Media

Who Pays Pennsylvania’s Personal Income Tax?

Pennsylvania has a flat rate Personal Income Tax (PIT) of 3.07%, which is a fair and simple distribution of taxation. Yet some people are imprudently calling for a state-wide graduated income tax, similar to the Internal Revenue Service (IRS). In this blog series, I will highlight some real facts about Pennsylvania’s PIT.

Part 1: Distribution by Income Brackets

It might sound appealing to charge wealthier taxpayers a higher percentage of their income but the fact is wealthier taxpayers already provide a significant majority of taxable income for the PIT. When taxable income is broken up by various population brackets it becomes apparent just how much more the wealthy contribute.

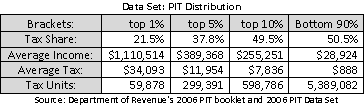

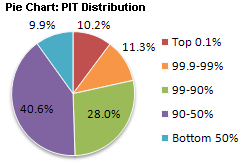

For instance, according to 2006 income tax data the top 10% tax filers provided nearly 50% of total taxable income. Conversely, the bottom 50% of tax filers only provided 10% of total taxable income.

The pie chart on the right and data table below shows the total tax share held by various brackets based on the 3.07% rate. As one can see, the current distribution is fair and simple. In addition there is a tax forgiveness program not factored into the data which further aleviates struggling taxpayers. There is no need to complicate the already fair and simple distribution of PIT.