Fact Sheet

Pennsylvania State & Local Taxpayer Debt

Gov. Ed Rendell frequently argues that Pennsylvania taxpayers can afford to incur more state debt. However, in order to justify the borrowing of billions of dollars, the governor conveniently ignores the debt burden placed on taxpayers by all levels of state and local government.

Today, Pennsylvanians owe $120 billion in state and local government debt. This equates to over $9,600 for every person, and over $38,400 for the average family of four in the Commonwealth.

| Pennsylvania State & Local Government Debt | ||

| Debtor | Debt Outstanding | Per Capita |

| Total State | $41,186,955,000 | $3,313 |

| State | $8,690,755,000 | $699 |

| State Agencies & Authorities | $32,496,200,000 | $2,614 |

| Total Local | $78,773,223,852 | $6,336 |

| School Districts | $26,059,284,754 | $2,096 |

| County/Municipal/Twp/other | $52,713,939,098 | $4,240 |

| Total | $119,960,178,852 | $9,649 |

| Sources: Governor’s Executive Budget (http://www.budget.state.pa.us) December 2009 data; PA Dept of Education (http://www.pde.state.pa.us/k12_finances/cwp/view.asp?a=3&q=89351) June 2009 data; U.S. Census Bureau (http://www.census.gov/govs/www/estimate.html) 2007 data/2009 projected by Commonwealth Foundation | ||

State Debt

Under Gov. Ed Rendell (Dec. 2002-Dec. 2009), total outstanding state general obligation debt increased 39% from $6.8B to $8.7B.

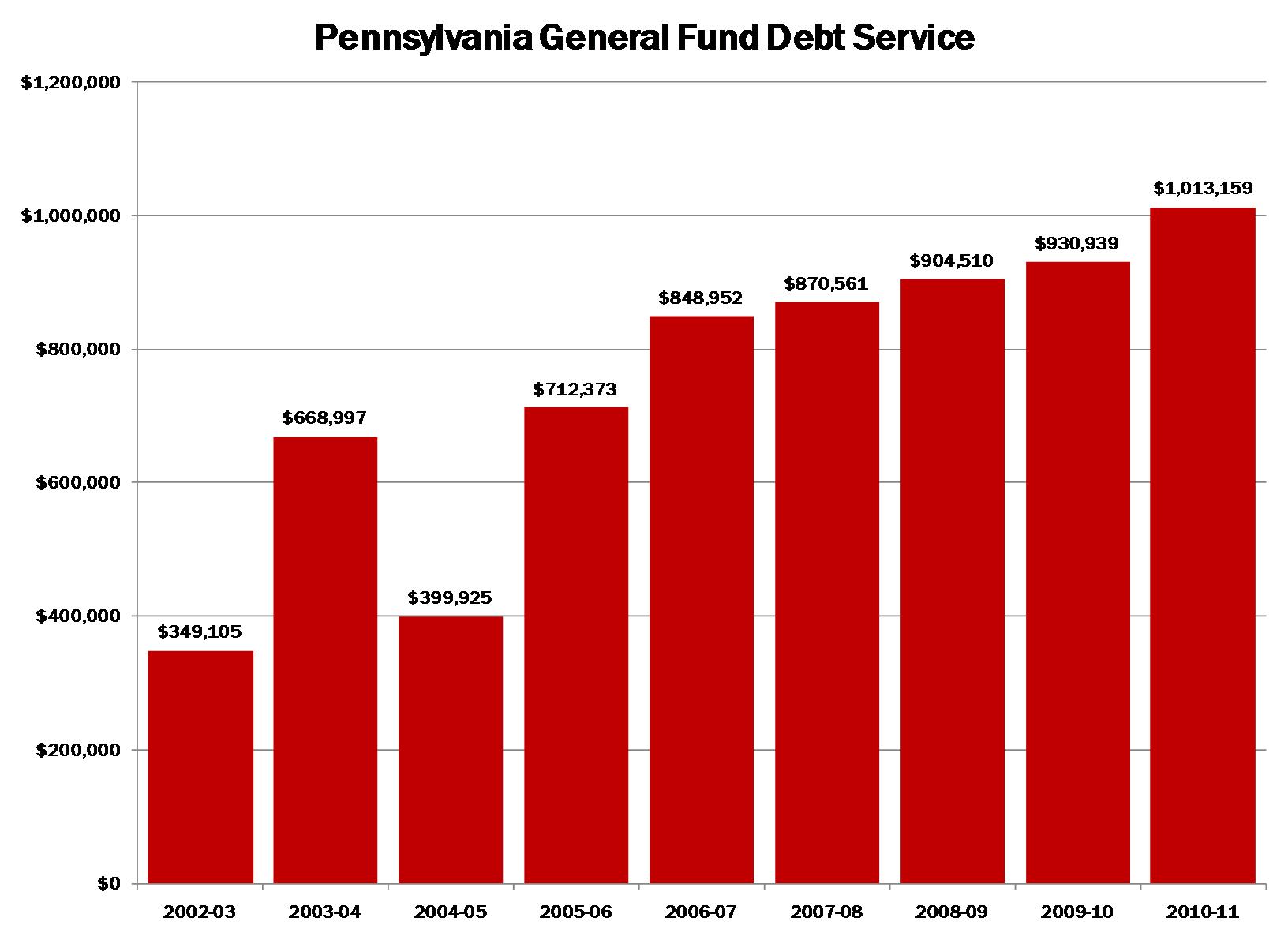

- Annual debt payments on general obligation bonds increased from $349M in FY 2002-03 to $1.01B in Rendell’s proposed FY 2010-11 budget, an increase of 189% in annual debt payments.

State Agencies & Authorities Debt

Three-fourths of Pennsylvania’s state-level borrowing is done by off-budget state agencies and authorities, like the Turnpike Commission and the Commonwealth Financing Authority.

- Debt owed by state agencies and authorities increased from $16.8B in 2002 to nearly $32.5B in 2009 – an increase of 93%.

- Total Pennsylvania state and state agencies and authorities debt increased from $23.6B to over $41.1B over the last seven years – representing a total state-level increase of 74%.

| Pennsylvania State, State Agencies & Authorities Debt | ||||

| Debtor | Debt Outstanding 2002 | Debt Outstanding 2009 | Increase | Change |

| State | $6,805,184,000 | $8,690,755,000 | $1,885,571,000 | 28% |

| State Agencies & Authorities | $16,848,800,000 | $32,496,200,000 | $15,647,400,000 | 93% |

| Total State | $23,653,984,000 | $41,186,955,000 | $18,067,764,000 | 74% |

| Source: Governor’s Executive Budget (http://www.budget.state.pa.us) | ||||

School District Debt

Pennsylvania taxpayers are also experiencing an increase in debt at the school district level.

- According to the Pennsylvania Department of Education, school district debt increased from $19.3B in 2002 to $26.1B in 2009 – an increase of 35%.

County, Municipal, Township, & Special District Debt

Other local government debt represents over 40% of all taxpayer debt in the Commonwealth.

- According to the U.S. Census Bureau’s most recent data (2007) and Commonwealth Foundation projections for 2009, county, municipal, township, and special district debt increased from $44.9B in 2002 to $52.7B in 2009 – an increase of 17%.

| Pennsylvania School District, County, Municipal, Township, Special District Debt | ||||

| Debtor | Debt Outstanding 2002 | Debt Outstanding 2009 | Increase | Change |

| School Districts | $19,351,014,152 | $26,059,284,754 | $6,708,270,602 | 35% |

| County/Municipal/Twp/other | $44,943,251,000 | $52,713,939,098 | $7,770,688,098 | 17% |

| Total Local | $64,294,265,152 | $78,773,223,852 | $14,478,958,700 | 23% |

| Sources: PA Dept of Education (http://www.pde.state.pa.us/k12_finances/cwp/view.asp?a=3&q=89351) June 2009 data; U.S. Census Bureau (http://www.census.gov/govs/www/estimate.html) 2007 data/2009 projected by Commonwealth Foundation | ||||

# # #

For more on Government Borrowing and Debt, visit www.CommonwealthFoundation.org

The Commonwealth Foundation (www.CommonwealthFoundation.org) is an independent, non-profit research and educational institute.