Memo

Four Things to Know about Wolf’s September Tax Increase Proposal

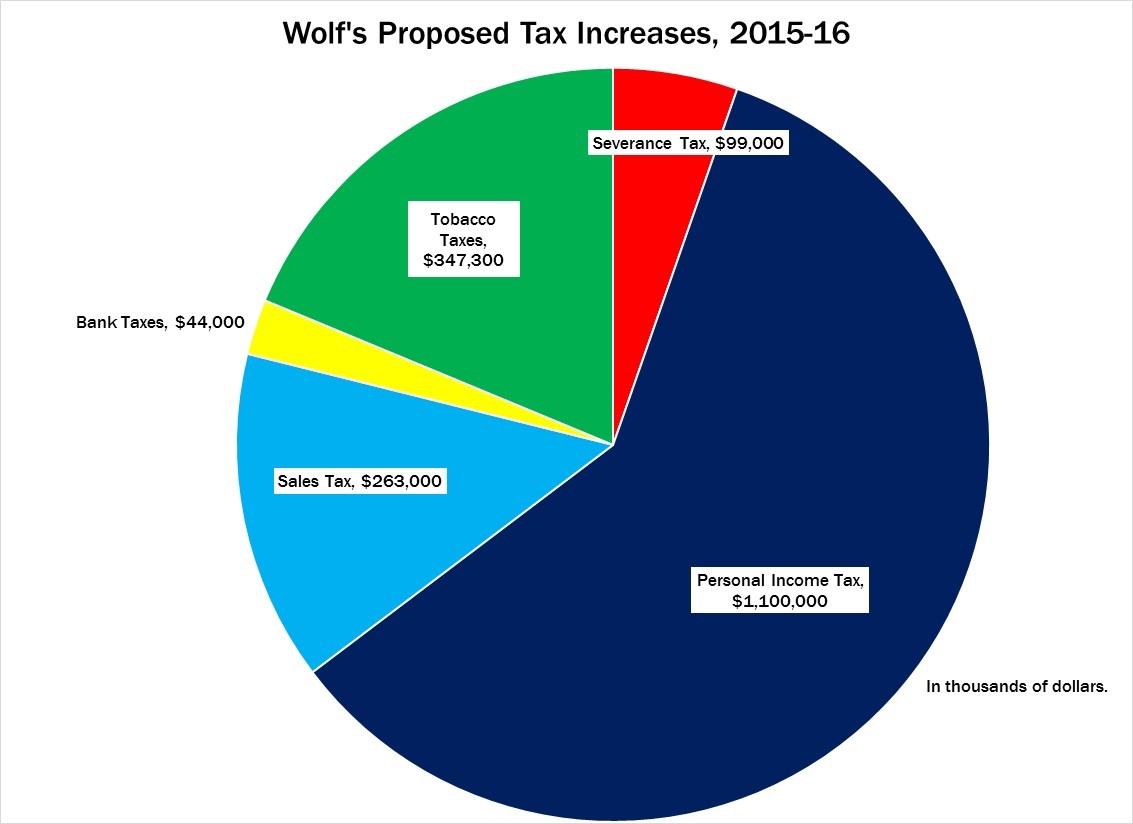

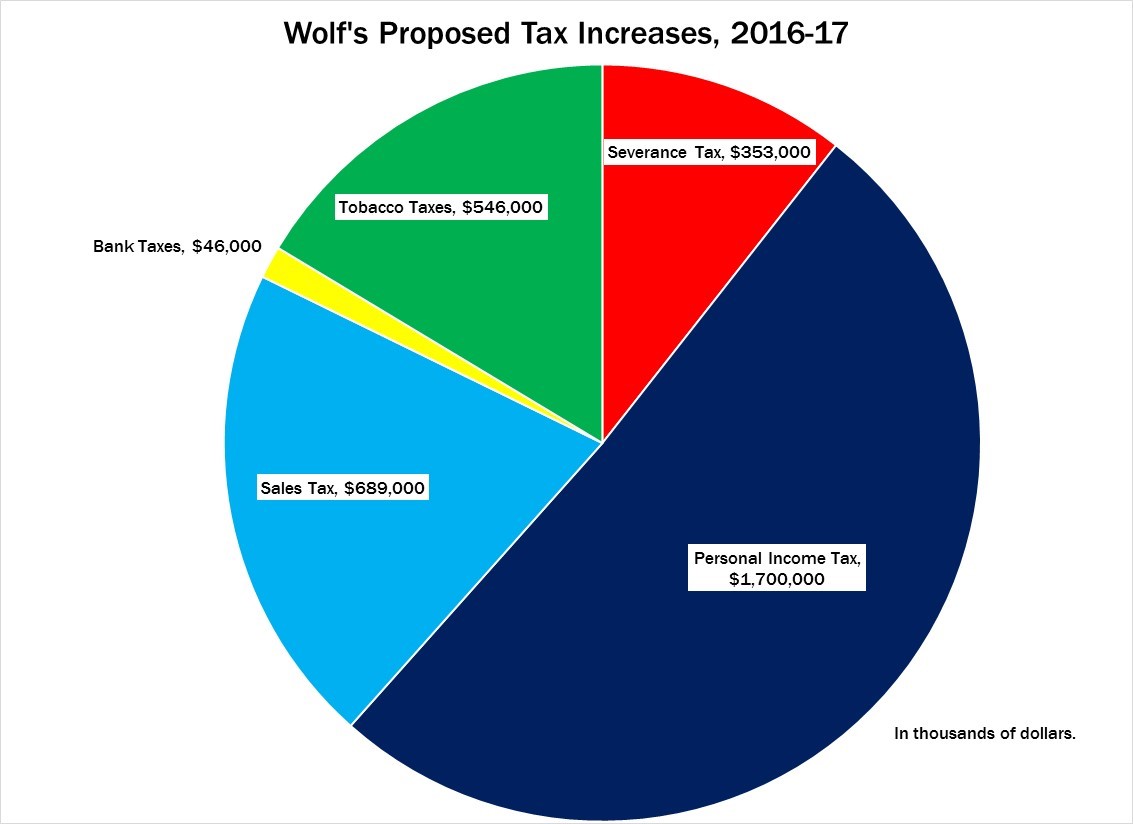

On September 11, 2015, Gov. Tom Wolf presented legislative leaders with a second tax increase proposal—totaling $1.8 billion for the 2015-16 budget year, and a $3.2 billion net increase in 2016-17, after all increases have taken effect.

UPDATE: Gov. Wolf offered a new tax proposal on October 6, 2015. Here is a summary of that plan

Here are four things to know about that tax increase.

Wolf’s tax hike represents an increase of more than $1,000 per family of four when fully implemented.

| Gov. Wolf's Proposed Tax Changes | ||||

| Item | 2015-16 | 2016-17 | ||

| State Tax Rate Changes | Total Revenue | Per Family of Four | Total Revenue | Per Family of Four |

| Severance Tax of 5% and 4.7 cents per MCF – Jan 1, 2016 (net of impact fee) | $99,000 | $31 | $353,000 | $110 |

| Personal Income Tax Rate Increase to 3.49% – October 1, 2015 | $1,100,000 | $344 | $1,700,000 | $532 |

| Personal Income Tax Imposed on Lottery – July 1, 2015 | $7,800 | $2 | $16,300 | $5 |

| Sales Tax Expanded to untaxed items and services – January 1, 2016 | $263,000 | $82 | $689,000 | $216 |

| Bank Shares Tax – immediate rate increase | $44,000 | $14 | $46,000 | $14 |

| Cigarette Tax increase $1 per pack – November 1, 2015 | $302,000 | $94 | $438,000 | $137 |

| Tobacco Products (not large cigars) and eCigarettes tax of 40% on wholesale price – January 1, 2016 | $37,300 | $12 | $95,000 | $30 |

| Sales Tax Increase from Cigarettes | $8,000 | $3 | $13,000 | $4 |

| Total State Tax Increases | $1,861,100 | $582 | $3,350,300 | $1,048 |

| Tax Forgiveness | ($80,000) | ($25) | ($106,000) | ($33) |

| Net Tax Increase | $1,781,100 | $557 | $3,244,300 | $1,015 |

There are no property tax relief provisions included in this plan.

While Wolf’s new plan reduces his overall tax increase, ending his calls for a sales tax rate increase and narrowing sales tax exemptions, he also dropped his proposal to use some revenue for property tax relief. Gov. Wolf has also dropped his proposal to reduce the Corporate Net Income Tax rate.

The severance tax (net of impact fee reimbursements) represents only 5 percent of new revenue in the first year, and 10 percent in the second year.

Despite the rhetoric of a “natural gas severance tax for education” the overwhelming majority revenue in Wolf’s tax plan comes from income and sales tax increases. These taxes would be borne directly by working families.

In fact, 95 percent of the new revenue in 2015-16 would come from sources other than the severance tax. In 2016-17, the severance tax—after replacing “impact fee revenues”—would generate only $353 million, or 10 percent of the total in new taxes.

Wolf’s tax increase would result in the loss of 14,000 total jobs, once fully implemented.

Based on analysis using the modeling developed by the Beacon Hill Institute at Suffolk University, Wolf’s tax increase would discourage the creation of 14,548 new jobs in 2016-17. This includes almost 21,000 fewer jobs in the private sector, and with growth of 6,000 government jobs.

| Total Employment | |||

| Without Wolf Taxes | With Wolf Taxes | Jobs Not Created | |

| 2015-16 | 5,764,652 | 5,754,301 | 10,350 |

| 2016-17 | 5,815,360 | 5,800,812 | 14,548 |

| 2017-18 | 5,866,631 | 5,852,799 | 13,832 |

| 2018-19 | 5,918,471 | 5,905,231 | 13,240 |

| 2019-20 | 5,970,885 | 5,958,142 | 12,742 |