Media

What’s in the Final 2016-17 Budget?

On June 30, the legislature passed a $31.6 billion General Fund Budget. Gov. Wolf allowed this budget to become law without his signature on July 12. On July 13, the House and Senate passed a revenue package to pay for the spending plan.

Here is what you need to know about the budget.

The Good

- Spends less than Gov. Wolf's proposal. The governor's $33.3 billion budget was never seriously considered, but it's still worth noting that the final budget spends $1.7 billion less.

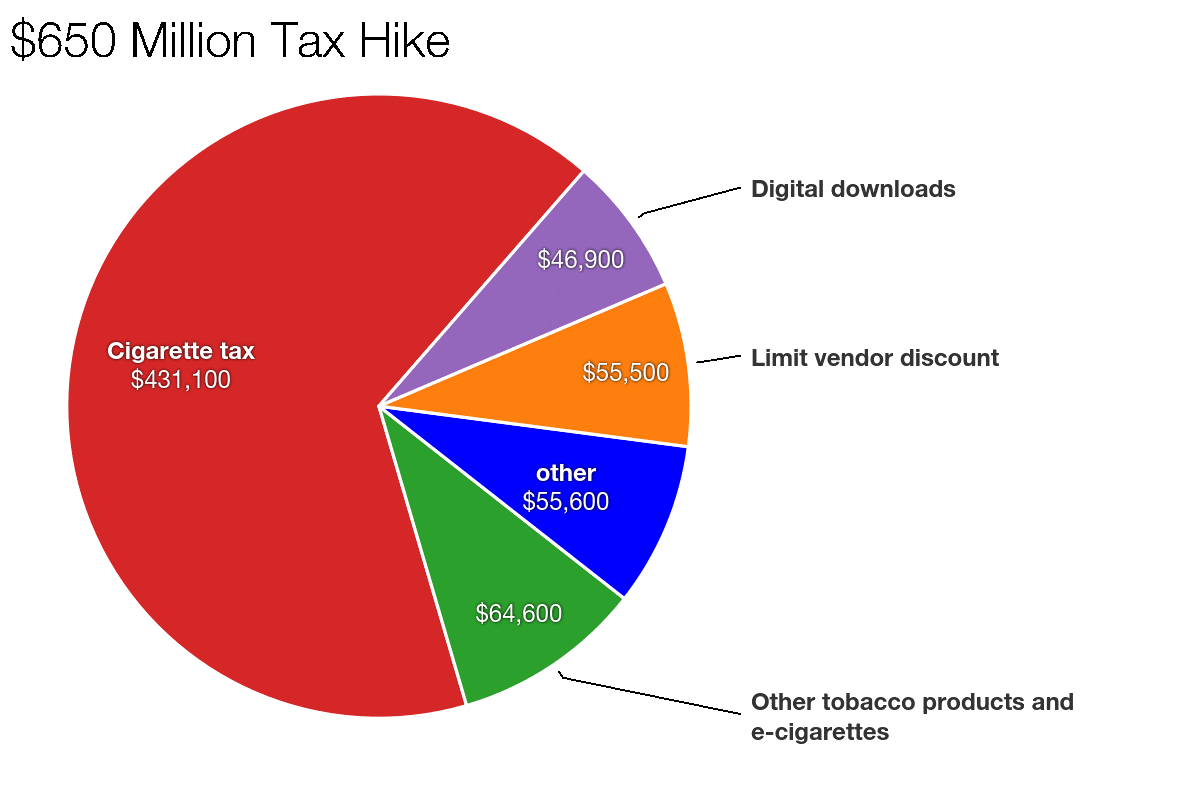

- No income or sales tax increases. The tax package does not include income or sales tax increases. The overall tax increase of $650 million is about one-fourth of the $2.7 billion tax hike Gov. Wolf proposed. The enacted tax increases amount to $203 per family of four, borne mostly by smokers.

- Expansion of school choice. The legislature increased the Educational Improvement Tax Credit (EITC) by $25 million. The EITC provides tens of thousands of private school scholarships to students in need. The state will now offer $75 million in tax credits for K-12 scholarships.

The Bad

- Spending growth 5 times the rate of inflation and population growth. The $1.6 billion increase represents a 5 percent increase in a year when inflation is less than 1 percent. This represents the biggest spending increase in a decade. The General Fund has grown by $2.5 billion in Gov. Wolf’s first two years, approaching the $2.85 billion General Fund increase passed during the prior eight years.

- $650 million tax increase. The $1 per pack cigarette tax hike makes up the bulk of the new revenue. This tax is an unreliable revenue source, would disproportionately harm the poor and do little to dramatically reduce the number of smokers in Pennsylvania. The tax could potentially hit 2 million adults.

- The budget remains unbalanced. The budget counts on $200 million in loans from other funds and $100 million from expanding online gambling—legislation that hasn’t passed the legislature yet. Pennsylvania's Constitution does not say the legislature can pass something pretty close to a balanced budget or a promise to balance the budget in the near future. It requires a balanced budget. By not balancing the budget and depending heavily on unreliable revenues from sin taxes, the risks of a large budget deficit and a renewed push for broad-based tax hikes in 2017 is high.

- Does not include vital spending reforms. Lawmakers did not address the $800 million in corporate welfare identified in the budget. Nor did they tackle reforms to slow the unsustainable growth of human services spending. There is much more the legislature and Gov. Wolf can do to prioritize the use of taxpayers’ dollars before calling for higher taxes on families.

For a more detailed version of our analysis, read our Policy Points on the 2016-17 budget.