Media

WITF Marcellus Forum Viewers Guide

Tonight at 8 p.m., WITF TV will air an hour-long “Marcellus Shale Forum”. While the discussion should be informative for most viewers wanting to learn about the Marcellus Shale industry’s impact, there were several questions left unanswered and some misinformation left unaddressed. CF was on hand during the taping of this town hall, and provides the following viewer’s guide:

What to Watch For: Early on, there is a discussion of the volume of water used by Marcellus drilling.

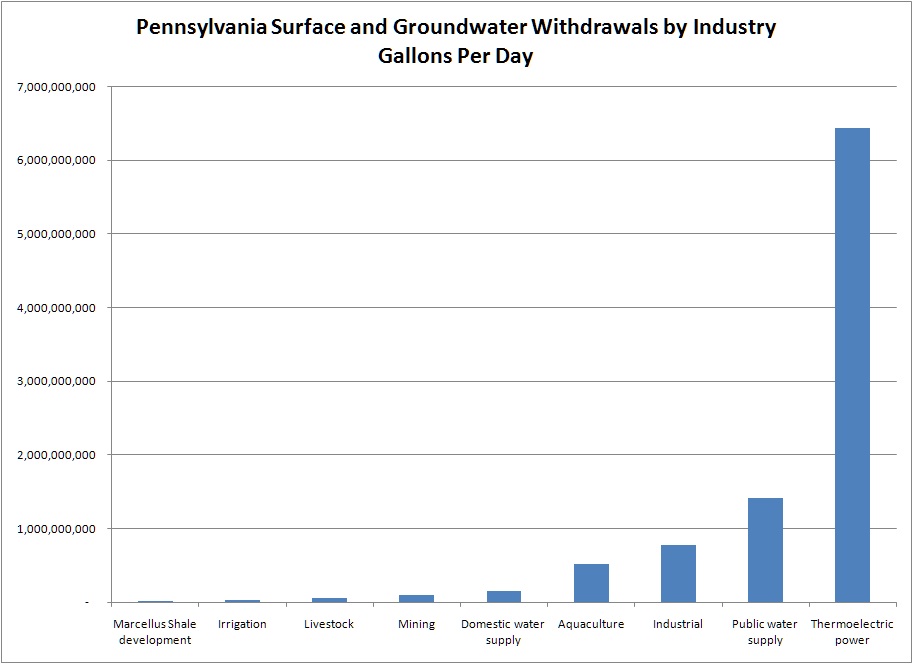

- According to the Susquehanna River Basin Commission, the gas industry uses about 2 million gallons of water per day from the Susquehanna watershed. In comparison, the recreation industry, such as ski resorts and golf clubs, uses 50 million gallons per day. Thermoelectric power plants are by far the largest users of water in Pennsylvania at 6.43 billion gallons per day. A lot of numbers are thrown around, and it is easier to see with a chart.

What to Watch For: Former Conservation and Natural Resources secretary John Quigley says that geologists “can’t rule out” that water left more than a mile underground could migrate upwards over decades into group aquifers. Later he says he can’t speculate what the chances are, whether “10 percent, 1 percent, or one-tenth of 1 percent” but there is a chance it could happen.

- The only way this could happen is if the laws of physics were reversed in a few decades. Physicists can’t rule this out, but-like fracking contaminating water supplies-is has never happened before.

What to Watch For: An audience member misunderstands the WITF promo—which said Marcellus Shale gas could power the entire world’s entire energy needs (not just gas consumption) for three years—and questions why we are focusing on Marcellus development when solar power could last forever and provide jobs that last forever.

- A better way of considering it is that Marcellus gas can fulfill the United States’ gas usage for 20 years.

- Despite billions in taxpayer subsidies, solar power provides very little of our energy needs. Moreover, solar power is 1000 percent more expensive than electricity from natural gas, driving up the cost of electricity. Finally, solar jobs are temporary because many are tied to construction, and green jobs crowd out sustainable jobs.

What to Watch For: An audience member asks about the impacts of seismic testing on water supplies, which no one can answer.

- The only way seismic testing could affect water quality is if the company does not refill the 2-3 inch wide holes used for detonating small explosives. These requirements should be laid out in a drilling lease.

What to Watch For: An audience member ask about the effects after drilling, including abandoned rigs. There is some discussion then about what a completed gas well looks like.

- There is some misconception about gas drilling; the “rigs” that are seen are only up while the well is being drilled. After the drilling process, the well site will include some piping, a meter, and usually a tank. Here is a picture of a finished well, and another, and on in the middle of a golf course.

What to Watch For: An audience member suggests fracking fluids are being loaded up in dump trucks, with sawdust, and then dumped in landfills in Carlisle.

- This is an urban legend, but is absolutely false. The source of this misinformation is that approved landfills, like Cumberland County Landfill, accept dry waste generated from the drilling process, such as tree cuttings and ground rocks. Wastewater isn’t accepted at state landfills.

What to Watch For: Mr. Quigley suggests that gas drillers pay for their “impact.” He doesn’t identify a number or cost, but suggest an “impact fee” is not enough.

- This is often the line of tax advocates, they always want more money. Mr. Quigley is now on retainer by PennFuture, an organization that lobbies for a tax which includes funding for “Growing Greener”. Growing Greener is a program that has given tax dollars to PennFuture. Is Mr. Quigley looking out for the environment, or his own paycheck?

- The fact is gas drillers have paid $1 billion in state taxes since 2006, including more than $230 million this year; $7 billion to landowners in lease and royalty payments since 2006; fully covers the cost of inspection with permitting fees to DEP; and put $200 million towards road improvements last year. Tax supporters have yet to identify which “impact” is not being fully covered already.

What to Watch For: Dr. Kinnaman, an economist with Bucknell, notes that Pennsylvania is the largest gas producing state without a severance tax and that a severance tax would be “less harmful” than the Personal Income Tax.

- This common talking point overlooks the overall tax burden and incidence of taxes on gas drillers. That is, most other gas producing states have lower corporate or income taxes (some have no corporate or personal income tax), and all but California have a lower overall state tax burden.

- Dr. Kinnaman makes the case for a severance tax which replaces other taxes, his study even states that the commonwealth’s economy would benefit from using the tax to reduce income taxes—but the only proposals on the table are for taxes on top of current taxes.

We encourage you to check it out tonight.