Media

Spending Restraint, Reform Needed to Balance Budget

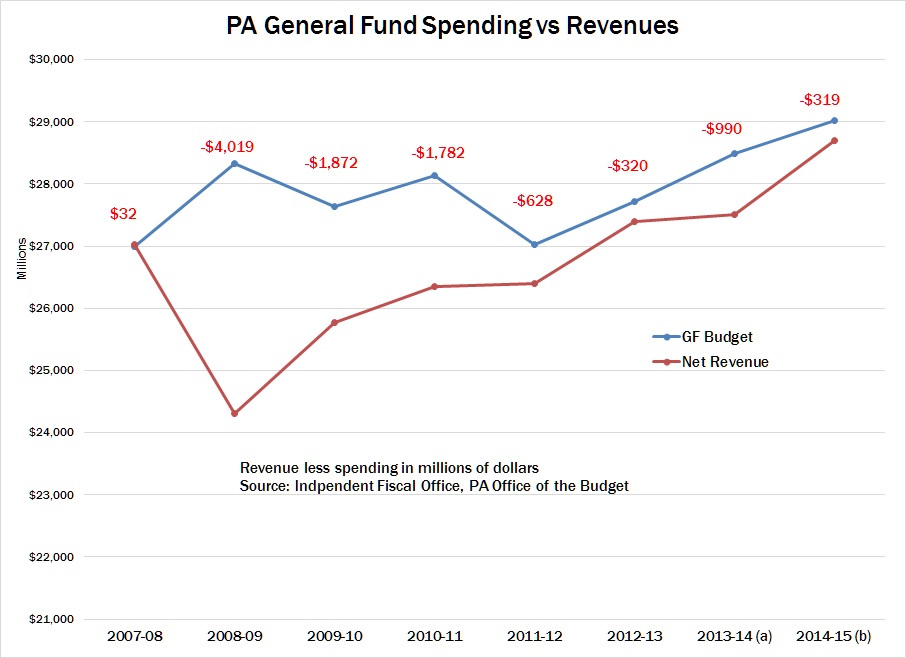

With an estimated $2 billion “planning deficit” announced this week, one might believe crafting a balanced budget that doesn’t raise taxes is impossible. Yet earlier this year, we released a report identifying reforms that could save taxpayers billions of dollars.

There are many areas where state spending isn’t helping Pennsylvanians. For example, over the last eight years, the commonwealth has spent more on so-called economic development than any state in the country, according to the Council for Community and Economic Research. However, such spending has been relatively ineffective. States that spent the most on economic development saw their economies grow at a slower rate than states spending the least on such initiatives.

The root of the commonwealth’s budget woes are mandated programs with ballooning costs—costs first ignored by Governor Rendell. Chief among those are increases in pension payments—estimated to grow by $1.7 billion over five years—and the enormous Medicaid program (with $5.8 billion just in General Fund costs), which is set to grow by 3.5 percent next year.

Years of overspending, not “right-wing ideology,” have resulted in our current fiscal predicament.

Senate Republicans got it right when they noted,

The Governor’s Mid-Year Budget Briefing shows that mandated spending cost drivers, such as pensions and Medicaid, must be addressed in order to repair the Commonwealth’s fiscal balance.

Balancing the budget without tax increases won’t be easy, but it is possible if officials are willing to take on the spending drivers that have been squeezing taxpayers for decades.