Fact Sheet

Pennsylvania State Pension Liabilities

Gov. Tom Corbett’s FY 2011-12 budget proposal includes $63.6 billion in total operating spending—$27.3 billion in General Fund spending—a reduction of $3.3 billion from FY 2010-11. This budget restores overall spending to pre-stimulus levels and proposes no new taxes. This is the ninth in a series of fact sheets on the state budget.

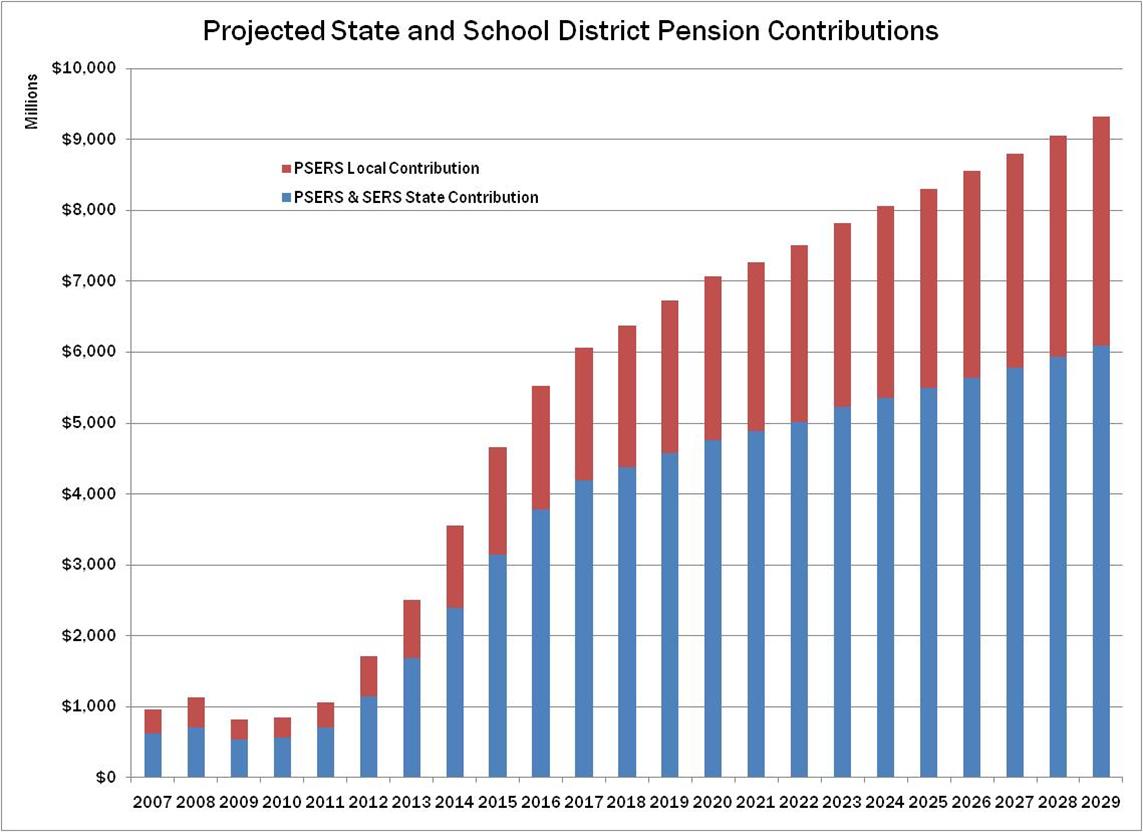

Taxpayer Pension Contributions

- Pennsylvania taxpayers fund two statewide pension plans for government employees—the State Employees’ Retirement System (SERS) for state employees and the Public School Employees’ Retirement System (PSERS) for school employees.

Act 120 of 2010

- Act 120 of 2010 reduced pension benefits for new state and school employees hired after January 1, 2011 (Dec 1, 2010 for new lawmakers), and artificially capped increases in taxpayer contributions, effectively delaying required payments.

- The reduction in pension benefits reduces taxpayers’ costs as new employees replace current workers, whereas the deferral increases taxpayers’ costs over 30 years.

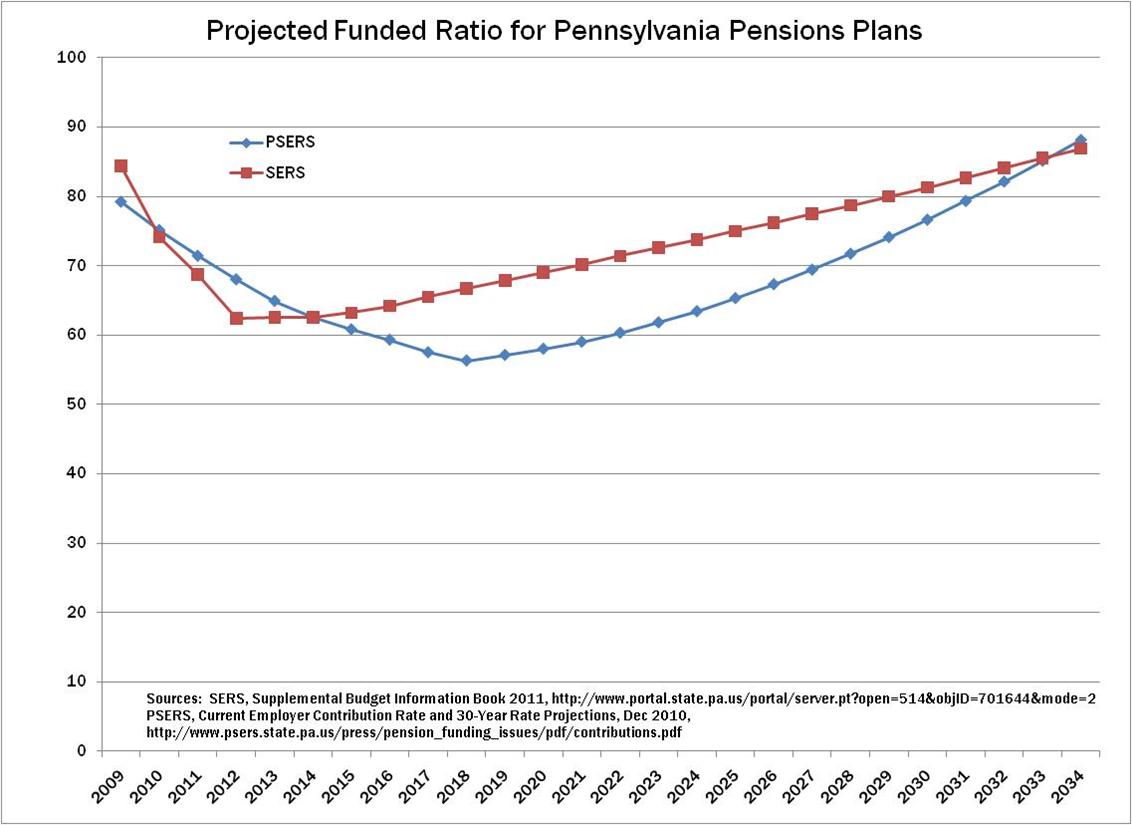

- Under Act 120, SERS’ funded ratio—the ratio of assets to accrued pension liabilities—is projected to dip to 62.6%. PSERS’ funded ratio is expected to decline to 56.3%.

- These projections are based on an 8% annual rate of return on investment for SERS and PSERS funds. In March, PSERS’ board voted to lower the assumed rate of return to 7.5%.

- Any investment losses or earnings less than this rate will reduce the funded ratio and require higher taxpayer contributions.

# # #

For more information on the Pennsylvania State Budget, visit CommonwealthFoundation.org/Budget.