiyear collective bargaining agreement. This is not fair to workers; an employee should always have the freedom to resign from union membership.

Review our Better PA 2023 polling here!

Criminal Justice Reform

Legislation Moves to Reform Licensing Laws for Citizens with Criminal Records

With a unanimous committee vote, the state House has opened the door to prosperity for 3 million Pennsylvanians. This week, the Pennsylvania House Judiciary Committee passed legislation helping incarcerated citizens…

Media

Read More: Legislation Moves to Reform Licensing Laws for Citizens with Criminal RecordsRegulation

PLCB is Bad for Business

The PLCB harms Pa. businesses in an industry that has been decimated by COVID-19.

Fact Sheet

Read More: PLCB is Bad for BusinessRegulation

Economic Aspects of Liquor Privatization

The Pennsylvania Liquor Control Board (PLCB) is a highly unprofitable monopoly with extraordinary powers that have recently been used to increase prices and harm businesses.

Fact Sheet

Read More: Economic Aspects of Liquor PrivatizationEducation

Understanding Cyber Charter Schools

Misconceptions abound when it comes to cyber charter schools—and opponents use that confusion to attack this important option. In the current era of school shutdowns, it's more important than ever…

Fact Sheet

Read More: Understanding Cyber Charter SchoolsGovernment Accountability

Transparency Can Curb the High Taxpayer Cost of Government Union Contracts

Behind closed doors, Pennsylvania elected officials routinely negotiate billion-dollar contracts with government unions leaders. Three new contracts will cost an additional $1 billion from 2019-23.

Memo

Read More: Transparency Can Curb the High Taxpayer Cost of Government Union ContractsCriminal Justice Reform

Can Criminal Justice Reform Unite America?

The following op-ed first appeared in the Philadelphia Inquirer. Are partisan division and political bickering unavoidable in American politics? The headlines make it seem so, but it’s not true.

Media

Read More: Can Criminal Justice Reform Unite America?