Fact Sheet

Pennsylvania State Budget 2013

Governor Corbett’s proposed budget of $28.4 billion in general fund spending and $67.6 billion in spending from all funds represents our highest spending levels ever—exceeding years when federal stimulus dollars inflated total spending. This budget, however, still reflects a reduction from 2010-11 spending levels when adjusting for inflation.

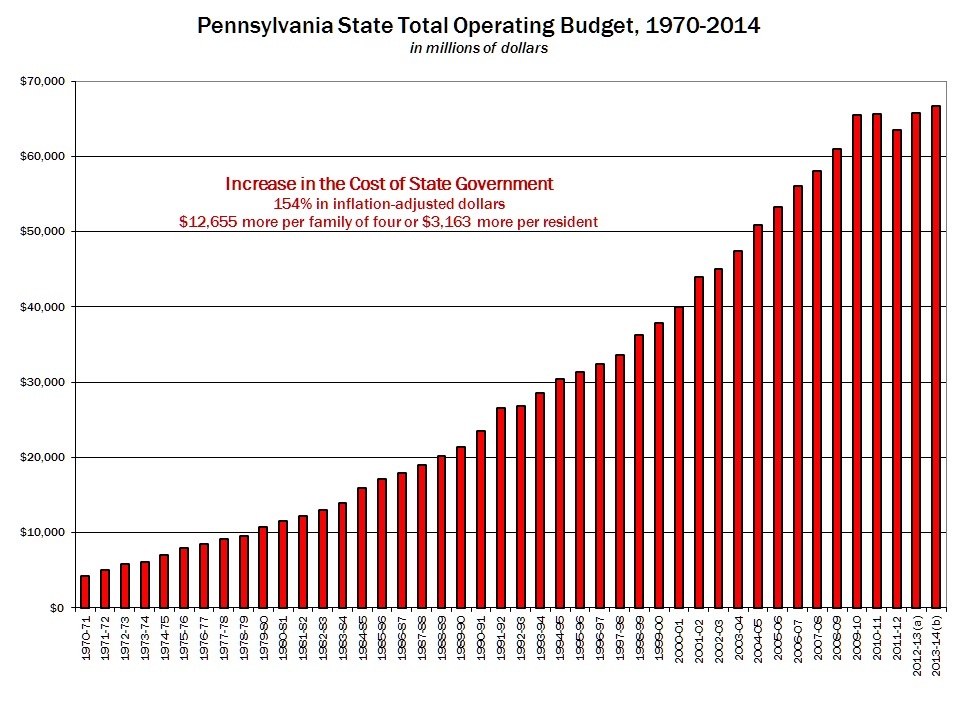

Spending has Dramatically Outpaced Inflation in PA

- Pennsylvania’s budgetary challenges stem from spending that has outpaced taxpayers’ ability to pay.

- From 1970 to 2014, state government spending increased from $4 billion to a proposed $67 billion, an inflation-adjusted increase of $12,655 per family of four (or $3,163 more per resident).

- If state government total spending had grown at the rate of inflation plus population since 2000, taxpayers would be saving more than $11 billion dollars this year, or $3,673 per family of four ($918 per resident).

Pennsylvania State Budget Basics

- While the General Fund Budget is the primary focus of both legislative discussions and public attention, it represents only about 40% of the commonwealth’s total operating budget.

- Total Operating Budget = $66.7 billion

- General Fund Budget = $28.4 billion

- Federal Funds = $21.7 billion

- Special Funds = $4.9 billion

- Other Funds = $11.6 billion

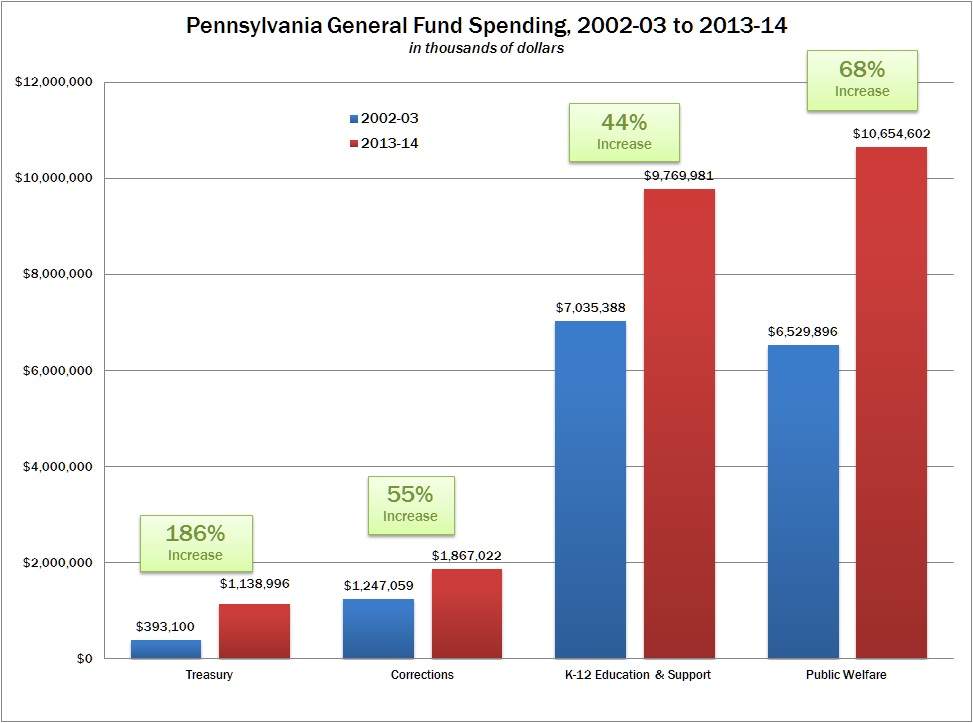

- General Fund spending increased by $8.1 billion (40%) from FY 2002-03 to the proposed 2013-14 budget, not including spending moved to other funds. Inflation was 27% over this time.

- K-12 Education, Public Welfare, Corrections and Treasury (debt payments) represent 85% of the General Fund Budget; but these four areas represent 100% of the spending growth.

- K-12 Education, Public Welfare, Corrections and Treasury grew by $7.6 billion.

- All other programs and departments were reduced by $426 million.

Debt and Tax Burden Growing

- From 2002 to 2012, Pennsylvania state debt—including debt held by state agencies—more than doubled, from $23.7 billion to $47.9 billion.

- Today, Pennsylvanians owe $125 billion in combined state and local government debt-almost $10,000 for every man, woman, and child.

- Pennsylvania has the 10th highest state and local tax burdenin the nation, up from 24th in 1991, according to the Tax Foundation.

- Pennsylvania taxpayers pay $4,183 per capita in state and local taxes, or 10.2% of their income.

Gov. Corbett’s Proposed Pension Reform

- All state and public school employees hired after January 1, 2015 would be placed into 401(a) defined-contribution plan, similar to 401(k)s common in the private sector.

- State employees would contribute 7.5% of their pay and school employees 6.25% of their salary, with taxpayers—via the state or school districts—contributing 4% of salary toward workers’ retirements. This money would be deposited into a personal account owned by employees.

- Moving to a defined-contribution plan would get politics out of pensions. Defined-contribution plans provide retirement benefits that are affordable for taxpayers, predictable for workers and governments, and are not subject to the political manipulation that has plagued Pennsylvania’s pension system.

- Gov. Corbett’s budget would arbitrarily lower state and school district contributions into pension plans. These temporary delays in payments require larger taxpayer contributions over time.

- Future benefits for current employees would be curtailed, reducing taxpayer costs.

- There would be no change to benefits for current retirees, nor any changes to benefits already earned by current employees.

- An individual’s pension benefit is determined by multiplying years worked by final pay by a “multiplier.” For most current workers, the multiplier is 2.5% of pay. Under the proposal, employees with a multiplier greater than 2% would see it reduced by 0.5% (or could pay more to keep the current multiplier) for each year worked after 2015.

- Final pay would be calculated by a five-year average instead of a three-year average, and “spiking” would be prohibited.

Liquor Store Privatization Proposal

Gov. Corbett proposed privatizing the state liquor stores as part of his budget. A version of this proposal passed the state House in March.

Wholesale Privatization

- One year after the legislation is signed into law, wholesale divestiture would occur. The state would negotiate wholesale licenses to distribute wine and liquor products to stores, bars and restaurants by brand.

New Privately-Run Wine and Spirits Stores

- The state would initially issue 1,200 wine and spirits licenses.

- Beer distributors would have right of first refusal on licenses for one year. If a distributor gets a wine and spirits license, they would be the one-stop shop to get wine, beer and liquor.

- After one year, the unclaimed licenses become available to the public on a ‘first-come basis,’ based on the number of licenses available in each county; no county will have fewer licenses available than the number of distributors.

Retail License Cost

- Licensees can purchase the right to sell wine, spirits or both.

- The cost for beer distributors would be significantly less than those for new stores.

- Licenses are renewed every two years at a cost of $1,000.

Greater Convenience through Grocery Stores and Package Reform

- Grocery stores may purchase a license to sell up to 12 bottles of wine.

- Restaurants may purchase a license to sell up to six wine bottles to go, in addition to beer which they are currently allowed to sell.

- The gas prohibition is removed, meaning that a gas station that has a restaurant license and sells food will also be allowed to sell limited amounts of beer and wine.

Closure of State Stores

- Once the number of privately-operated stores (including grocery stores selling wine) doubles the number of government-run liquor stores in a county, the state stores in that county must close within six months.

- As the 600 state stores close, the state can offer up to 600 additional wine and spirits licenses.

- The PLCB will have to close all state store operations once it has 100 or fewer stores remaining.

Benefits for Current PLCB Employees

- These include: training and education grants, tax credits for businesses to hire displaced workers, and a civil service hiring preference.

Safety

- Transaction scan devices would be required and employees be trained in alcohol safety.

- State Troopers would be allowed undercover investigations in licensed establishments, something that does not occur in PLCB stores.

Proposed Transportation Spending Increases

- Gov. Corbett’s proposal would uncap the Oil Company Franchise Tax over a five-year period. Currently, the tax applies only to the first $1.25 of fuel prices. By uncapping this, the tax would be charged on the full price of motor fuel.

- This is estimated to equal 28.5 cents per gallon of gas given current prices.

- To help offset this, the proposal calls for reducing the Liquid Fuels Tax (flat gasoline tax) from 12 cents per gallon to 10 cents per gallon over two years.

- Pennsylvania already has among the highest gas tax rates in the U.S., and estimates suggest this proposal would give Pennsylvania the highest state gas tax in the nation.

- The administration says the plan will generate $1.8 billion in additional revenue by “year 5,” but this spending increase is not reflected in the Governor’s Executive Budget, which shows only a $1.2 billion increase for transportation by 2017-18.

- In addition, the proposal includes several mechanisms to spend more efficiently and leverage private sector capital.

- The proposal calls for ending the Turnpike Commission’s transfers under Act 44 ($250 million per year for highways and mass transit) in 10 years.

- Local transit agencies would have to increase their local match of costs, and conduct consolidation studies.

- A new office would implement and oversee Public Private Partnerships under the new law, utilizing private sector capital to build and maintain infrastructure.

# # #

For more information on the Pennsylvania State Budget, visit www.CommonwealthFoundation.org/Budget