Memo

Marijuana Money Can’t Fix the Budget

- Neither marijuana taxes nor any other feasible revenue measure can bring Pennsylvania into long-term fiscal balance. The state must address its spending addiction.

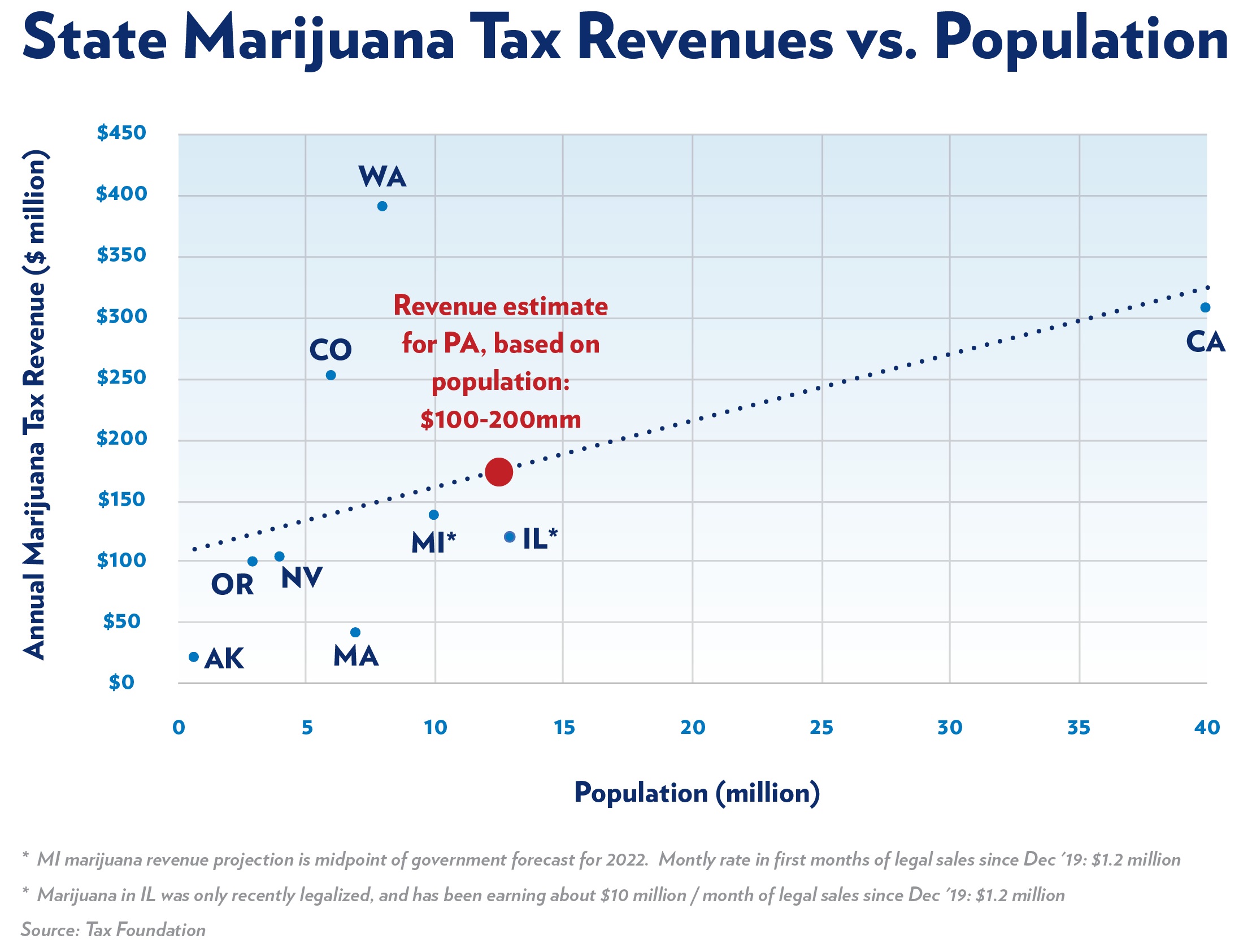

- A generous estimate of Pennsylvania’s potential marijuana tax revenue is $100-200 million. Even if this money came with no new expenses, it would fund about one day of state operations.

On September 3, Governor Tom Wolf proposed the legalization of marijuana sales for recreational use. His press release cited “a desperate need for the economic boost cannabis legalization can provide.” 1

The commonwealth needs to address the deteriorating budget situation: state revenue for fiscal years 2019-20 and 2020-21 could fall $5 billion short of what was projected one year ago. Marijuana, however, can generate nowhere near the amount necessary to make a difference. Moreover, the experience of other states indicates that much of the revenue from marijuana taxation will be spent on marijuana-related items. California, for example, allocated about two-thirds of fiscal year 2019 marijuana collections to the marijuana regulatory apparatus and to drug treatment programs.2 Here in Pennsylvania, Governor Wolf proposes spending marijuana revenue on grants to minority-owned businesses and on “restorative justice” programs.

A generous estimate of Pennsylvania’s potential marijuana tax revenue is $100-200 million. Even if this money came with no new expenses, it would be less than 0.2% of the total state budget—enough to fund about one day of operations.3 The best comparables for a revenue estimate are Michigan and Illinois, which have similar populations to Pennsylvania and have both legalized recreational marijuana in the past year. They are earning an annualized $120 million and $137 million, respectively, based on monthly tax collections.

As it stands, legal recreational marijuana sales are ongoing in nine states. A scatter plot of the populations and marijuana tax revenue in those states is shown below in Figure 1. Population-based estimates, however, are only a rough guide. The specific tax regime is crucial. Taxing by price gives an unstable revenue stream as prices fluctuate. Taxing by weight encourages the sale of artificially high potency products. Taxing by potency requires an extensive regulatory regime. Tax rates that are too high encourage persistence of an illegal market and tax rates that are too low generate de minimis revenue. In short, the devil is in the details.

Tax rates currently range from as much as 37% of retail price (Washington State) down to 10% (Michigan). Six states tax the product at multiple levels (wholesale and retail) or vary taxation based on product or potency. Most states impose their taxes in addition to the regular state sales tax.

After surveying these and other facts, a study from the Tax Foundation on recreational marijuana states that “An excise tax on recreational marijuana should target the externality and raise sufficient revenue to fund marijuana-related spending while simultaneously out competing illicit operators. Excise taxes should not be implemented in an effort to raise general fund revenue. [emphasis added].”4 In other words: marijuana taxation is drug policy, not budget policy.

Governor Wolf’s plan to grant prospective marijuana revenue to small business offers nothing new. Several points stand out:

- The Commonwealth already runs dozens of grant, loan, and loan guarantee programs for businesses of all sizes. The Department of Community and Economic Development’s last full-year budget was $219 million.5 Total state spending on business handouts is about $800 million per year.6 50% of a $100-$200 marijuana tax, then, does not even pay for existing programs of this type.

- Business assistance programs of this type have been subject to notable cases of fraud and have minimal controls to prevent it. A December 2019 grand jury report, for example, detailed the theft of an alleged $10.6 million in taxpayer money.7

- Programs that target politically favored areas for business investment on special terms do not have a good track record.8 Encouraging capital accumulation is a worthy goal, but there are better ways to do it. Lowering small business taxes, giving businesses the ability to carry forward more losses when they have a bad year, streamlining regulations, and easing license requirements would all help achieve the governor’s aims more directly.

Neither marijuana taxes nor any other feasible revenue boosting measure can bring Pennsylvania into long-term fiscal balance. Instead, policy makers should implement spending limits and procedural reforms to control the budget from the expense side.9

Notes:

1. Gov. Wolf and Lt. Gov. Fetterman Renew Call for Legislature to Take up Legalization of Adult-Use Cannabis to Help with COVID Recovery, Restorative Justice.” Office of the Governor, September 3, 2020. https://www.governor.pa.gov/newsroom/gov-wolf-and-lt-gov-fetterman-renew-call-for-legislature-to-take-up-legalization-of-adult-use-cannabis-to-help-with-covid-recovery-restorative-justice/

2. A Road Map to Recreational Marijuana. Tax Foundation, June 2020. https://files.taxfoundation.org/20200608144852/A-Road-Map-to-Recreational-Marijuana-Taxation.pdf, p. 10

3. State government collected and spent $86 billion from all sources, including federal funds, in fiscal year 2018-2019. See Slicing State Finances Part 3: Revenue on Autopilot. Commonwealth Foundation, October 28, 2019. https://tinyurl.com/y75xbam9

4. Tax Foundation, Road Map, page 1

5. Pennsylvania House Appropriations Committee budget printout https://www.pahouse.com/Files/Documents/Appropriations/series/3094/Printout_2019-20_HB790_PN2215_062419.pdf

6. “Corporate Welfare’s Record of Failure.” Commonwealth Foundation, October 16, 2018. https://www.commonwealthfoundation.org/policyblog/detail/corporate-welfares-record-of-failure

7. “How to Make an Easy Six Million.” Commonwealth Foundation, December 10, 2019. https://www.commonwealthfoundation.org/policyblog/detail/how-to-make-an-easy-six-million

8. “The O-Zone Hole.” Commonwealth Foundation, November 15, 2019. https://www.commonwealthfoundation.org/policyblog/detail/the-o-zone-hole

9. Three Steps to an Honest Budget. Commonwealth Foundation Policy Report, February 16, 2020. https://www.commonwealthfoundation.org/policyblog/detail/three-steps-to-an-honest-budget-fiscal-reform-priorities-2020-2021