Memo

Protecting Seniors and Taxpayers from the Lottery Cliff

Senior Benefits Outgrowing Lottery Revenue

From the greatest generation to the latest generation, our senior citizens have sacrificed to make Pennsylvania safe and prosperous. Our seniors deserve world-class care and assurance that their growing needs will be met with compassion and efficiency.

Currently, the Pennsylvania Lottery generates $1 billion annually for high-demand senior programs such as property tax rebates, prescription drug programs and senior centers. The demand for these services is sadly outpacing Lottery revenues. More than 5,000 older Pennsylvanians are already on a waiting list to receive program benefits. Over the past two years, waiting lists grew by 52 percent. The imbalance will worsen as Pennsylvania’s senior population continues to grow. Unless Lottery profits grow with this rapidly aging population, seniors will face program cuts or Pennsylvania taxpayers will see more tax hikes.

Pennsylvania’s New and Improved Lottery Halts Program Cuts or Higher Taxes

Pennsylvania recently completed a competitive bidding process for a private company—Camelot Global Services—to manage the state lottery. Camelot runs the United Kingdom’s national lottery, about three times the size of Pennsylvania’s Lottery. Camelot also has a track record of increasing lottery revenues in other states, having consulted with California to grow sales by $400 million across various games and working with the Massachusetts lottery to develop new gaming systems.

Historically, Pa. Lottery profits have been unpredictable. Over the past five years, Lottery profits were erratic, ranging from a decline of 2.2 percent to growth of 4.9 percent. A study by the Legislative Budget and Finance Committee found the Lottery missed budgeted sales in four of the last eight years.

Today, there is no fall-back provision when the Lottery fails to meet profit projections. Instead, older Pennsylvanians are more likely to find themselves on waiting lists. In order to combat this negative impact, the private management agreement (PMA) provides a guaranteed minimum of $34 billion in lottery profits for Pennsylvania over 20 years. Camelot already put $50 million down as part of its bid, would provide another $150 million cash collateral for the commonwealth to draw from if the company fails to deliver on its profit promises. In addition, Camelot is offering a $50 million letter of credit if the fund is depleted to less than $50 million at any point during the contract.

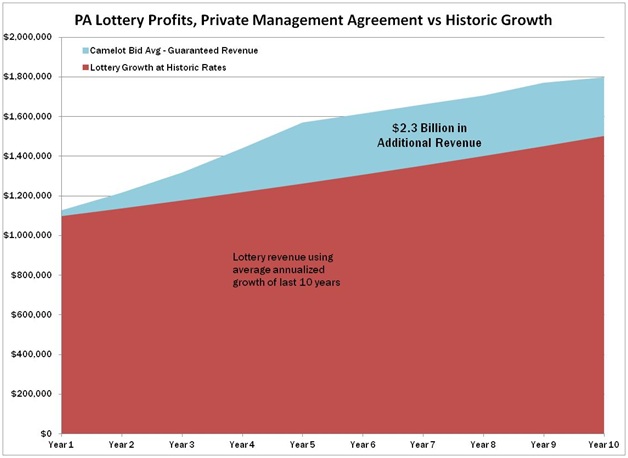

Compared to the historic performance of the Lottery over the past 10 years (3.54 percent annualized growth), Camelot’s bid would generate an additional $2.3 billion for senior services over the first decade of the agreement.

At a minimum, the bid guarantees 5.8 percent average annual profit growth over the first decade of the contract, and 1 percent annual profit growth in years 11 through 20. However, the commonwealth has the right to renegotiate and seek higher profit commitments based on actual performance after 10 years.

Seniors and Taxpayers Gain Accountability through Lottery Contract

Pennsylvania’s proposed contract incorporates lessons learned from other lottery management deals, like those in Illinois and Indiana. The management contract includes stricter taxpayer protections, such as requiring more collateral than other state’s contracts.

In addition to profit guarantees, the contract provides liability protection and allows the state to terminate the PMA for a variety of reasons, including continuous profit shortfalls. After three years, the state can terminate the contract at any time as long as they provide 180 days notice.

Pennsylvania initially received three bids for the lottery contract. This represents more bidders than any state Lottery management procurement to date, pulling from the handful of companies worldwide qualified to operate Pennsylvania’s multi-billion dollar enterprise. New Jersey’s recently announced PMA drew only one bidder.

More than 95 Percent of Lottery Profits Would Fund Senior Programs

Under the improved plan, the commonwealth is guaranteed 20 years of profit growth and a minimum of $34 billion in lottery profits. Camelot will not receive one dime beyond expenses unless it exceeds these profit commitments. Camelot and the commonwealth will split any profits above this guaranteed level, but federal law limits private operators’ profits to 5 percent of the total. In other words, the state will receive at least 95 percent of all lottery profits.

Lottery Improvements Would Create Private Sector Jobs and Increase Tax Revenue

Camelot will incorporate in Pennsylvania and pay all the same taxes other businesses pay. In fact, the contract requires that 80 percent of the manager hours worked, 80 percent of the manager’s employees and 80 percent of the manager’s contractors and subcontractors must be physically located in Pennsylvania.

Additionally, Camelot aims to expand rather than cut the current Lottery workforce. Under the proposed contract, the commonwealth would retain 70 of the 230 Lottery employees. The contract guarantees the remaining 160 state Lottery workers one year of employment. During the transition time, Camelot will offer new positions to state employees and the commonwealth will find replacement positions for anyone who does not receive an offer.

More private sector employment means new job opportunities, less strain on our public pension system and more tax revenue to help assist seniors.

In contrast, AFSCME union bosses are fighting private Lottery management to protect the $100,000 in forced union dues 160 state lottery employees would no longer pay if they transitioned into jobs with a private company. These worker dues funded six-figure salaries for union bosses and nearly $1 million in political activity in 2011-12.

Timeline of the Lottery PMA

The formal contract process began more than eight months ago, and followed a legislatively commissioned study of the Lottery.

- June 2011: House Resolution 106 passes (202-0) requiring a study of the Pennsylvania Lottery.

- Feb. 2012: Legislative Budget and Finance Committee releases report on the Lottery, finding profit shortfalls will threaten senior services.

- April 2, 2012: Commonwealth issues Request for Qualifications (RFQ) to solicit potential private lottery managers and verify potential bidders are qualified.

- April 3, 2012: Aging Secretary Brian Duke, Revenue Secretary Dan Meuser, and Lottery Director Todd Rucci testify before the House Aging and Older Adult Services Committee regarding the process for the Lottery PMA.

- June 12, 2012: Pa. Department of Revenue announces plans to move forward with the next phase of the PMA.

- June 22, 2012: Department of Revenue issues Invitation for Bid — Step One.[1]

- July 2012: Bidder meetings and site visits conducted to ensure bidder integrity.

- Aug. 2012: One qualified bidder withdraws from the process to explore other Lottery PMA opportunities.

- Aug. – Oct. 2012: Business terms and contract negotiated with qualified bidders.

- Nov. 2012: A second qualified bidder withdraws because they believe the PMA is too one-sided in the commonwealth’s favor.

- Nov. 9, 2012: Department of Revenue outlines key terms of a Lottery PMA.

- Nov. 15, 2012: Department of Revenue issues Invitation for Bid — Step 2.

- Nov. 16, 2012: The final qualified bidder submits a priced bid and $50 million bid security.

- Nov. 20, 2012: Department of Revenue announces winning bid and posts full PMA online. Commonwealth launches full investigation of Camelot to verify all claims made in PMA.

- Jan. 8, 2013: Deadline for AFSCME to offer a counter-proposal.

- Jan.10, 2013: Expiration of Camelot binding bid, barring additional extension.

- Jan. 14, 2013: Scheduled Senate Finance Committee hearing on the Lottery PMA.

- Jan. 16, 2013: Deadline to accept Camelot’s bid according to Pennsylvania’s Procurement Code, barring extension.

# # #

Elizabeth Stelle is a policy analyst with the Commonwealth Foundation (www.CommonwealthFoundation.org), Pennsylvania’s free-market think tank.

[1] The multistep sealed bidding process includes two steps. First, the commonwealth explores various ways to maximize revenue, investigates each bidder’s character and develops a private management agreement. In the second step, the bidders are invited to submit priced bids in the form of binding Annual Profit Commitments for the initial 20-year term.