Media

Academic Achievement Stagnates

Pennsylvania students are not making much academic progress according to 2011 PSSA test results. The Patriot-News reports small gains were not enough to keep some central Pennsylvania school districts from failing to make AYP (Adequate Yearly Progress), part of the No Child Left Behind Act (NCLB). This year, academic standards were raised from 54 to 67 percent proficiency in math and 63 to 72 percent proficiency in reading, as the goal of NCLB is to have every child proficient by 2014.

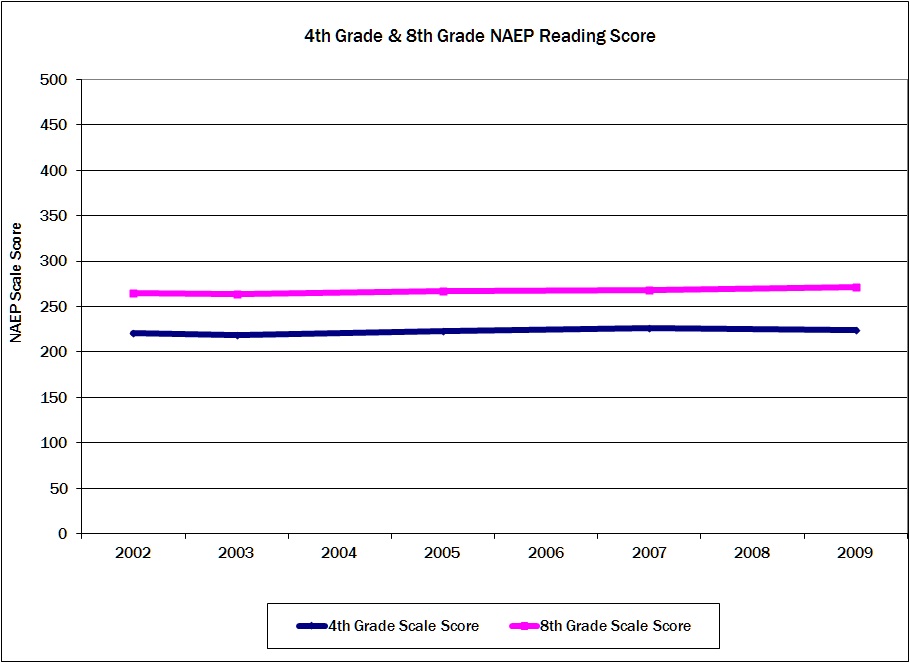

The results are unsurprising considering Pennsylvania’s relatively flat academic performance over the past decade. SAT scores have remained unchanged in Pennsylvania for the past 25 years. State PSSA test exams show only minor gains, and the National Assessment of Education Progress, a national test and more rigorous measure of proficiency, shows little improvement.

In contrast to mediocre academic gains, education spending has doubled in the last 15 years to $26 billion. Yet the education establishment, as usual, continues to preach the fallacy that more money means more student progress. Education Secretary Tomalis summed it up well when he said test score improvements have not been proportional to the rate of increased spending;

It’s becoming pretty obvious that the most important thing that affects student achievement … is the quality of the teacher in the classroom, more than the dollars.