Fact Sheet

Pennsylvania State Budget Overview

Gov. Tom Corbett’s FY 2011-12 budget proposal includes $63.6 billion in total operating spending—$27.3 billion in General Fund spending—a reduction of $3.3 billion from FY 2010-11. This budget restores overall spending to pre-stimulus levels and proposes no new taxes. This is the first in a series of fact sheets on the state budget.

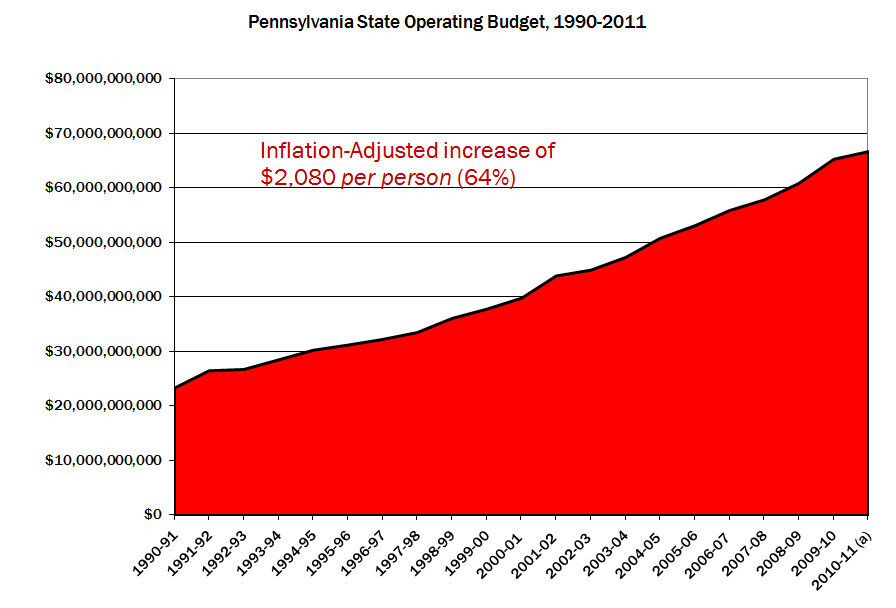

Spending Outpaced Inflation

- Since 1990, Pennsylvania state government spending increased 64%, an inflation-adjusted increase of $2,080 per Pennsylvania resident.

- Under former Gov. Ed Rendell, the General Fund budget increased by $8.1 billion, or 40.1% from 2003 to 2011, nearly double the rate of inflation (21%).

- If Pennsylvania had limited the growth of spending to inflation plus population growth over the last eight years, the state would have a surplus this year (without stimulus aid of $3.1 billion) rather than a $4 billion dollar shortfall.

- The FY 2010-11 budget relied on $3.1 billion of temporary federal stimulus money and other one-time state revenue sources which have now been exhausted.

- The Commonwealth Court ruled the state must pay back $800 million taken from the MCare fund to balance budget in FY 2009-10.

- Over the last eight years, Pennsylvania state debt increased 82%, from $23.65 billion to more than $42.94 billion. Today, Pennsylvanians owe $125 billion in total state and local government debt.

- State and local government debt and long-term obligations amounts to more than $15,000 for every resident, or more than $62,000 per family of four.

- The state’s Unemployment Compensation fund owes $3 billion to the federal government.

- The Keystone State has the 10th highest state and local tax burden out of the 50 states, up from 24th in 1990, according to the Tax Foundation. On average residents must work 104 days—nearly one-third of the year—to earn enough money just to pay their federal, state, and local tax bills.

- Pennsylvanians pay $4,463 per capita in state and local taxes (representing 10.2% of their income).

Corbett’s Budget Proposal

- Total Operating Budget (proposed) = $63.6 billion ($3.3 billion less than prior year)

- General Fund Budget (proposed) = $27.3 billion ($866 million less than prior year)

- Federal Funds = $22.2 billion ($1.7 billion less than last year, not including stimulus funds)

- Special Funds = $4.3 billion ($150 million less than prior year)

- Other Funds = $9.8 billion ($500 million less than prior year)

- Gov. Tom Corbett’s proposed General Fund Budget is $27.3 billion, a 3% decrease.

- Spending from expected state tax revenue is higher than in FY 2010-11—a $2.2 billion increase—replacing a portion of the stimulus funds.

- K-12 Education spending is reduced by 10%—approximately $1 billion—returning funding to pre-stimulus levels of $9.2 billion.

- Gov. Corbett’s proposal also calls for voter approval for school property tax increases above the rate of inflation and to relieve school districts from state education mandates.

- Taxpayer subsidies for universities are reduced by 50%, while PHEAA grants for students and community colleges are reduced by less than 2%.

Work Left to be Done

- Address Public Pension Crisis.

- Act 120 of 2010 delayed the pension “spike”—but taxpayer contributions will rise from $500 million in 2010 to $6 billion in 2015 and $10 billion by 2030.

- Implement Medicaid Reform.

- Public Welfare spending would increase by $600 million in the proposed budget, primarily in Medical Assistance (Medicaid) with a loss of federal funds and rigid federal rules.

- Overhauling Medicaid to reduce fraud, ensure long-term care benefits help the truly needy, and convert the system to one helping recipients purchase private insurance will save taxpayers billions.

- End All Corporate Welfare.

- The Redevelopment Assistance Capital Program (RACP) would be maintained, estimated to borrow $270 million in FY 2011-12; economic developments programs would be consolidated into the Liberty Loan Fund; and the film tax credit and other funds for special interests groups would be retained.

# # #

For more information on the Pennsylvania State Budget, visit CommonwealthFoundation.org/Budget.