Fact Sheet

The Failure of Government-run Liquor Stores

The Pennsylvania Liquor Control Board (PLCB) is the exclusive wholesaler and retailer of wine and spirits in the commonwealth. A current proposal would get the government out of the business of selling alcohol, allowing the state to concentrate on its enforcement role, permitting private stores to sell wine and liquor and allowing consumers to choose brands for themselves.

National Context

- Only two states, including Pennsylvania, have a government-run monopoly on the retail sale and wholesale (distribution to bars, restaurants and hotels) of wine and spirits. Pennsylvania is:

- One of 12 states with exclusively state-run spirits wholesale.

- One of 8 states with exclusively state-run spirits retail stores.

- One of 4 states with exclusively state-run wine wholesale.

- One of 2 states with exclusively state-run wine retail stores.

- 30 states have never involved government in the sale of alcohol.

- There are fewer than 650 liquor stores (wine is also sold at state-run wine boutiques, wine kiosks and licensed wineries) across the entire commonwealth, representing nearly 20,000 residents per store.

- Nationally, there are 4,461 residents per liquor store, and nearly 1,900 residents for every wine retailer.

- For Pennsylvania to be at the national average, the state would have to allow for more than 2,800 liquor stores and 6,600 wine retailers.

| Population Per Alcohol Retail Store (Off-Site Vendor) | ||

| Spirits | Wine | |

| Pennsylvania (Currently) | 19,926 | 16,470 |

| National Average | 4,461 | 1,897 |

| Number of Outlets for PA to be at National Average | 2,832 | 6,660 |

| Sources: Spirits Stores: NABCA, Beverage Information Group, and state websites, compiled by DISCUS; Wine Retail: Adams Handbook Outlet tables – “Off Premise Vendors,” 2010; Population: US Census, Population Estimates, www.census.gov | ||

| Prepared by Commonwealth Foundation, www.CommonwealthFoundation.org | ||

Pennsylvanians Support Privatization

- The latest Quinnipiac University poll, released in June 2011, shows 69% of Pennsylvania voters support selling the state liquor stores.

- Those polled showed support across party identification — 80% of Republicans, 60% of Democrats, 70% of Independents — and across all regions of the state. Even the majority of union households support privatization.

- According to a taxpayer-funded survey by the Neiman Group commissioned by the PLCB, more than 70% of respondents think prices are not competitive with other states and almost half don’t believe the government-run wine and spirits stores have affordable pricing.

Liquor Safety and Government Control

- Compared to bordering states, and all states in the nation, the commonwealth ranks in the middle of the pack or worse in alcohol-related deaths and alcohol-related traffic fatalities (whether measured on a per-person or per-highway mile rate).

| Pennsylvania Alcohol Related Deaths and Traffic Fatalities Compared to Bordering States | ||||||||

| Alcohol Related Deaths | Alcohol Related Traffic Fatalities, 2009 | MADD Ranking | ||||||

| State | Population | Total Alcohol Related Deaths (Avg. 2001-05) | Per 100,000 Residents | Number | % of total fatalities | Per 100,000 Residents | Per 1,000 State Hwy Miles | DUI-related accidents per capita |

| Pennsylvania | 12,632,780 | 3,210 | 25.41 | 406 | 32 | 3.21 | 3.33 | 30 |

| Delaware | 891,464 | 220 | 24.68 | 45 | 38 | 5.05 | 7.14 | 39 |

| Maryland | 5,737,274 | 1,278 | 22.28 | 162 | 30 | 2.82 | 5.15 | 17 |

| New Jersey | 8,732,811 | 1,772 | 20.29 | 149 | 25 | 1.71 | 3.84 | 3 |

| New York | 19,577,730 | 3,825 | 19.54 | 321 | 28 | 1.64 | 2.80 | 11 |

| Ohio | 11,532,111 | 2,875 | 24.93 | 324 | 32 | 2.81 | 2.63 | 26 |

| West Virginia | 1,825,513 | 573 | 31.39 | 115 | 32 | 6.30 | 2.98 | 29 |

| United States | 309,050,816 | 79,646 | 25.77 | 10,839 | 32 | 3.51 | 2.68 | |

| Sources: Alcohol Related Deaths: http://apps.nccd.cdc.gov/DACH_ARDI/Default/Default.aspx; Alcohol Related Traffic Fatalities: http://www-nrd.nhtsa.dot.gov/Pubs/811363.pdf; Highway Miles: http://www.fhwa.dot.gov/policyinformation/statistics/2009/hm20.cfm; MADD Rankings: http://www.madd.org/drunk-driving/campaign/state-ranking/ | ||||||||

| Prepared by Commonwealth Foundation, www.CommonwealthFoundation.org | ||||||||

- A survey by the U.S. Department of Health and Human Services ranks Pennsylvania higher than the national average in underage drinking, binge drinking, and underage binge drinking.

| Underage and Binge Drinking Rates Among Pennsylvania and Its Border States | |||

| Alcohol Use in past month Age 12-20 | Binge Drinking Age 12-20 | Binge Drinking Age 12 + | |

| Pennsylvania | 29% | 19% | 24% |

| Delaware | 30% | 21% | 25% |

| Maryland | 28% | 18% | 22% |

| New Jersey | 26% | 18% | 23% |

| New York | 32% | 20% | 23% |

| Ohio | 29% | 21% | 26% |

| West Virginia | 24% | 16% | 19% |

| United States | 27% | 18% | 23% |

| Source: U.S. Department of Health and Human Services, Substance Abuse and Mental Health Statistics, http://www.oas.samhsa.gov/2k8State/AppB.htm | |||

| Prepared by Commonwealth Foundation, www.CommonwealthFoundation.or | |||

- A study by John Pulito and Dr. Antony Davies of Duquesne University finds that the level of state control over alcohol sales has no link to underage drinking, binge drinking and DUI fatalities.

- A subsequent study examines 49 states over 21 years using sophisticated analytic techniques and finds that states with private alcohol markets have lower alcohol-related fatality rates.

- A comprehensive literature review by Dr. Davies of peer-reviewed studies of liquor privatization finds no consistent evidence linking control of alcohol markets to social behaviors.

- State police do not perform sting operations to see if PLCB employees are selling alcohol to underage teens, as they do in bars and restaurants, because PLCB monitors its own operations.

- Currently, the PLCB has a dual mandate to promote liquor sales and oversee regulations.

- The agency spends more than $10 million per year on marketing and advertising.

- Attempting to attract more customers, the PLCB “rebranded” liquor stores at an estimated $3.7 million cost to taxpayers.

PA Losing Liquor Sales to Bordering States

- The Neiman Group survey conducted for the PLCB shows that 45% of residents in Philadelphia and its surrounding counties purchase some or all of their alcohol outside of Pennsylvania, even though it is illegal to transport it back into the state.

- Survey respondents purchased approximately 23% of their wine and spirits outside of Pennsylvania. Given the PLCB sales in these surveyed counties totaled $808 million in 2010, out-of-state purchases lost represented upwards of $180 million in sales, and more than $40 million in potential sales and alcohol tax revenue Pennsylvania did not collect.

- Pennsylvania loses an estimated $3.5 million in revenue annually from state residents crossing into West Virginia to buy their alcohol, according to a study by Dr. Todd Nesbit of the College of Charleston and Dr. Kerry King-Adzima of Penn State University-Erie.

Border States Price Comparison

- The Commonwealth Foundation compared wine and spirits prices from stores in all six states bordering Pennsylvania, comparing the PLCB’s top 10 best-selling items in each price category.

- Average wine prices were lower in all six border states. Average spirits prices were lower in Ohio, Delaware, and Maryland, but higher in West Virginia, New Jersey, and New York.

| Price Comparison Results (includes state sales taxes) | ||||||

| Avg. Wine Prices Compared to PA, Top 10 Selling PLCB Products per Price Category | ||||||

| Price Category | Ohio | Delaware | West Virginia | Maryland | New York | New Jersey |

| Ultra Premium | -25% | 7% | 0% | -16% | -2% | 1% |

| Super Premium | -3% | -1% | -9% | -9% | -5% | 5% |

| Premium | -7% | -6% | 5% | -29% | -21% | -11% |

| Standard | -5% | -12% | -15% | -22% | -12% | -7% |

| Value | -9% | -11% | -13% | -23% | -13% | -1% |

| Average | -10% | -5% | -6% | -20% | -11% | -3% |

| Avg. Spirit Prices Compared to PA, Top 10 Selling PLCB Products per Price Category | ||||||

| Price Category | Ohio | Delaware | West Virginia | Maryland | New York | New Jersey |

| Ultra Premium | -10% | -10% | 8% | -4% | 2% | 3% |

| Super Premium | 5% | -4% | 13% | -12% | 5% | 8% |

| Premium | -6% | -10% | 9% | -11% | 10% | 11% |

| Standard | -4% | -13% | 9% | -16% | 7% | 12% |

| Value | 1% | -8% | 15% | -3% | 14% | 11% |

| Average | -3% | -9% | 11% | -9% | 8% | 9% |

| Sales Data by Product provided by PLCB on request | ||||||

| Prepared by Commonwealth Foundation, www.CommonwealthFoundation.org | ||||||

Understanding PLCB Revenue

- More than 80% of the approximate $500 million transferred from the PCLB to the state General Fund comes from taxes charged to consumers — the Johnstown Flood tax and the state sales tax.

- The PLCB imposes an 18% Johnstown Flood Tax (first created in 1936 as a temporary tax to fund repairs following the Johnstown Flood), the 6% state sales tax (along with local taxes), a $1.50 per bottle handling fee, and a 30% markup on all wine and spirits sold.

- The state budget sets an amount of “profits” the PLCB will transfer each year to the state General Fund, regardless of the PLCB’s net revenues.

- A gallonage tax has been proposed to replace the Johnstown Flood Tax and state store “profits” that are transferred to the General Fund.

- A gallonage tax is imposed on volume and alcohol content. This contrasts with the current Johnstown Flood tax, which is based on the price of an item.

- In addition, private retailers will pay the state corporate income tax, sales tax on their (taxable) purchases, local property taxes, and other taxes imposed on businesses.

- Changing the tax structure raises questions of whether to impose taxes on liquor based on price or on the amount of alcohol sold, and whether to retain or reduce the current state tax burden.

- Privatizing government-run liquor stores would generate up-front revenue for the state by (1) auctioning off retail licenses, (2) selling wholesale licenses and (3) auctioning off the inventory of state liquor stores.

- The amount of revenue generated would depend on the number of licenses available and the length and time of the contracts.

- As of June 2010, according to the PLCB’s income statement, the value of inventory was $304 million.

Pennsylvania Liquor Control Board Spending

- In 2010, the PLCB transferred more money to the state’s General Fund than they had available in revenue, resulting in a year-end fund balance of negative $8 million.

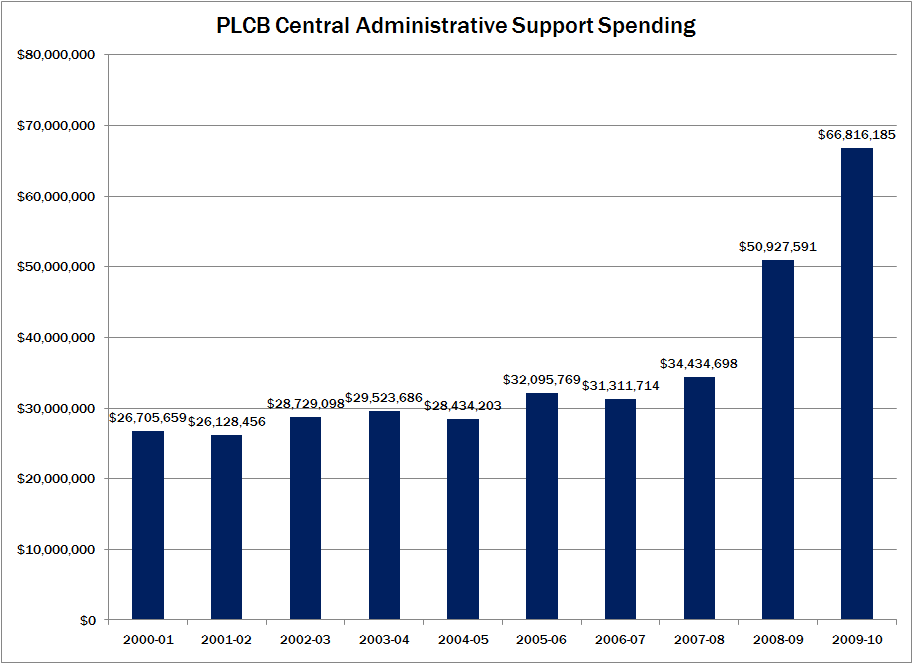

- Financial records from the PLCB show that from 2000 to 2010:

- Net operating income declined 248%.

- Sales revenue increased 65%.

- Central administrative support costs increased 150%.

- Store operating spending increased 70%.

- In 2008, the PLCB awarded a wine kiosk contract to Simple Brands, despite their own committee advising against it, citing a “deficient” business plan. Simple Brands now owes the state $1 million.

- The PLCB poured out $66 million, nearly two-and-a-half times its originally planned cost, for an inventory system that failed to compute adequate amounts of inventory, creating widespread shortages. This caused hoarding by store managers and led to over-ordering. The PLCB stored the surplus inventory in non-temperature controlled trailers that cost $500,000 in leases and extra security.

- The PLCB awarded a contract to conduct “courtesy training” costing more than $287,000 to a company owned by the husband of a high-ranking PLCB official. The original contract was for $173,820.

# # #

For more information on Liquor Store Privatization, visit CommonwealthFoundation.org